Real wage perception greatly influences employee satisfaction and motivation by reflecting the actual purchasing power of their income after accounting for inflation. Understanding how your wages compare to the cost of living helps you make informed decisions about personal finances and career growth. Explore the full article to learn how real wage perception impacts economic behavior and strategies to improve your financial well-being.

Table of Comparison

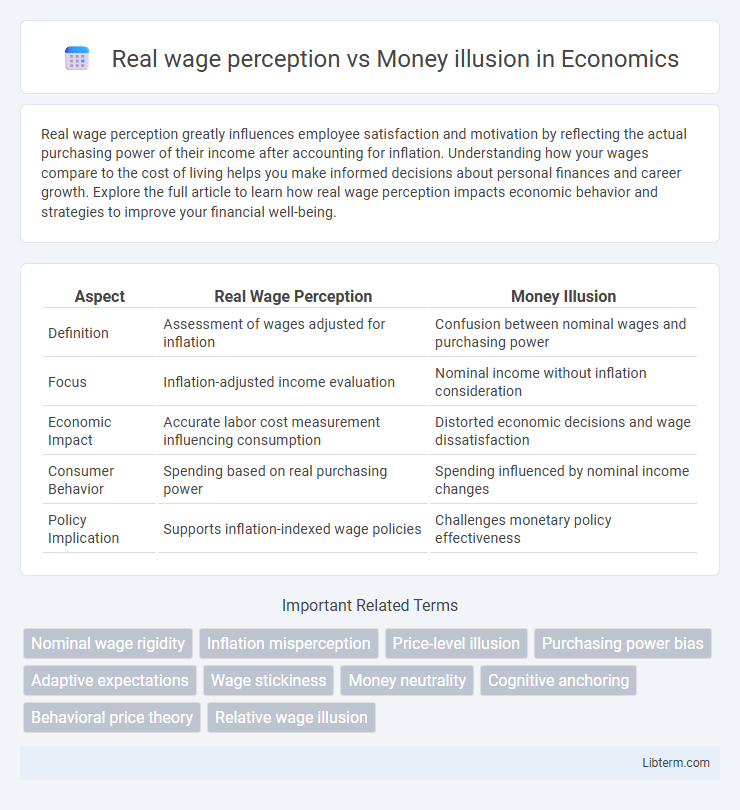

| Aspect | Real Wage Perception | Money Illusion |

|---|---|---|

| Definition | Assessment of wages adjusted for inflation | Confusion between nominal wages and purchasing power |

| Focus | Inflation-adjusted income evaluation | Nominal income without inflation consideration |

| Economic Impact | Accurate labor cost measurement influencing consumption | Distorted economic decisions and wage dissatisfaction |

| Consumer Behavior | Spending based on real purchasing power | Spending influenced by nominal income changes |

| Policy Implication | Supports inflation-indexed wage policies | Challenges monetary policy effectiveness |

Understanding Real Wages: Definition and Importance

Real wages represent the purchasing power of income adjusted for inflation, reflecting the true standard of living and economic well-being of workers. Understanding real wages is crucial because nominal wage increases may be misleading if inflation erodes the actual value of earnings, leading to money illusion where individuals perceive higher income despite stagnant or declining purchasing power. Accurate assessment of real wages helps policymakers, businesses, and employees make informed decisions about labor market conditions and wage setting.

What is Money Illusion? A Psychological Perspective

Money illusion refers to the cognitive bias where individuals perceive their income or wages in nominal terms without adjusting for inflation, leading to a distorted understanding of their real purchasing power. From a psychological perspective, this illusion arises because people focus more on the face value of money rather than its actual value in terms of goods and services, causing misjudgments in financial decisions and labor market behavior. Real wage perception counters this by emphasizing the importance of inflation-adjusted income, helping people accurately assess their economic well-being.

The Difference Between Nominal and Real Wages

Nominal wages refer to the amount of money paid to workers without adjusting for inflation, while real wages represent purchasing power after accounting for price level changes. Money illusion occurs when individuals perceive wage increases nominally without recognizing that real income may remain unchanged or decline due to rising costs. Understanding the difference between nominal and real wages is crucial for accurately assessing economic well-being and labor market conditions.

How Inflation Shapes Real Wage Perception

Inflation distorts real wage perception by causing workers to focus on nominal wage increases rather than purchasing power, leading to money illusion where individuals feel better off despite stagnant or declining real income. When inflation rises faster than nominal wage growth, real wages effectively decrease, eroding consumer confidence and labor satisfaction. This disconnect between nominal wages and inflation-driven cost of living adjustments shapes wage negotiations and influences economic behavior.

Money Illusion: Why We Misinterpret Pay Raises

Money illusion occurs when individuals perceive pay raises based on nominal income increases without accounting for inflation, leading to misinterpretations of real wage growth. This cognitive bias causes workers to feel wealthier despite stagnant or declining purchasing power, distorting their economic decisions and satisfaction. Understanding the disparity between nominal and real wages is crucial for accurately assessing compensation and making informed financial choices.

Economic Impacts of Money Illusion on Households

Money illusion occurs when households evaluate their income and purchasing power based on nominal wages rather than real wages adjusted for inflation. This misperception can lead to suboptimal financial decisions, such as overspending during periods of rising prices, which ultimately reduces savings and financial security. Economic impacts include distorted consumption patterns and increased vulnerability to economic shocks, affecting overall household welfare and economic stability.

Real Wage Perception in Policy Making

Real wage perception plays a crucial role in policymaking by providing a more accurate understanding of workers' purchasing power adjusted for inflation. Policymakers use real wage data to design effective labor market regulations and inflation controls that reflect the true economic well-being of employees. Ignoring real wage perception and relying solely on nominal wages can lead to misguided policy decisions that fail to address cost-of-living changes and economic inequality.

Money Illusion in Salary Negotiations and Labor Markets

Money illusion significantly impacts salary negotiations and labor markets by causing workers to focus on nominal wages rather than real purchasing power. This cognitive bias leads employees to accept pay raises that do not keep up with inflation, effectively reducing their real income over time. Employers may exploit money illusion to manage labor costs, resulting in wage stagnation despite rising living expenses.

Strategies to Overcome Money Illusion

Recognizing the difference between real wage perception and money illusion is crucial for effective financial decision-making and policy formulation. Strategies to overcome money illusion include enhancing financial literacy, promoting awareness of inflation-adjusted wages, and encouraging the use of real income indicators rather than nominal figures in both personal finance and salary negotiations. Employers and policymakers can implement transparent communication about inflation impacts on purchasing power to reduce the cognitive bias associated with nominal wage increases.

The Future of Real Wage Awareness in the Digital Economy

The future of real wage awareness in the digital economy depends heavily on advanced data analytics and transparent wage reporting, enabling workers to accurately assess purchasing power beyond nominal salary figures. Machine learning algorithms integrated into payroll platforms can highlight inflation-adjusted earnings, helping employees counteract money illusion and make informed financial decisions. Enhanced real-time financial dashboards will play a crucial role in fostering greater wage transparency and boosting economic literacy among digital workers.

Real wage perception Infographic

libterm.com

libterm.com