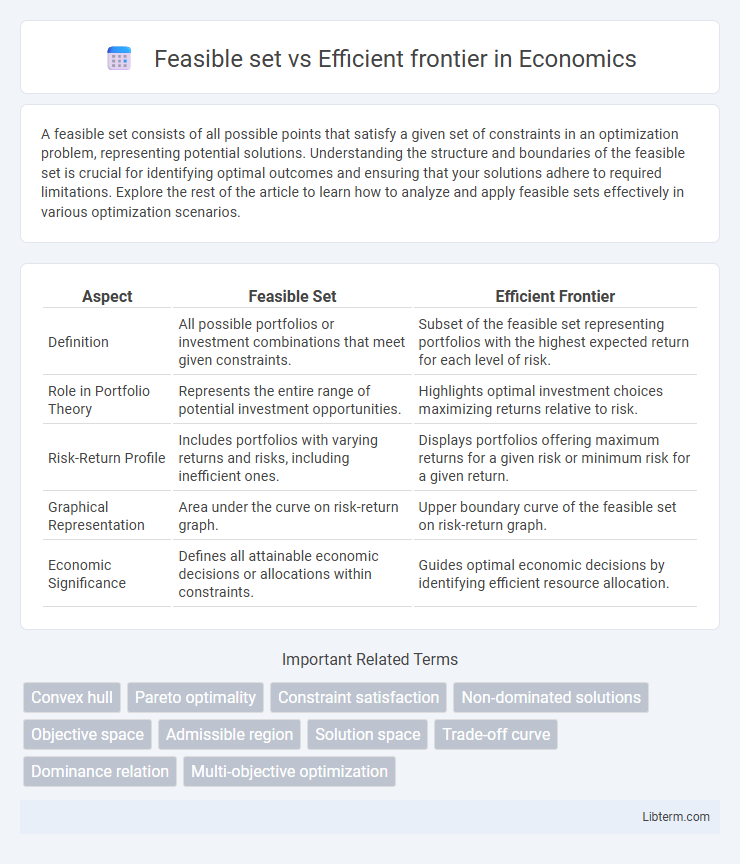

A feasible set consists of all possible points that satisfy a given set of constraints in an optimization problem, representing potential solutions. Understanding the structure and boundaries of the feasible set is crucial for identifying optimal outcomes and ensuring that your solutions adhere to required limitations. Explore the rest of the article to learn how to analyze and apply feasible sets effectively in various optimization scenarios.

Table of Comparison

| Aspect | Feasible Set | Efficient Frontier |

|---|---|---|

| Definition | All possible portfolios or investment combinations that meet given constraints. | Subset of the feasible set representing portfolios with the highest expected return for each level of risk. |

| Role in Portfolio Theory | Represents the entire range of potential investment opportunities. | Highlights optimal investment choices maximizing returns relative to risk. |

| Risk-Return Profile | Includes portfolios with varying returns and risks, including inefficient ones. | Displays portfolios offering maximum returns for a given risk or minimum risk for a given return. |

| Graphical Representation | Area under the curve on risk-return graph. | Upper boundary curve of the feasible set on risk-return graph. |

| Economic Significance | Defines all attainable economic decisions or allocations within constraints. | Guides optimal economic decisions by identifying efficient resource allocation. |

Introduction to Feasible Set and Efficient Frontier

The feasible set represents all potential investment portfolios that satisfy given constraints such as budget, risk tolerance, and asset allocation limits. The efficient frontier is a subset of the feasible set, consisting of portfolios that optimize returns for a given level of risk or minimize risk for a given level of return. Understanding the distinction between the feasible set and the efficient frontier is crucial for portfolio optimization and investment decision-making.

Defining the Feasible Set in Portfolio Theory

The feasible set in portfolio theory consists of all possible portfolios constructed from a given set of assets, representing combinations of asset weights that satisfy investment constraints such as budget and non-negativity conditions. Each portfolio within the feasible set has a corresponding expected return and risk (variance or standard deviation), allowing investors to evaluate trade-offs. Defining the feasible set is crucial as it forms the foundation for identifying the efficient frontier, which represents portfolios offering the highest expected return for a given level of risk.

