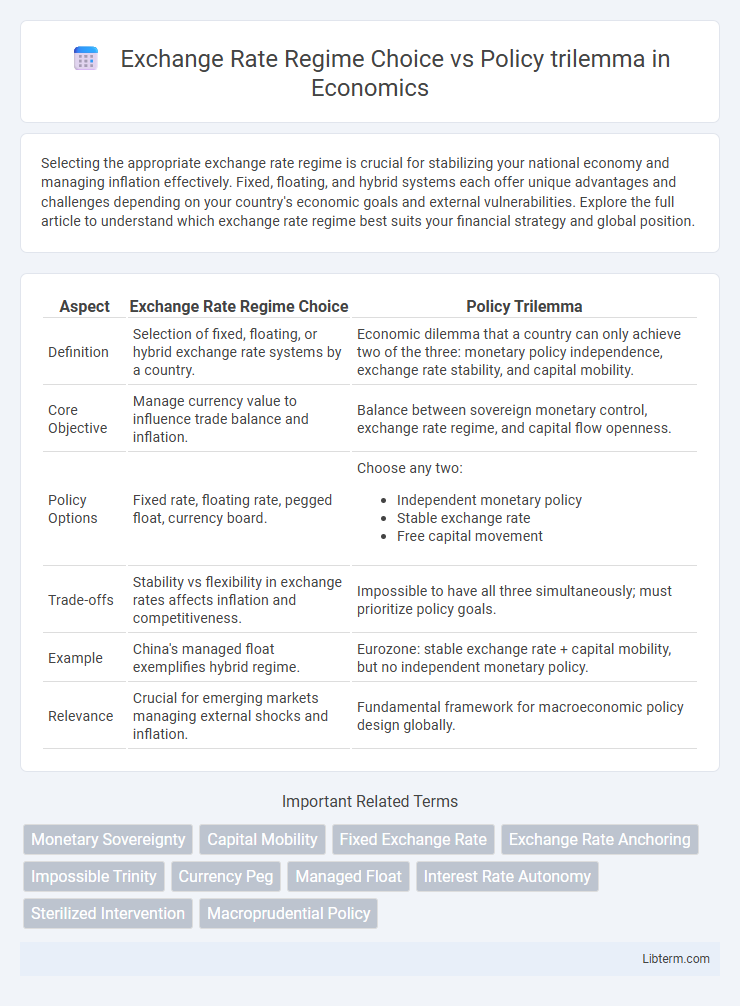

Selecting the appropriate exchange rate regime is crucial for stabilizing your national economy and managing inflation effectively. Fixed, floating, and hybrid systems each offer unique advantages and challenges depending on your country's economic goals and external vulnerabilities. Explore the full article to understand which exchange rate regime best suits your financial strategy and global position.

Table of Comparison

| Aspect | Exchange Rate Regime Choice | Policy Trilemma |

|---|---|---|

| Definition | Selection of fixed, floating, or hybrid exchange rate systems by a country. | Economic dilemma that a country can only achieve two of the three: monetary policy independence, exchange rate stability, and capital mobility. |

| Core Objective | Manage currency value to influence trade balance and inflation. | Balance between sovereign monetary control, exchange rate regime, and capital flow openness. |

| Policy Options | Fixed rate, floating rate, pegged float, currency board. | Choose any two:

|

| Trade-offs | Stability vs flexibility in exchange rates affects inflation and competitiveness. | Impossible to have all three simultaneously; must prioritize policy goals. |

| Example | China's managed float exemplifies hybrid regime. | Eurozone: stable exchange rate + capital mobility, but no independent monetary policy. |

| Relevance | Crucial for emerging markets managing external shocks and inflation. | Fundamental framework for macroeconomic policy design globally. |

Understanding the Exchange Rate Regime Spectrum

The exchange rate regime spectrum ranges from fixed to floating systems, each presenting unique trade-offs within the policy trilemma framework that balances exchange rate stability, monetary policy independence, and capital mobility. Fixed regimes offer exchange rate predictability but limit monetary policy autonomy, while floating regimes enhance policy flexibility at the cost of exchange rate volatility. Hybrid regimes, such as managed floats or crawling pegs, attempt to optimize these competing objectives by blending elements of stability and autonomy.

