Privatization transfers ownership of businesses or services from the public sector to private entities, boosting efficiency and fostering competitive markets. It often leads to improved service quality, innovation, and cost reduction by incentivizing private companies. Explore the article to understand how privatization can impact your community and economy.

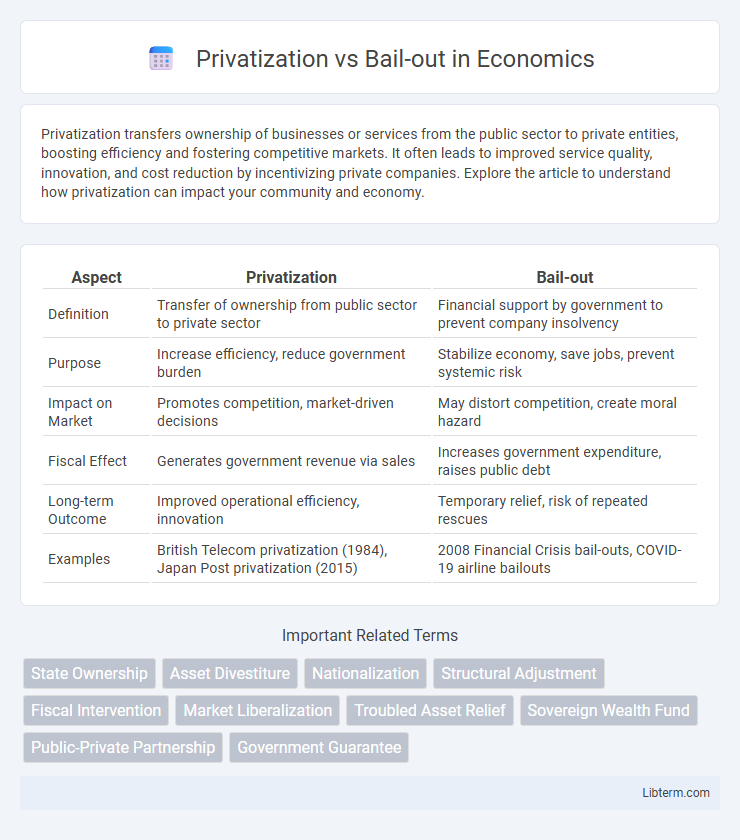

Table of Comparison

| Aspect | Privatization | Bail-out |

|---|---|---|

| Definition | Transfer of ownership from public sector to private sector | Financial support by government to prevent company insolvency |

| Purpose | Increase efficiency, reduce government burden | Stabilize economy, save jobs, prevent systemic risk |

| Impact on Market | Promotes competition, market-driven decisions | May distort competition, create moral hazard |

| Fiscal Effect | Generates government revenue via sales | Increases government expenditure, raises public debt |

| Long-term Outcome | Improved operational efficiency, innovation | Temporary relief, risk of repeated rescues |

| Examples | British Telecom privatization (1984), Japan Post privatization (2015) | 2008 Financial Crisis bail-outs, COVID-19 airline bailouts |

Understanding Privatization: Definition and Objectives

Privatization involves transferring ownership and management of public sector enterprises to private entities to enhance efficiency, profitability, and market competitiveness. Objectives include reducing government fiscal burden, promoting innovation, and encouraging investment through competitive market dynamics. This strategy contrasts with bail-outs, which aim to provide temporary financial support to failing companies without changing ownership structures.

Bail-Outs Explained: Key Features and Purposes

Bail-outs involve financial support from the government or external entities to prevent the collapse of failing companies or financial institutions, ensuring economic stability and protecting jobs. Key features include emergency funding, debt restructuring, and temporary ownership stakes to restore solvency and market confidence. The primary purpose is to mitigate systemic risk, maintain essential services, and prevent broader economic downturns.

Economic Impacts: Privatization vs Bail-Out

Privatization typically enhances economic efficiency by transferring state-owned enterprises to private ownership, promoting competition, innovation, and better resource allocation. Bail-outs can stabilize struggling companies and preserve jobs but often lead to increased public debt and reduced market discipline, potentially causing long-term economic inefficiencies. The choice between privatization and bail-outs significantly affects fiscal health, investor confidence, and overall economic growth trajectories.

Government Involvement: Roles and Responsibilities

Government involvement in privatization involves transferring ownership and management of public enterprises to private entities to enhance efficiency and stimulate market competition. In contrast, bail-outs entail direct financial support or intervention by the government to rescue failing companies deemed critical to economic stability, safeguarding jobs and preventing systemic risks. Both approaches reflect distinct roles: privatization reduces government footprint in operational control, while bail-outs emphasize regulatory oversight and temporary stewardship to stabilize troubled sectors.

Efficiency and Performance Outcomes

Privatization often leads to improved efficiency and performance outcomes by introducing competitive pressures and profit incentives that drive cost reduction and innovation. Bail-outs, while preventing immediate financial collapse, may reduce operational efficiency due to moral hazard and continued reliance on government support, diminishing incentives for firms to optimize performance. Empirical studies indicate that privatized firms typically exhibit higher productivity and profitability compared to those sustained through bail-outs, which tend to maintain inefficiencies and distort market dynamics.

Social Implications: Employment and Public Services

Privatization often leads to workforce reductions as private firms prioritize efficiency, which can result in job losses and decreased job security for employees. Bail-outs tend to preserve existing public sector jobs and maintain continuity in public services, though they may perpetuate inefficiencies or dependence on government support. Social implications include changes in service quality and accessibility, with privatization potentially reducing public service coverage in less profitable areas while bail-outs aim to protect broader social welfare.

Financial Sustainability and Risk Management

Privatization enhances financial sustainability by transferring operational risks and fiscal burdens from the public sector to private entities, often leading to increased efficiency and reduced government debt. Bail-outs, while preventing immediate financial collapse, pose long-term risks by fostering moral hazard and potentially encouraging risky behavior without adequate risk management incentives. Effective risk management in privatization involves stringent regulatory oversight, whereas bail-outs require clear exit strategies to ensure fiscal responsibility and sustainable recovery.

Case Studies: Global Examples and Lessons Learned

Privatization in cases such as British Airways in the 1980s demonstrated increased efficiency and profitability through market-driven reforms, while bailout examples like the 2008 U.S. financial crisis revealed the moral hazard risks and long-term fiscal burdens associated with government rescues. Lessons from global case studies emphasize the importance of regulatory frameworks that balance market discipline with strategic public intervention to prevent systemic collapse. Countries like Germany and South Korea showcase hybrid approaches, combining targeted bailouts with privatization efforts to stabilize key industries without compromising competitive dynamics.

Stakeholder Perspectives: Public vs Private Interests

Stakeholder perspectives in privatization emphasize efficiency and profit maximization, aligning with private interests focused on market competitiveness and shareholder value. Public interests during bail-outs prioritize economic stability, job preservation, and protecting taxpayers from financial losses, reflecting broader societal welfare concerns. The tension arises as privatization often limits public control, while bail-outs invoke public funds to support failing private entities, highlighting conflicting priorities between market freedom and social responsibility.

Policy Considerations and Future Directions

Policy considerations in privatization emphasize enhancing efficiency and reducing fiscal burdens by transferring state assets to private ownership, promoting competitive markets and innovation. Bail-out strategies prioritize stabilizing critical industries and preserving employment during economic crises, often involving government intervention to prevent systemic risks. Future directions suggest hybrid approaches combining regulatory frameworks with targeted privatization to balance market dynamism and social welfare, alongside increased focus on transparency and stakeholder accountability.

Privatization Infographic

libterm.com

libterm.com