Relative interest rate parity explains how differences in inflation rates between two countries affect exchange rate movements, ensuring that the expected change in exchange rates offsets interest rate differentials. Investors use this concept to predict currency fluctuations and hedge foreign exchange risk effectively. Discover how understanding relative interest rate parity can improve your currency risk management strategies in the rest of this article.

Table of Comparison

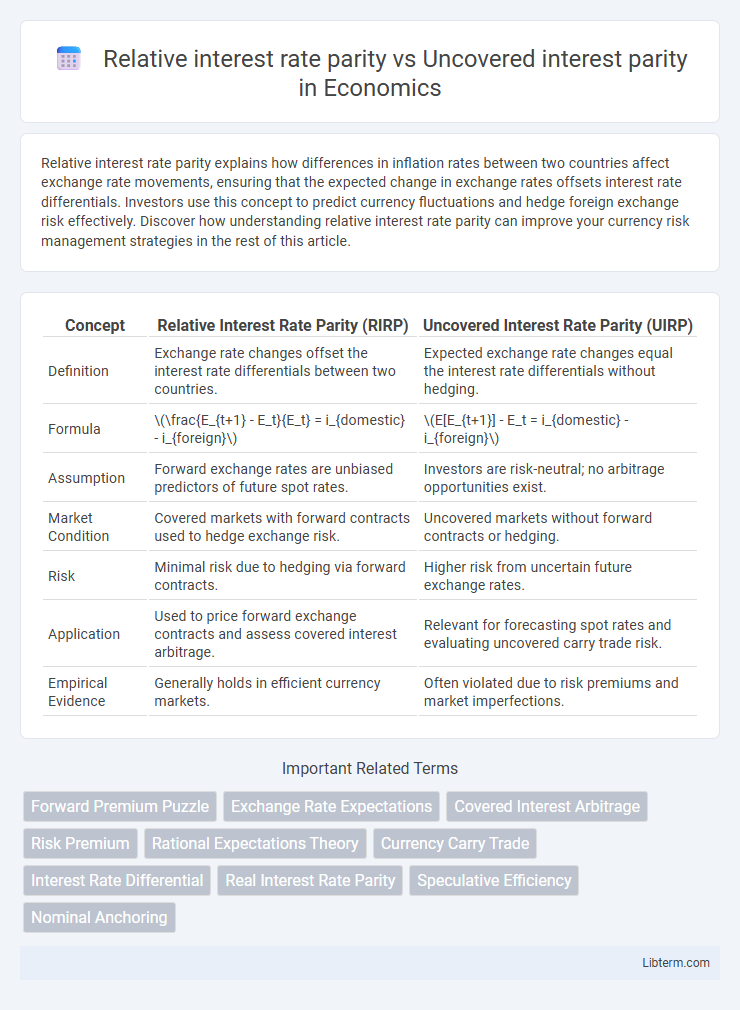

| Concept | Relative Interest Rate Parity (RIRP) | Uncovered Interest Rate Parity (UIRP) |

|---|---|---|

| Definition | Exchange rate changes offset the interest rate differentials between two countries. | Expected exchange rate changes equal the interest rate differentials without hedging. |

| Formula | \(\frac{E_{t+1} - E_t}{E_t} = i_{domestic} - i_{foreign}\) | \(E[E_{t+1}] - E_t = i_{domestic} - i_{foreign}\) |

| Assumption | Forward exchange rates are unbiased predictors of future spot rates. | Investors are risk-neutral; no arbitrage opportunities exist. |

| Market Condition | Covered markets with forward contracts used to hedge exchange risk. | Uncovered markets without forward contracts or hedging. |

| Risk | Minimal risk due to hedging via forward contracts. | Higher risk from uncertain future exchange rates. |

| Application | Used to price forward exchange contracts and assess covered interest arbitrage. | Relevant for forecasting spot rates and evaluating uncovered carry trade risk. |

| Empirical Evidence | Generally holds in efficient currency markets. | Often violated due to risk premiums and market imperfections. |

Introduction to Interest Rate Parity

Interest Rate Parity (IRP) establishes a fundamental relationship between foreign exchange rates and interest rates, ensuring no arbitrage opportunities in international finance. Relative Interest Rate Parity explains that changes in exchange rates between two currencies are proportional to the difference in their interest rates, incorporating expected inflation differentials. Uncovered Interest Parity assumes that expected future spot exchange rates offset interest rate differentials, predicting that the currency with a higher interest rate will depreciate to prevent arbitrage profits without using forward contracts.

Defining Relative Interest Rate Parity

Relative Interest Rate Parity (RIRP) defines the relationship where the expected change in exchange rates between two currencies is proportional to the difference in their nominal interest rates, adjusted for inflation differentials. It assumes that investors are indifferent to returns after accounting for expected currency depreciation or appreciation, ensuring no arbitrage opportunities in real returns across countries. Uncovered Interest Parity (UIP) similarly relates nominal interest rate differentials to expected exchange rate movements but excludes inflation adjustments, focusing purely on nominal rates without guaranteed forward contracts.

