Face value refers to the original monetary value printed on a financial instrument such as a bond, stock certificate, or currency note, representing its nominal worth. It is essential for investors to understand face value when assessing the price and potential returns of securities, as market value can fluctuate independently. Discover more about how face value impacts your investment decisions in the rest of this article.

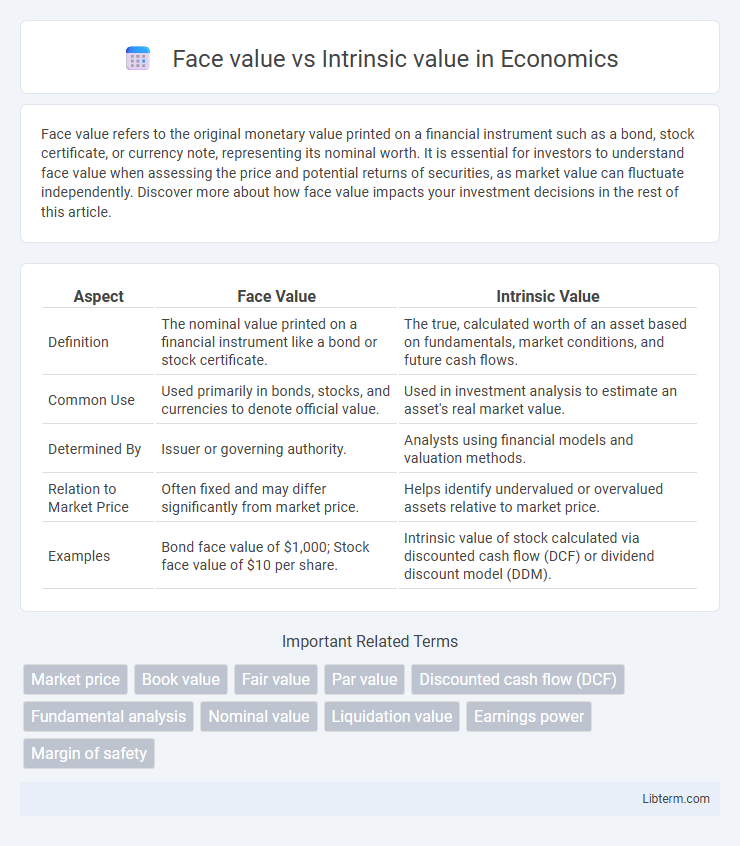

Table of Comparison

| Aspect | Face Value | Intrinsic Value |

|---|---|---|

| Definition | The nominal value printed on a financial instrument like a bond or stock certificate. | The true, calculated worth of an asset based on fundamentals, market conditions, and future cash flows. |

| Common Use | Used primarily in bonds, stocks, and currencies to denote official value. | Used in investment analysis to estimate an asset's real market value. |

| Determined By | Issuer or governing authority. | Analysts using financial models and valuation methods. |

| Relation to Market Price | Often fixed and may differ significantly from market price. | Helps identify undervalued or overvalued assets relative to market price. |

| Examples | Bond face value of $1,000; Stock face value of $10 per share. | Intrinsic value of stock calculated via discounted cash flow (DCF) or dividend discount model (DDM). |

Understanding Face Value: Definition and Examples

Face value represents the nominal worth printed on a financial instrument like a bond or stock certificate, indicating its original cost or maturity amount. For example, a bond with a face value of $1,000 will pay that amount to the holder upon maturity, regardless of market fluctuations. Understanding face value helps investors distinguish the stated value from the market price or intrinsic value, which reflects the actual worth based on underlying assets and earning potential.

What is Intrinsic Value? Key Concepts Explained

Intrinsic value represents the true, inherent worth of an asset based on its fundamental characteristics, independent of market price fluctuations. It is calculated using factors such as discounted cash flows, earnings potential, and asset liquidation value, providing a more accurate measure of an investment's real value. Understanding intrinsic value is crucial for investors aiming to identify undervalued or overvalued securities beyond their face value or market price.

Face Value vs Intrinsic Value: Core Differences

Face value represents the nominal worth printed on a financial instrument, such as a bond or stock certificate, and does not fluctuate with market conditions. Intrinsic value reflects the true, underlying worth of an asset based on fundamental analysis, including factors like cash flow, earnings, and growth potential. The core difference lies in face value being a fixed statutory amount, while intrinsic value varies according to an asset's actual financial performance and market perceptions.

Importance of Face Value in Financial Instruments

Face value represents the nominal value of a financial instrument printed on the certificate, serving as the baseline for calculations like interest payments on bonds or dividends on shares. It is crucial for investors to understand the face value because it determines the fixed payments, maturity amount, and legal value of the security. Despite market price fluctuations, the face value remains a reference point for assessing returns and contractual obligations in financial markets.

Intrinsic Value and Its Role in Investment Decisions

Intrinsic value represents the true worth of an asset based on fundamentals like cash flow, earnings, and growth potential, rather than its market price or face value. Investors rely on intrinsic value to make informed decisions by identifying undervalued or overvalued securities, guiding buy or sell actions. Understanding intrinsic value helps in assessing long-term investment viability and mitigating market price volatility risks.

Factors Influencing Face Value

Face value, the nominal value printed on a financial instrument like a bond or stock certificate, is primarily influenced by the issuing company's initial pricing strategy and regulatory guidelines. Factors such as market conditions, inflation rates at issuance, and the purpose of the security issuance also play crucial roles in determining face value. Unlike intrinsic value, which reflects the true worth based on fundamentals and market perceptions, face value remains fixed and unaffected by subsequent market fluctuations.

How to Calculate Intrinsic Value

Intrinsic value is calculated by estimating the present value of expected future cash flows generated by an asset, discounted at an appropriate rate reflecting its risk. For stocks, the discounted cash flow (DCF) model is commonly used, which involves projecting future earnings and dividing by the discount rate minus growth rate. Unlike face value, which is the nominal or stated value printed on a security, intrinsic value provides a more accurate measure of the asset's true worth based on its fundamentals.

Practical Applications: Face Value vs Intrinsic Value in Stocks and Bonds

Face value represents the original cost printed on a stock or bond certificate, indicating the amount paid at issuance or the bond's maturity value. Intrinsic value in stocks reflects the true worth based on fundamental analysis, considering factors like earnings, dividends, and growth potential, while for bonds, it represents the present value of future coupon payments and principal repayment discounted at the market interest rate. Investors use face value for nominal reference, but intrinsic value guides practical decision-making in evaluating investment attractiveness and potential returns.

Common Misconceptions about Face and Intrinsic Values

Face value is often mistaken for the true worth of a security, but it merely represents the nominal value printed on the certificate, such as a bond's par value or a stock's original issuance price. Intrinsic value reflects the actual, underlying worth based on fundamentals like cash flow, dividends, and asset value, which investors use to assess an asset's real potential. Confusing face value with intrinsic value can lead to poor investment decisions, as face value ignores market conditions and company performance that determine intrinsic worth.

Which Matters More: Face Value or Intrinsic Value?

Intrinsic value matters more than face value when assessing an asset's true worth, as intrinsic value considers fundamental factors like cash flow, growth potential, and market conditions. Face value simply represents the nominal or stated amount on financial instruments such as bonds or stocks, often unrelated to their market price or real economic value. Investors prioritize intrinsic value to make informed decisions, ensuring they do not rely solely on face value which may misrepresent an asset's actual profitability or risk.

Face value Infographic

libterm.com

libterm.com