Investment strategies vary widely depending on your financial goals and risk tolerance, ranging from stocks and bonds to real estate and mutual funds. Understanding market trends and diversification is crucial for maximizing returns while minimizing risks. Explore the rest of the article to discover how to tailor your investment approach effectively.

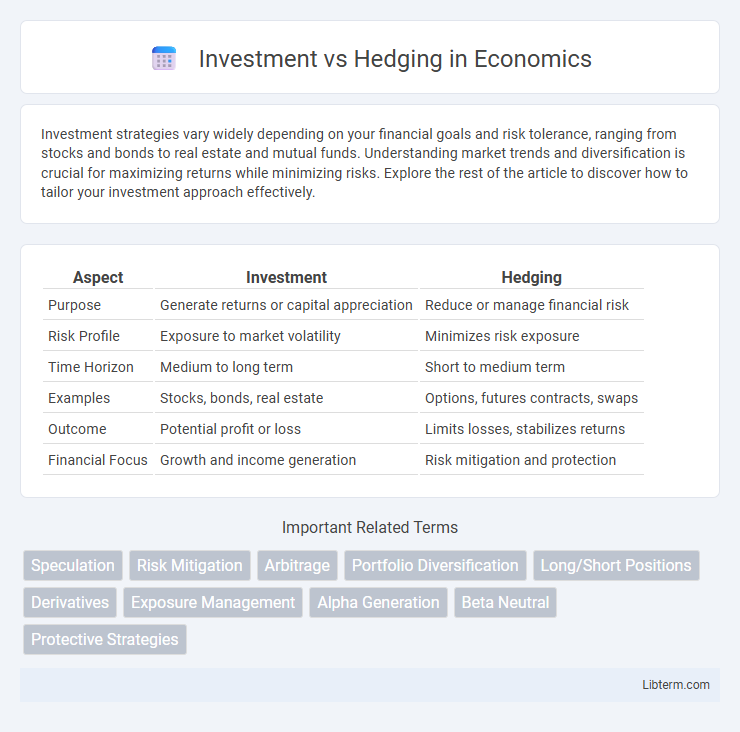

Table of Comparison

| Aspect | Investment | Hedging |

|---|---|---|

| Purpose | Generate returns or capital appreciation | Reduce or manage financial risk |

| Risk Profile | Exposure to market volatility | Minimizes risk exposure |

| Time Horizon | Medium to long term | Short to medium term |

| Examples | Stocks, bonds, real estate | Options, futures contracts, swaps |

| Outcome | Potential profit or loss | Limits losses, stabilizes returns |

| Financial Focus | Growth and income generation | Risk mitigation and protection |

Introduction to Investment and Hedging

Investment involves allocating capital to assets like stocks, bonds, or real estate with the expectation of generating long-term returns or capital appreciation. Hedging is a risk management strategy designed to protect investments against potential losses by using financial instruments such as options, futures, or derivatives. Both investment and hedging play crucial roles in optimizing portfolio performance and managing financial risks effectively.

Defining Investment: Purpose and Strategies

Investment involves allocating capital to assets such as stocks, bonds, or real estate with the goal of generating long-term financial returns and wealth appreciation. Strategies commonly used in investment include diversification to reduce risk, value investing to identify undervalued assets, and growth investing targeting companies with high earnings potential. The primary purpose of investment is to build and preserve wealth through strategic asset allocation and market analysis over an extended period.

What is Hedging? Concepts and Techniques

Hedging is a risk management strategy employed to offset potential losses in investments by taking an opposite position in a related asset, thereby minimizing exposure to price fluctuations. Common hedging techniques include using derivatives such as options, futures, and swaps, which allow investors to lock in prices or rates, reducing uncertainty in volatile markets. Effective hedging protects portfolios against adverse market movements, ensuring stability without aiming for profit generation like traditional investment strategies.

Key Differences Between Investment and Hedging

Investment involves allocating capital to assets such as stocks, bonds, or real estate with the goal of generating returns over time, while hedging is a risk management strategy designed to protect against potential losses in an existing investment or portfolio. Investments carry market risk and aim for profit maximization, whereas hedging uses financial instruments like options, futures, or swaps to offset exposure to price fluctuations and minimize financial risk. The fundamental difference lies in investment seeking growth, whereas hedging seeks risk reduction without necessarily generating additional profit.

Investment: Risk and Return Considerations

Investment involves allocating capital to assets with the expectation of generating returns, where risk and return considerations are critical for portfolio management. Higher potential returns typically come with increased risk, necessitating thorough analysis of market volatility, asset correlation, and economic factors to optimize investment decisions. Effective risk management strategies, such as diversification and asset allocation, can balance potential rewards against exposure to losses.

Hedging: Minimizing Risk in Volatile Markets

Hedging involves using financial instruments such as options, futures, and derivatives to minimize exposure to price volatility and reduce potential losses in unpredictable markets. This risk management strategy protects portfolios by offsetting adverse price movements, ensuring more stable returns despite market fluctuations. Effective hedging is essential for businesses and investors seeking to safeguard assets against currency risks, commodity price shifts, and interest rate changes.

Tools and Instruments Used in Investment

Investment utilizes tools such as stocks, bonds, mutual funds, ETFs, and real estate to generate returns and build wealth over time. Investors often leverage financial derivatives like options and futures to enhance portfolio performance or manage risk within their investment strategy. These instruments provide opportunities for capital appreciation, income generation, and diversification across various asset classes and market sectors.

Popular Hedging Instruments and Approaches

Popular hedging instruments include options, futures contracts, and swaps, which allow investors to manage risk exposure effectively. Approaches such as portfolio diversification, currency hedging, and interest rate swaps help mitigate potential losses from market volatility. These strategies are essential for businesses and investors aiming to protect assets while maintaining growth opportunities in fluctuating markets.

Choosing Between Investing and Hedging: Factors to Consider

Choosing between investing and hedging depends on risk tolerance, financial goals, and market conditions. Investors seek capital appreciation through asset growth, while hedgers aim to reduce potential losses by offsetting exposure. Key factors include time horizon, expected volatility, and the alignment of strategies with overall portfolio objectives.

Conclusion: Balancing Investment Growth and Risk Management

Balancing investment growth and risk management requires integrating strategic hedging techniques to protect portfolios from market volatility while pursuing capital appreciation. Effective allocation between high-growth assets and hedging instruments like options or futures enhances long-term financial stability. Optimal balance minimizes downside risk without significantly sacrificing potential returns, ensuring sustainable wealth accumulation.

Investment Infographic

libterm.com

libterm.com