Consumption smoothing refers to the strategy individuals use to maintain a stable standard of living by adjusting their spending and saving habits in response to fluctuating income or unexpected expenses. It involves allocating resources to ensure that consumption remains relatively consistent over time despite financial ups and downs. Discover how mastering consumption smoothing can improve your financial security and long-term well-being throughout the rest of this article.

Table of Comparison

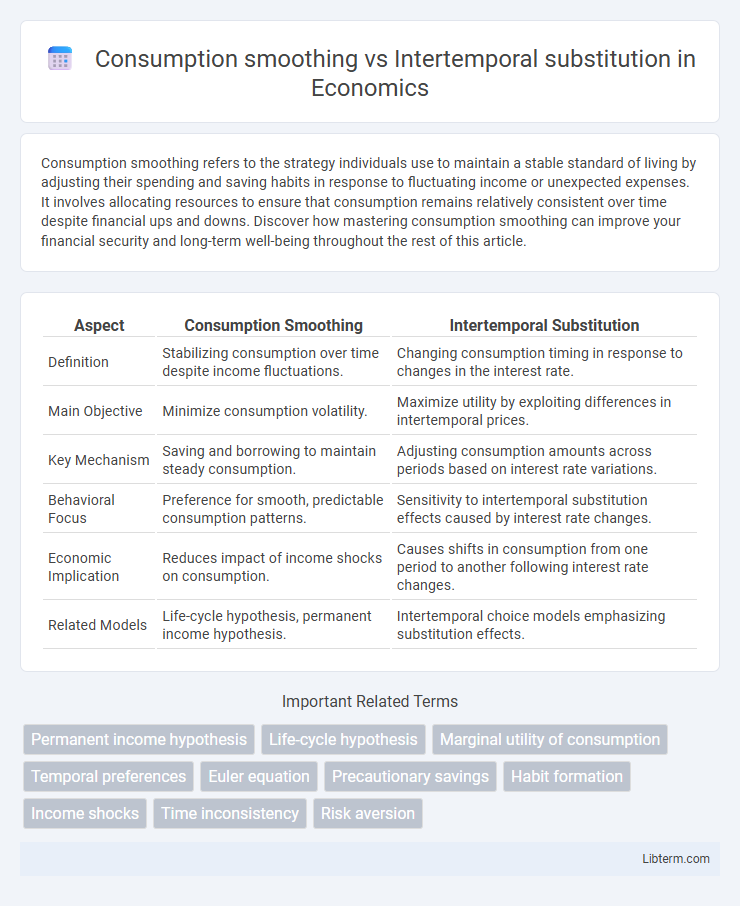

| Aspect | Consumption Smoothing | Intertemporal Substitution |

|---|---|---|

| Definition | Stabilizing consumption over time despite income fluctuations. | Changing consumption timing in response to changes in the interest rate. |

| Main Objective | Minimize consumption volatility. | Maximize utility by exploiting differences in intertemporal prices. |

| Key Mechanism | Saving and borrowing to maintain steady consumption. | Adjusting consumption amounts across periods based on interest rate variations. |

| Behavioral Focus | Preference for smooth, predictable consumption patterns. | Sensitivity to intertemporal substitution effects caused by interest rate changes. |

| Economic Implication | Reduces impact of income shocks on consumption. | Causes shifts in consumption from one period to another following interest rate changes. |

| Related Models | Life-cycle hypothesis, permanent income hypothesis. | Intertemporal choice models emphasizing substitution effects. |

Introduction to Consumption Smoothing and Intertemporal Substitution

Consumption smoothing refers to individuals' efforts to maintain a stable level of consumption over time despite fluctuations in income, enabling them to avoid significant changes in their living standards. Intertemporal substitution involves adjusting consumption patterns by shifting spending between different time periods in response to changes in the relative price of consumption, such as variations in interest rates. Understanding both concepts is crucial for analyzing how consumers optimize utility by balancing current and future consumption in response to economic incentives and constraints.

Defining Consumption Smoothing: Concepts and Mechanisms

Consumption smoothing refers to the economic behavior where individuals seek to maintain a stable level of consumption over time despite fluctuations in income or financial resources. This mechanism relies on saving during periods of high income and borrowing or dissaving during periods of low income to avoid drastic changes in consumption patterns. It contrasts with intertemporal substitution, where consumption is adjusted in response to changes in the relative price of current versus future consumption, emphasizing timing rather than stability.

