Precautionary saving refers to setting aside funds to protect against unexpected financial emergencies or income fluctuations. It plays a crucial role in maintaining financial stability and reducing anxiety during uncertain times. Explore the full article to understand how precautionary saving can secure your financial future.

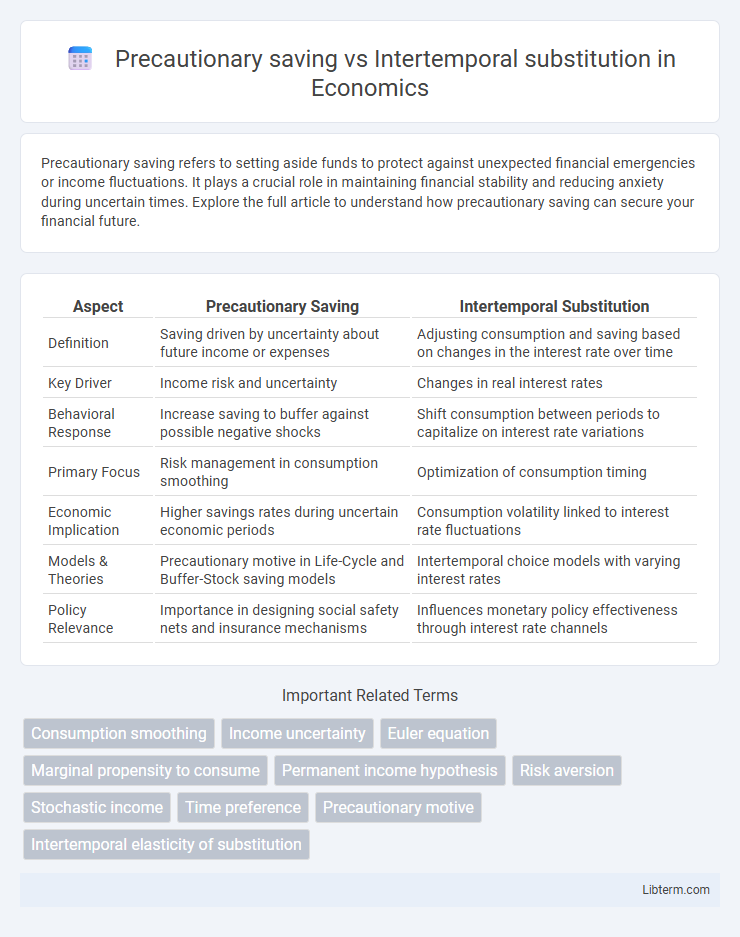

Table of Comparison

| Aspect | Precautionary Saving | Intertemporal Substitution |

|---|---|---|

| Definition | Saving driven by uncertainty about future income or expenses | Adjusting consumption and saving based on changes in the interest rate over time |

| Key Driver | Income risk and uncertainty | Changes in real interest rates |

| Behavioral Response | Increase saving to buffer against possible negative shocks | Shift consumption between periods to capitalize on interest rate variations |

| Primary Focus | Risk management in consumption smoothing | Optimization of consumption timing |

| Economic Implication | Higher savings rates during uncertain economic periods | Consumption volatility linked to interest rate fluctuations |

| Models & Theories | Precautionary motive in Life-Cycle and Buffer-Stock saving models | Intertemporal choice models with varying interest rates |

| Policy Relevance | Importance in designing social safety nets and insurance mechanisms | Influences monetary policy effectiveness through interest rate channels |

Introduction to Precautionary Saving and Intertemporal Substitution

Precautionary saving arises from uncertainty about future income, prompting individuals to save more today to buffer against potential risks like job loss or unexpected expenses. Intertemporal substitution refers to consumer decisions to allocate consumption over time based on anticipated changes in interest rates or wages, optimizing satisfaction across different periods. Understanding these concepts is essential for analyzing how households adjust saving and spending behavior in response to economic fluctuations and uncertainty.

Defining Precautionary Saving: Motivations and Examples

Precautionary saving refers to the additional money individuals set aside to protect against future income uncertainty or unexpected expenses, driven primarily by risk aversion and imperfect insurance markets. Motivations include preparing for potential job loss, medical emergencies, or economic downturns, which create a buffer against financial shocks. Examples are increasing savings when income volatility rises or holding emergency funds to maintain consumption during periods of unemployment or unforeseen expenditures.