Explaining Uncovered Interest Rate Parity

Uncovered Interest Rate Parity (UIP) posits that the expected change in exchange rates between two currencies offsets the interest rate differential, implying no arbitrage opportunities in foreign exchange markets without using forward contracts. Unlike Relative Interest Rate Parity, which involves forward exchange rates to hedge currency risk, UIP relies on expected future spot exchange rates, making it contingent on market expectations and risk premiums. Empirical evidence often finds UIP deviations due to factors like risk aversion and capital controls impacting currency behavior.

Core Assumptions of Each Parity Theory

Relative interest rate parity assumes that the difference in interest rates between two countries reflects expected changes in exchange rates, relying on the assumption of rational expectations and no arbitrage opportunities. Uncovered interest parity, meanwhile, posits that expected future spot exchange rates adjust to offset interest rate differentials without the use of forward contracts, assuming perfect capital mobility and risk neutrality among investors. Both theories depend on market efficiency but diverge in their treatment of risk and certainty regarding future exchange rate movements.

Mathematical Formulation: Relative vs Uncovered Interest Rate Parity

Relative Interest Rate Parity (RIRP) is expressed mathematically as (1 + i_d) = (1 + i_f) * (E_t+1 / E_t), where i_d and i_f denote domestic and foreign interest rates, and E represents the expected future exchange rate relative to the spot rate. Uncovered Interest Parity (UIP) assumes no risk premium and is formulated as i_d - i_f = (E_t+1 - E_t) / E_t, implying the expected change in exchange rates offsets interest rate differentials. RIRP adjusts for inflation differentials between countries, while UIP focuses exclusively on nominal interest rates and spot and expected forward exchange rates without inflation adjustments.

The Role of Exchange Rates in Both Parity Concepts

Relative interest rate parity (RIRP) explains the relationship between interest rate differentials and expected changes in exchange rates, asserting that the rate of currency depreciation or appreciation offsets interest rate differences to prevent arbitrage. Uncovered interest parity (UIP) assumes that expected future spot exchange rates adjust to equalize returns on deposits in different currencies without using forward contracts, linking interest rate differentials directly to expected currency movements. In both concepts, exchange rates play a crucial role in equilibrating international returns, with RIRP involving forward exchange rates and UIP focusing solely on expected future spot rates.

Key Differences between Relative and Uncovered Interest Rate Parity

Relative interest rate parity (RIRP) emphasizes the relationship between expected changes in exchange rates and the interest rate differential while factoring in expected inflation differences, making it forward-looking and based on anticipated currency movements. Uncovered interest parity (UIP) assumes no hedging through forward contracts and posits that expected returns on domestic and foreign assets are equalized after adjusting for expected exchange rate changes, relying on unbiased expectations without risk premiums. The key difference lies in RIRP focusing on relative price levels and inflation expectations to predict exchange rate adjustments, whereas UIP strictly compares spot rates and interest rates without explicit inflation consideration.

Real-World Applications and Empirical Evidence

Relative interest rate parity (RIRP) explains exchange rate movements by accounting for expected inflation differentials between countries, providing more accurate forecasts in real-world financial markets, especially for long-term investments and international trade pricing. Uncovered interest parity (UIP) assumes forward-looking investors are risk-neutral and that exchange rate changes will offset interest rate differentials, but empirical evidence often reveals persistent deviations due to risk premiums, market imperfections, and behavioral factors. Studies in emerging and developed markets show that RIRP tends to hold better when inflation expectations are stable, while UIP is frequently rejected, highlighting the importance of risk adjustments and macroeconomic variables in currency forecasting models.

Limitations and Criticisms of Both Parities

Relative interest rate parity assumes perfect capital mobility and rational expectations, which often do not hold in real markets, leading to deviations from predicted exchange rate movements. Uncovered interest parity faces challenges due to risk premiums and market imperfections, causing actual returns to diverge from parity conditions. Both parities are criticized for oversimplifying currency risk dynamics and ignoring factors such as transaction costs, political risk, and investor behavior anomalies.

Conclusion: Practical Implications for Investors and Policymakers

Relative interest rate parity (RIRP) provides investors and policymakers with insights into expected exchange rate movements based on interest rate differentials adjusted for inflation, making it a useful tool for hedged foreign investments and inflation-linked policy decisions. Uncovered interest parity (UIP), which assumes no hedging and focuses on expected spot rates, often exhibits empirical deviations, highlighting risks in speculative currency investments and signaling policymakers to consider market expectations and risk premiums. Understanding the practical implications of both parity conditions guides strategic decisions in portfolio allocation, currency risk management, and monetary policy formulation, enhancing financial stability and investment returns.

Relative interest rate parity Infographic

libterm.com

libterm.com