Hot money refers to the flow of funds that move rapidly between financial markets to capitalize on short-term interest rate differences or speculative opportunities. This capital can significantly impact currency values and economic stability as it swiftly enters or exits countries based on market conditions. Learn more about how hot money influences global economies and what it means for your investments in the following article.

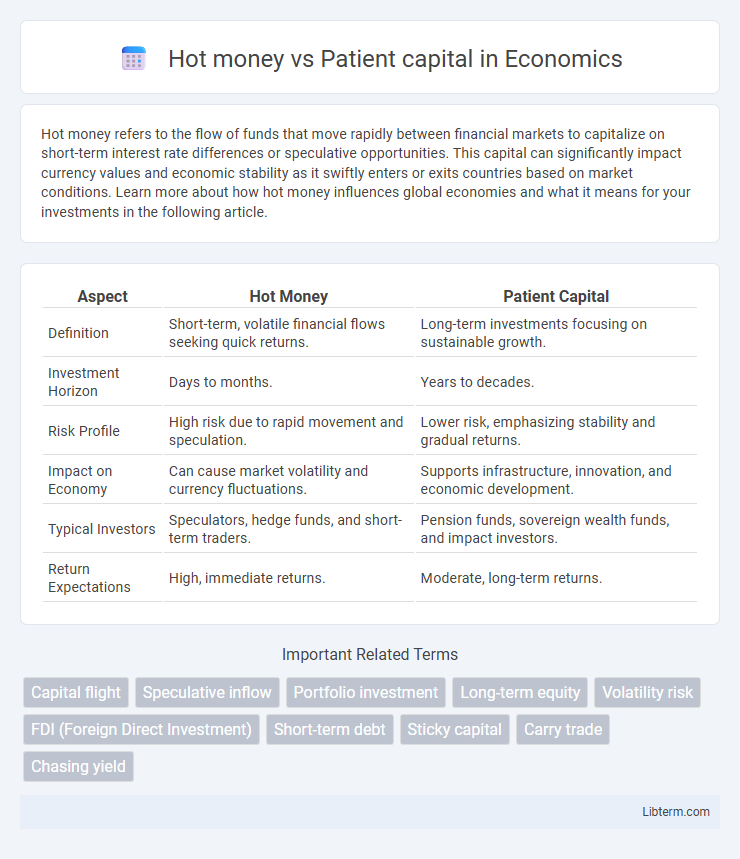

Table of Comparison

| Aspect | Hot Money | Patient Capital |

|---|---|---|

| Definition | Short-term, volatile financial flows seeking quick returns. | Long-term investments focusing on sustainable growth. |

| Investment Horizon | Days to months. | Years to decades. |

| Risk Profile | High risk due to rapid movement and speculation. | Lower risk, emphasizing stability and gradual returns. |

| Impact on Economy | Can cause market volatility and currency fluctuations. | Supports infrastructure, innovation, and economic development. |

| Typical Investors | Speculators, hedge funds, and short-term traders. | Pension funds, sovereign wealth funds, and impact investors. |

| Return Expectations | High, immediate returns. | Moderate, long-term returns. |

Introduction to Hot Money and Patient Capital

Hot money refers to short-term, highly liquid capital that moves rapidly across borders seeking quick returns, often causing volatility in financial markets. Patient capital, by contrast, involves long-term investments with a focus on sustainable growth, supporting enterprises and infrastructure over extended periods. Understanding the dynamics between hot money and patient capital is crucial for policymakers aiming to balance economic stability and growth.

Defining Hot Money: Characteristics and Examples

Hot money refers to short-term capital that flows rapidly in and out of financial markets seeking quick profits from interest rate differentials or currency fluctuations. Characterized by high liquidity, volatility, and sensitivity to market changes, hot money often impacts exchange rates and asset prices in emerging economies. Examples include speculative foreign exchange trades, short-term government bond investments, and rapid movements in portfolio capital across borders.

Patient Capital Explained: Key Features and Benefits

Patient capital refers to long-term investments made with the expectation of steady growth rather than immediate returns, often in sectors like infrastructure, technology, and social enterprises. It prioritizes sustainable value creation by allowing businesses to develop and scale over several years without the pressure of quick profits, fostering innovation and resilience. The key benefits of patient capital include enhanced business stability, increased potential for impactful growth, and alignment with socially responsible investment goals.

Sources of Hot Money and Patient Capital

Hot money typically originates from speculative investments, hedge funds, and short-term foreign portfolio inflows seeking quick returns in volatile markets. Patient capital is predominantly sourced from long-term institutional investors such as pension funds, endowments, sovereign wealth funds, and impact investors committed to sustainable growth and social impact. These distinct origins influence their investment horizons, risk tolerance, and impact on economic stability.

Investment Horizons: Short-Term vs Long-Term Strategies

Hot money refers to short-term investment capital that rapidly moves between markets seeking quick profits, often driven by interest rate differentials or speculative opportunities. Patient capital emphasizes long-term investment horizons, supporting sustainable growth by providing steady funding for ventures with extended development timelines. Distinguishing between these strategies is crucial for portfolio diversification, as it balances immediate liquidity needs with enduring value creation.

Economic Impact of Hot Money Inflows and Outflows

Hot money inflows can cause rapid currency appreciation, asset bubbles, and increased market volatility, destabilizing emerging economies' financial systems. Sudden outflows of hot money exacerbate capital flight, reduce liquidity, and trigger sharp exchange rate depreciation, often leading to economic crises and recessionary pressures. Managing hot money volatility requires strong monetary policies and financial regulations to mitigate adverse economic impacts and sustain long-term growth.

Patient Capital in Sustainable Development

Patient capital plays a crucial role in sustainable development by providing long-term investments that support environmental and social projects with extended timelines for returns. Unlike hot money, which seeks rapid profits through quick entry and exit in markets, patient capital emphasizes stable funding, enabling renewable energy, infrastructure, and social enterprises to achieve lasting impact. This type of capital aligns financial goals with sustainable outcomes, fostering resilience and inclusive growth in developing economies.

Risks Associated with Hot Money Movement

Hot money movements pose significant risks including rapid capital flight that can destabilize financial markets and lead to currency volatility. These short-term investments often seek quick returns, increasing the likelihood of sudden withdrawals during economic uncertainty, which can trigger liquidity crises. In contrast, patient capital provides stability by committing funds for longer periods, reducing the risk of abrupt market disruptions.

Comparing Returns: Hot Money vs Patient Capital

Hot money typically seeks quick, high returns through short-term investments in volatile markets, often resulting in unpredictable and rapidly changing gains. Patient capital focuses on long-term investments, emphasizing steady, sustainable returns by supporting companies with growth potential over several years. While hot money can generate immediate profits, patient capital generally delivers more stable and cumulative returns by riding out market fluctuations.

Policy Implications and Regulatory Considerations

Hot money flows, characterized by rapid short-term capital movements seeking quick returns, require stringent regulatory measures such as capital controls and enhanced monitoring to prevent financial instability and speculative bubbles. In contrast, patient capital, which involves long-term investments aimed at sustainable growth, benefits from policies that encourage stable funding environments, such as tax incentives and supportive legal frameworks to promote innovation and infrastructure development. Effective policy design must balance the agility of hot money with the stability of patient capital, ensuring financial markets remain resilient while attracting diverse investment horizons.

Hot money Infographic

libterm.com

libterm.com