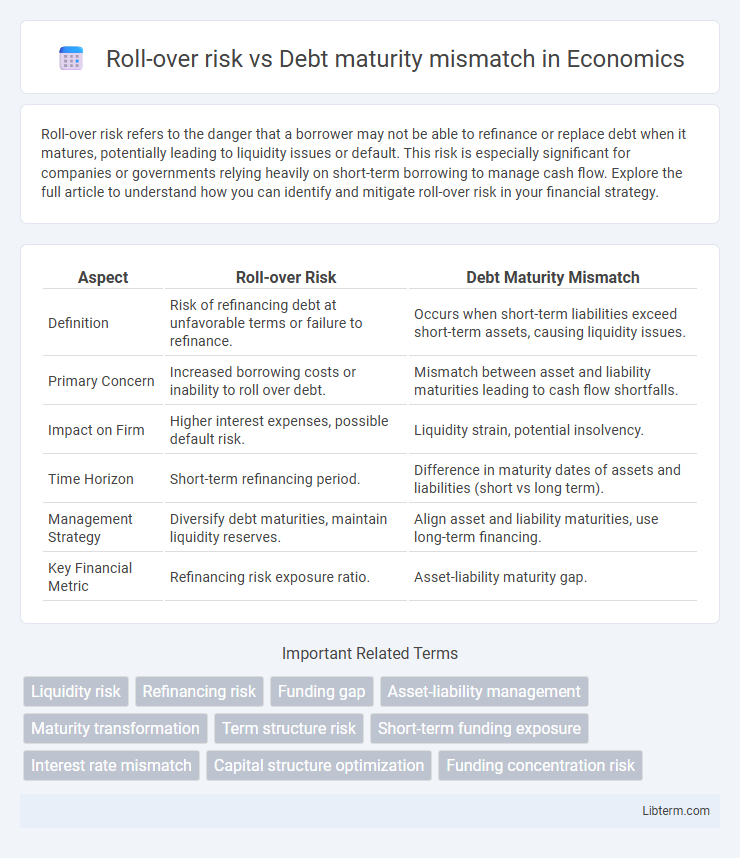

Roll-over risk refers to the danger that a borrower may not be able to refinance or replace debt when it matures, potentially leading to liquidity issues or default. This risk is especially significant for companies or governments relying heavily on short-term borrowing to manage cash flow. Explore the full article to understand how you can identify and mitigate roll-over risk in your financial strategy.

Table of Comparison

| Aspect | Roll-over Risk | Debt Maturity Mismatch |

|---|---|---|

| Definition | Risk of refinancing debt at unfavorable terms or failure to refinance. | Occurs when short-term liabilities exceed short-term assets, causing liquidity issues. |

| Primary Concern | Increased borrowing costs or inability to roll over debt. | Mismatch between asset and liability maturities leading to cash flow shortfalls. |

| Impact on Firm | Higher interest expenses, possible default risk. | Liquidity strain, potential insolvency. |

| Time Horizon | Short-term refinancing period. | Difference in maturity dates of assets and liabilities (short vs long term). |

| Management Strategy | Diversify debt maturities, maintain liquidity reserves. | Align asset and liability maturities, use long-term financing. |

| Key Financial Metric | Refinancing risk exposure ratio. | Asset-liability maturity gap. |

Understanding Roll-Over Risk: Definition and Implications

Roll-over risk refers to the danger that a borrower cannot refinance or roll over existing debt upon maturity, potentially leading to liquidity shortages or financial distress. This risk is closely tied to debt maturity mismatch, where short-term liabilities fund long-term assets, creating exposure if market conditions deteriorate at refinancing time. Understanding roll-over risk is crucial for managing corporate and sovereign debt portfolios, as failure to secure new financing can trigger defaults or escalate borrowing costs.

What is Debt Maturity Mismatch?

Debt maturity mismatch occurs when a company's short-term liabilities exceed its liquid assets or when the timing of asset cash flows does not align with debt repayment schedules. This mismatch increases the risk that the company will be unable to refinance or repay debt on time, potentially causing liquidity problems. Roll-over risk is a specific consequence of debt maturity mismatch, referring to the risk that short-term debt cannot be rolled over at maturity, forcing the borrower to find alternative funding or face default.