Defining the Policy Trilemma (Impossible Trinity)

The policy trilemma, also known as the impossible trinity, defines the challenge in international economics where a country cannot simultaneously maintain a fixed exchange rate, free capital movement, and an independent monetary policy. Choosing an exchange rate regime forces policymakers to prioritize two of these three objectives while sacrificing the third. This fundamental constraint shapes monetary and fiscal policy decisions, influencing financial stability and economic growth.

Fixed vs. Floating Exchange Rates: Core Differences

Fixed exchange rate regimes maintain a stable currency value by pegging to a benchmark like the US dollar or gold, facilitating trade predictability but limiting monetary policy autonomy. Floating exchange rates fluctuate based on market forces, granting central banks flexibility in domestic economic management but increasing exchange rate volatility. The policy trilemma highlights the trade-off that countries cannot simultaneously achieve a fixed exchange rate, free capital mobility, and an independent monetary policy, forcing policymakers to prioritize two out of three goals.

The Role of Monetary Policy Independence

Monetary policy independence is crucial in the policy trilemma, which states that a country cannot simultaneously maintain fixed exchange rates, free capital movement, and independent monetary policy. Choosing a fixed exchange rate regime limits monetary policy autonomy because the central bank must adjust interest rates to maintain the peg. In contrast, a floating exchange rate allows full monetary policy independence, enabling central banks to target inflation or output without exchange rate constraints.

Capital Mobility in Modern Economies

Capital mobility plays a pivotal role in the policy trilemma, forcing modern economies to choose between fixed exchange rates and independent monetary policy. High capital mobility limits the ability to maintain both a stable exchange rate and autonomous monetary policy simultaneously, often compelling countries to prioritize one at the expense of the other. Emerging markets and advanced economies alike must balance capital flow volatility with macroeconomic stability when selecting an exchange rate regime.

Trade-Offs in Exchange Rate Regime Choice

Choosing an exchange rate regime involves balancing the policy trilemma between exchange rate stability, monetary policy autonomy, and capital mobility. Fixed exchange rate regimes offer currency stability beneficial for trade and investment but limit monetary policy independence, while flexible regimes provide policy autonomy at the cost of exchange rate volatility. This trade-off forces policymakers to prioritize between stabilizing external shocks and maintaining control over domestic economic conditions.

Historical Case Studies of Policy Trilemma Outcomes

Historical case studies of the policy trilemma reveal diverse exchange rate regime choices that governments adopted to balance monetary policy autonomy, exchange rate stability, and capital mobility. The collapse of the Bretton Woods system in the early 1970s exemplifies the tension between fixed exchange rates and monetary policy independence under capital mobility pressures. Emerging markets like Argentina in the 1990s demonstrate the challenges of maintaining currency pegs while preserving policy flexibility, often leading to financial crises and eventual regime shifts.

Exchange Rate Regime and Crisis Vulnerability

Fixed exchange rate regimes can reduce nominal exchange rate volatility but often increase crisis vulnerability due to limited monetary policy flexibility and the risk of depleting foreign reserves during speculative attacks. In contrast, flexible exchange rate regimes enhance monetary independence and absorption of external shocks, lowering the likelihood of balance of payments crises, but may experience higher exchange rate volatility. The choice of exchange rate regime thus directly affects a country's exposure to financial crises, as inflexible systems tend to amplify vulnerability under global capital flow volatility.

Policy Trilemma in Emerging vs. Advanced Economies

Emerging economies often face a more acute policy trilemma, balancing exchange rate stability, monetary policy autonomy, and capital mobility, with limited resources intensifying trade-offs. Advanced economies typically prioritize monetary policy independence and capital mobility, tolerating exchange rate flexibility due to deeper financial markets and institutional resilience. The trilemma's constraints shape exchange rate regime choices, as emerging markets frequently adopt intermediate or managed regimes to mitigate shocks while maintaining some policy control.

Future Challenges in Exchange Rate Policy Choices

Future challenges in exchange rate policy choices stem from balancing the policy trilemma's constraints of monetary autonomy, exchange rate stability, and capital mobility in an increasingly interconnected global economy. The rise of digital currencies and rapid capital flows complicate maintaining fixed exchange rate regimes without sacrificing monetary policy independence or exposure to external shocks. Emerging markets face heightened vulnerability due to volatile capital movements, necessitating innovative frameworks that can adapt to global financial integration while preserving economic stability.

Exchange Rate Regime Choice Infographic

libterm.com

libterm.com