Credit rationing occurs when financial institutions limit the amount of credit available to borrowers, despite their willingness to pay prevailing interest rates. This practice can result from information asymmetry, where lenders cannot accurately assess borrower risk, leading to constrained loan availability even for creditworthy applicants. Explore the rest of the article to understand how credit rationing impacts your access to finance and strategies to navigate this challenge.

Table of Comparison

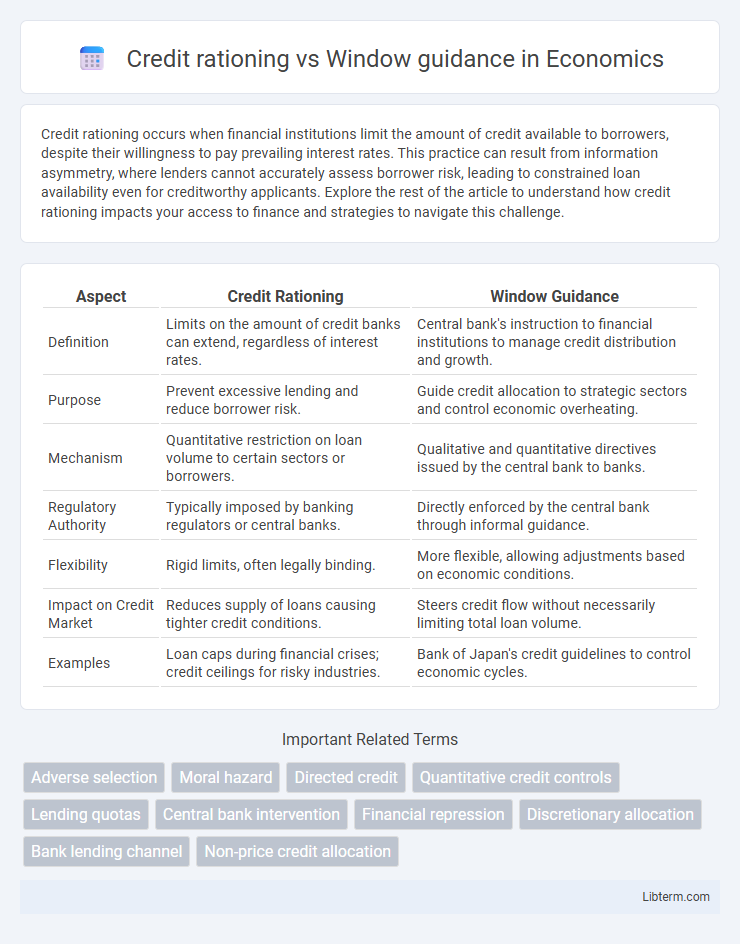

| Aspect | Credit Rationing | Window Guidance |

|---|---|---|

| Definition | Limits on the amount of credit banks can extend, regardless of interest rates. | Central bank's instruction to financial institutions to manage credit distribution and growth. |

| Purpose | Prevent excessive lending and reduce borrower risk. | Guide credit allocation to strategic sectors and control economic overheating. |

| Mechanism | Quantitative restriction on loan volume to certain sectors or borrowers. | Qualitative and quantitative directives issued by the central bank to banks. |

| Regulatory Authority | Typically imposed by banking regulators or central banks. | Directly enforced by the central bank through informal guidance. |

| Flexibility | Rigid limits, often legally binding. | More flexible, allowing adjustments based on economic conditions. |

| Impact on Credit Market | Reduces supply of loans causing tighter credit conditions. | Steers credit flow without necessarily limiting total loan volume. |

| Examples | Loan caps during financial crises; credit ceilings for risky industries. | Bank of Japan's credit guidelines to control economic cycles. |

Introduction to Credit Rationing and Window Guidance

Credit rationing occurs when banks limit the amount of credit available to borrowers despite demand exceeding supply, often to manage risk and maintain financial stability. Window guidance is a regulatory tool used primarily by central banks to direct commercial banks on lending targets and credit allocation to specific sectors. Both mechanisms influence credit distribution but differ in their implementation: credit rationing is a market-driven constraint, whereas window guidance is a policy-driven intervention.