Key Differences Between Roll-Over Risk and Debt Maturity Mismatch

Roll-over risk refers to the uncertainty and potential inability to refinance or repay existing debt when it matures, while debt maturity mismatch arises when the maturities of assets and liabilities are not aligned, creating liquidity pressures. Roll-over risk primarily impacts short-term borrowing and the cost of refinancing, whereas debt maturity mismatch affects overall balance sheet stability and long-term financial planning. Managing roll-over risk involves ensuring access to capital markets or liquidity reserves, while addressing debt maturity mismatch requires strategic asset-liability matching and duration management.

Causes of Roll-Over Risk in Financial Institutions

Roll-over risk in financial institutions primarily arises from short-term funding dependency where liabilities mature quickly, forcing frequent refinancing that exposes institutions to market fluctuations. A debt maturity mismatch occurs when assets have longer maturities than liabilities, creating gaps that increase vulnerability to roll-over risk during liquidity constraints or adverse market conditions. Key causes include heavy reliance on wholesale funding, abrupt changes in investor sentiment, and regulatory shifts affecting refinancing ability.

How Debt Maturity Mismatch Impacts Liquidity

Debt maturity mismatch significantly impacts liquidity by forcing firms to refinance short-term liabilities with uncertain access to capital markets, increasing rollover risk. When debt obligations mature faster than the assets generate cash, companies face liquidity shortfalls, potentially leading to distress or default. This mismatch intensifies vulnerability during market downturns, as refinancing options become limited and borrowing costs escalate.

Real-World Examples of Roll-Over Risk

Roll-over risk occurs when a borrower cannot refinance maturing debt at favorable terms or at all, leading to liquidity crises, as seen during the 2008 Global Financial Crisis when many banks faced massive roll-over risk due to frozen credit markets. Debt maturity mismatch, on the other hand, arises when short-term liabilities exceed short-term assets, increasing vulnerability but not directly causing refinancing failure. For instance, Argentina's repeated sovereign debt crises highlight roll-over risk where inability to roll over short-term external debt triggered defaults and economic turmoil.

Strategies to Manage Debt Maturity Mismatch

Effective strategies to manage debt maturity mismatch include implementing a staggered debt maturity schedule to avoid large liabilities coming due simultaneously, thereby reducing roll-over risk. Utilizing financial instruments such as interest rate swaps and forward rate agreements can help align cash flows with debt obligations. Maintaining adequate liquidity reserves and establishing contingency funding sources are crucial to cover short-term cash flow gaps and mitigate refinancing uncertainties.

The Role of Central Banks in Mitigating Roll-Over Risk

Central banks play a crucial role in mitigating roll-over risk by providing liquidity support through discount window lending and open market operations, ensuring uninterrupted funding for financial institutions facing short-term debt maturities. By actively managing interest rates and implementing macroprudential policies, they help stabilize market expectations and reduce refinancing uncertainties caused by debt maturity mismatches. Central banks' interventions during financial crises, such as quantitative easing and emergency lending facilities, enhance market confidence and prevent systemic risks associated with sudden funding gaps.

Effects of Market Volatility on Roll-Over Risk and Maturity Mismatch

Market volatility significantly amplifies roll-over risk by increasing uncertainty around refinancing conditions and interest rate fluctuations, potentially leading to higher borrowing costs or funding shortages. Debt maturity mismatches become more pronounced during volatile periods as short-term liabilities may need to be rolled over under unfavorable terms, while long-term assets remain illiquid or underperforming. This misalignment can strain liquidity, escalate default risk, and undermine a firm's financial stability during market stress.

Best Practices for Aligning Debt Maturities and Minimizing Risk

Aligning debt maturities with cash flow profiles and asset life cycles is essential for minimizing roll-over risk and preventing debt maturity mismatch. Implementing staggered debt maturities and maintaining liquidity buffers enhance financial flexibility and reduce refinancing pressures during market downturns. Regular stress testing and scenario analysis help identify potential refinancing gaps, enabling proactive capital structure adjustments and risk mitigation strategies.

Roll-over risk Infographic

libterm.com

libterm.com