Understanding Intertemporal Substitution: Concept and Significance

Intertemporal substitution refers to the consumer's decision to shift consumption across different time periods in response to changes in the real interest rate or expected future income, aiming to maximize lifetime utility. It plays a crucial role in understanding how individuals balance present and future consumption, emphasizing the elasticity of intertemporal substitution, which measures responsiveness to interest rate variations. This concept helps explain fluctuations in savings rates and consumption patterns over time, influencing economic policy decisions and financial planning.

Core Differences Between Precautionary Saving and Intertemporal Substitution

Precautionary saving arises from uncertainty about future income or expenses, motivating individuals to accumulate wealth as a buffer against risks. Intertemporal substitution involves adjusting consumption patterns in response to changes in the relative price of current versus future consumption, such as interest rate fluctuations. The core difference lies in the motivation: precautionary saving is driven by risk aversion and uncertainty, while intertemporal substitution is driven by optimizing consumption timing based on changing economic incentives.

Economic Theories Underpinning Saving Behavior

Precautionary saving stems from uncertainty in future income, emphasizing the role of risk aversion and the need for financial buffers in the Life-Cycle Hypothesis and Permanent Income Hypothesis frameworks. Intertemporal substitution highlights consumer responses to changing interest rates, where saving behavior adjusts based on the trade-off between current and future consumption, grounded in the Intertemporal Choice Theory. Both theories collectively explain saving patterns through consumption smoothing, risk management, and time preference in economic decision-making models.

Factors Driving Precautionary Saving Decisions

Precautionary saving decisions are primarily driven by income uncertainty, unpredictable expenses, and lack of complete insurance, which create a buffer against potential financial shocks. Risk aversion and the volatility of future earnings amplify the desire to accumulate savings as a safeguard, distinguishing this behavior from intertemporal substitution, which responds mainly to changes in interest rates and consumption preferences over time. Empirical evidence highlights that higher income volatility and limited social safety nets significantly increase precautionary savings rates across households.

Determinants of Intertemporal Consumption Choices

Intertemporal consumption choices are primarily determined by factors such as income expectations, interest rates, and individual time preferences, which influence the trade-off between current and future consumption. Precautionary saving arises from income uncertainty and risk aversion, motivating individuals to save more as a buffer against possible future income shocks. In contrast, intertemporal substitution depends on the relative price of consumption today versus tomorrow, driving consumers to shift spending in response to changes in the interest rate environment.

Impact of Uncertainty on Consumer Saving Patterns

Uncertainty about future income or expenses drives precautionary saving, prompting consumers to increase savings as a financial buffer against unforeseen risks. In contrast, intertemporal substitution reflects consumers' adjustment of saving and consumption patterns based on changing interest rates or expected future income, optimizing utility over time. The impact of uncertainty intensifies precautionary saving motives, often outweighing intertemporal substitution effects, leading to higher aggregate savings during periods of economic volatility.

Policy Implications for Saving and Consumption Dynamics

Precautionary saving increases household savings rates in response to income uncertainty, affecting overall consumption dynamics by cushioning against economic shocks and promoting financial stability. Intertemporal substitution allows consumers to adjust their spending over time based on changes in the real interest rate, influencing the timing of consumption but potentially amplifying fluctuations in aggregate demand. Policymakers should consider these behaviors when designing fiscal and monetary policies to balance incentives for savings accumulation and consumption smoothing, enhancing economic resilience and growth stability.

Conclusion: Balancing Precautionary Motives and Intertemporal Choices

Balancing precautionary saving motives and intertemporal substitution requires understanding that individuals allocate resources to buffer against income uncertainty while simultaneously optimizing consumption over time. Empirical evidence shows that heightened uncertainty increases precautionary savings, whereas favorable intertemporal substitution elasticity promotes consumption smoothing across periods. Effective economic models must integrate both factors to accurately predict savings behavior and inform policy designed to enhance financial stability and consumption efficiency.

Precautionary saving Infographic

libterm.com

libterm.com