Understanding Intertemporal Substitution in Economics

Intertemporal substitution in economics examines how individuals adjust their consumption patterns in response to fluctuations in interest rates or income over time, prioritizing consumption during periods of higher return or lower opportunity cost. This concept contrasts with consumption smoothing, which emphasizes maintaining a stable consumption level despite income variations by saving or borrowing. Understanding intertemporal substitution aids in analyzing how consumers optimize utility by shifting consumption across different time periods based on economic incentives and personal preferences.

Key Differences Between Consumption Smoothing and Intertemporal Substitution

Consumption smoothing involves maintaining a stable level of consumption over time despite fluctuating income, driven by preferences for stable utility and risk aversion; in contrast, intertemporal substitution emphasizes altering consumption patterns in response to changing relative returns, such as interest rates. Consumption smoothing relies on saving and borrowing to offset income shocks, while intertemporal substitution depends on the trade-off between present and future consumption incentivized by changes in the intertemporal price of consumption. The key distinction lies in consumption smoothing focusing on stabilizing utility over time, whereas intertemporal substitution prioritizes optimizing consumption timing based on changing economic incentives.

Theoretical Models Explaining Consumption Patterns

Theoretical models of consumption patterns distinguish between consumption smoothing, which posits that individuals aim to maintain stable consumption levels over time by saving or borrowing, and intertemporal substitution, where consumers adjust consumption in response to changes in the real interest rate to maximize utility. The Life-Cycle Hypothesis and Permanent Income Hypothesis emphasize consumption smoothing by predicting stable consumption based on lifetime income expectations. In contrast, models incorporating intertemporal substitution, such as the Euler equation framework in dynamic optimization, highlight how variations in interest rates incentivize shifting consumption between periods.

Impact of Income Shocks on Consumption Decisions

Income shocks significantly influence consumption decisions through distinct mechanisms of consumption smoothing and intertemporal substitution. Consumption smoothing involves individuals adjusting savings and borrowing to maintain stable consumption despite income fluctuations, minimizing immediate welfare loss. Intertemporal substitution reflects changes in the timing of consumption as consumers respond to variations in income by shifting spending across periods based on expected future earnings and interest rates.

Role of Interest Rates in Intertemporal Consumption Choices

Interest rates play a crucial role in intertemporal consumption choices by influencing the opportunity cost of current versus future consumption, where higher rates incentivize saving and delay consumption to benefit from increased future returns. Consumption smoothing aims to maintain stable consumption levels despite fluctuating income, while intertemporal substitution involves adjusting consumption timing in response to changes in interest rates. The interplay between interest rates and these behaviors determines how individuals allocate resources over time to optimize utility.

Policy Implications: Social Safety Nets and Economic Behavior

Consumption smoothing allows individuals to maintain stable spending patterns despite income fluctuations, influencing the design of social safety nets to provide timely support during economic shocks. Intertemporal substitution involves adjusting consumption based on expected changes in interest rates or income over time, guiding policies that encourage saving or spending to optimize economic growth. Well-structured social safety nets reduce the need for drastic consumption cuts, promoting economic stability while accounting for behavioral responses linked to intertemporal consumption decisions.

Real-World Examples and Empirical Evidence

Consumption smoothing describes individuals' tendency to maintain stable consumption patterns despite fluctuating income, exemplified by households using savings or borrowing during income shocks like job loss or medical emergencies. Intertemporal substitution involves adjusting consumption timing in response to changes in real interest rates or wages, as seen when workers increase labor supply during high wage periods and reduce it when wages fall. Empirical studies using panel data from countries such as the United States and Japan show strong evidence of consumption smoothing driven by precautionary saving motives, while intertemporal substitution effects are generally weaker but observable in labor supply responses to tax changes and credit availability.

Conclusion: Balancing Smoothing and Substitution in Economic Planning

Balancing consumption smoothing and intertemporal substitution is crucial for effective economic planning, as households aim to maintain stable consumption patterns while optimizing utility based on changing interest rates and income over time. Policymakers must consider mechanisms that support both immediate consumption stability and incentives for saving or spending in response to shifting economic conditions. Achieving this balance enhances economic resilience and promotes sustainable long-term growth.

Consumption smoothing Infographic

libterm.com

libterm.com