Historical Context and Evolution

Credit rationing emerged prominently during the Great Depression when banks limited loan supply despite demand to mitigate risks, shaping modern financial regulation frameworks. Window guidance, developed in post-war Japan during the 1950s and 1960s, became a key monetary policy tool, enabling the Bank of Japan to direct credit allocation toward strategic sectors without altering interest rates. Over time, credit rationing evolved with financial liberalization, while window guidance influenced targeted credit control in several Asian economies.

Definitions: Credit Rationing vs. Window Guidance

Credit rationing refers to the restriction of credit supply by financial institutions despite borrowers being willing to pay higher interest rates, often due to asymmetric information and risk concerns. Window guidance is a regulatory tool used by central banks to influence lending behavior by providing informal directives on credit allocation without formal changes in interest rates. Both mechanisms affect credit distribution but differ in their implementation, with credit rationing emerging from market imperfections and window guidance stemming from policy intervention.

Mechanisms of Credit Rationing

Credit rationing operates through quantity restrictions where lenders limit the amount of credit available regardless of interest rates, often due to asymmetric information and risk assessment challenges. Borrowers facing credit rationing cannot obtain additional loans because lenders fear adverse selection and moral hazard, which hampers efficient market clearing. In contrast, window guidance involves central bank directives that influence credit allocation by guiding financial institutions toward preferred lending targets to support economic policy objectives.

Mechanisms of Window Guidance

Window guidance operates through non-binding directives from central banks to commercial banks, steering credit allocation toward priority sectors without explicit interest rate changes. This mechanism leverages informal targets and moral suasion to influence lending behavior, effectively complementing formal monetary policy tools. It contrasts with credit rationing, where quantitative constraints limit loan availability, as window guidance focuses on guiding credit distribution rather than outright restrictions.

Key Differences Between Credit Rationing and Window Guidance

Credit rationing is a market-driven phenomenon where banks limit credit supply due to asymmetric information and risk concerns, leading to borrowers being denied loans despite willingness to pay. Window guidance is a regulatory tool used primarily by central banks to direct financial institutions to control or expand credit allocation according to macroeconomic and policy objectives. Key differences include credit rationing's basis in market imperfections versus window guidance's reliance on administrative intervention, and credit rationing often restricts credit involuntarily, whereas window guidance actively steers credit flow to targeted sectors.

Economic Impacts and Policy Outcomes

Credit rationing limits the quantity of credit available to borrowers despite demand, often leading to reduced investment and slower economic growth due to restricted access to financing. Window guidance, commonly used in economies like China, directs banks to allocate credit strategically to priority sectors, promoting targeted economic development and reducing systemic risk. Both tools impact monetary policy effectiveness; credit rationing may lead to inefficiencies and credit shortages, whereas window guidance can enhance policy control and sectoral stability but may also cause market distortions if misapplied.

Case Studies and Real-World Examples

Credit rationing in developing countries like India has been documented through case studies showing financial institutions limiting loan access to small enterprises despite demand, often due to risk assessment or regulatory constraints. Window guidance, as practiced in Japan during the post-war economic boom, involved government directives steering banks to prioritize credit allocation toward strategic industries, effectively managing economic development. Real-world examples demonstrate how window guidance enabled targeted credit flows promoting industrial growth, while credit rationing can restrict entrepreneurship and economic expansion by curbing necessary capital availability.

Advantages and Disadvantages of Each Approach

Credit rationing limits loan availability to control financial risk and promote equitable resource distribution, reducing the likelihood of credit bubbles but potentially stifling entrepreneurial growth and market efficiency. Window guidance, used primarily by central banks, directs credit flow toward specific sectors to stimulate economic priorities and manage systemic risk, although it may lead to distorted market signals and reduced financial autonomy. Both approaches balance financial stability and economic growth but differ in flexibility and market impact, with credit rationing imposing stricter constraints and window guidance offering more targeted intervention.

Future Trends in Credit Allocation Policies

Credit rationing remains a critical tool for controlling risk exposure in financial markets, while window guidance continues to influence credit distribution towards strategic sectors, especially in emerging economies. Future trends indicate a shift towards integrating advanced data analytics and AI-driven models to enhance precision in credit allocation policies, balancing growth objectives with financial stability. The increasing emphasis on sustainable finance suggests credit policies will also prioritize green projects and socially responsible investments.

Credit rationing Infographic

libterm.com

libterm.com