Understanding the Efficient Frontier Concept

The feasible set represents all possible portfolios that can be constructed with a given set of assets, while the efficient frontier consists of portfolios that offer the highest expected return for a defined level of risk or the lowest risk for a given return. Understanding the efficient frontier involves recognizing its role as a boundary in mean-variance optimization that guides investors in selecting optimal portfolios based on risk-return trade-offs. This concept is foundational in modern portfolio theory, enabling investors to maximize returns while minimizing risk through diversification.

Key Differences Between Feasible Set and Efficient Frontier

The feasible set represents all possible investment portfolios that satisfy given constraints, including risk and return parameters, whereas the efficient frontier consists solely of portfolios offering the highest expected return for a given level of risk. Portfolios on the efficient frontier are non-dominated, meaning no other portfolio exists with both higher return and lower risk, while the feasible set contains dominated portfolios below this optimal curve. The key difference lies in the optimality criterion: the feasible set encompasses all allowable portfolios, and the efficient frontier identifies the subset that maximizes risk-return efficiency.

Importance of the Feasible Set in Investment Decisions

The feasible set represents all possible portfolios that meet given constraints, forming the foundation for identifying optimal investment choices. Understanding the feasible set is crucial as it outlines the risk-return combinations investors can realistically achieve before applying efficiency criteria. This ensures informed decisions by highlighting the full spectrum of attainable portfolios, enabling selection of those on the efficient frontier for maximum return at a given risk.

Constructing the Efficient Frontier: Methodology and Tools

Constructing the efficient frontier involves identifying the set of optimal portfolios that maximize expected return for a given level of risk within the feasible set, which consists of all possible portfolios. Methodologies like mean-variance optimization use quadratic programming to solve for portfolio weights that minimize variance for targeted returns. Tools such as Microsoft Excel Solver, MATLAB, and Python libraries like CVXPY facilitate this process by enabling numerical optimization and visualization of the efficient frontier curve.

Risk and Return Implications on the Feasible Set

The feasible set represents all possible portfolios that can be constructed from a given selection of assets, encompassing varying levels of risk and return. Risk within this set is typically measured by portfolio variance or standard deviation, indicating potential deviations from expected returns. The efficient frontier emerges as the subset of portfolios within the feasible set that offer the highest expected return for a given level of risk or the lowest risk for a given expected return, highlighting optimal risk-return trade-offs.

Practical Applications of the Efficient Frontier

The efficient frontier represents the set of optimal portfolios offering the highest expected return for a defined level of risk, making it crucial for investment decision-making and asset allocation. While the feasible set includes all possible portfolios, only those on the efficient frontier provide the best risk-return trade-offs, guiding investors in constructing portfolios that maximize returns without unnecessary risk. Practical applications of the efficient frontier involve portfolio optimization in wealth management, retirement planning, and risk assessment, enabling financial advisors to tailor investment strategies aligned with clients' risk tolerance and financial goals.

Feasible Set vs Efficient Frontier: Real-World Examples

The feasible set represents all possible portfolios achievable with given assets, showcasing the range of risk-return combinations investors can select. The efficient frontier narrows this to portfolios offering the highest return for a given level of risk, serving as the optimal investment choices. Real-world examples include diversified mutual funds and pension portfolios positioned on the efficient frontier, while individual asset choices and less optimized portfolios fall within the feasible set but below the frontier.

Conclusion: Choosing Optimal Portfolios

The feasible set represents all possible portfolios that meet given investment constraints, while the efficient frontier consists of portfolios that offer the highest expected return for a defined level of risk. Optimal portfolio selection occurs on the efficient frontier, where investors achieve maximum returns without unnecessary risk exposure. Prioritizing portfolios on the frontier enables informed decisions consistent with individual risk tolerance and investment objectives.

Feasible set Infographic

libterm.com

libterm.com