Interest rates significantly influence borrowing costs and saving returns, shaping economic growth and personal financial decisions. Understanding how fluctuating interest rates affect loans, mortgages, and investments is crucial for effective money management. Explore the rest of the article to learn how you can optimize your financial strategies based on interest rate trends.

Table of Comparison

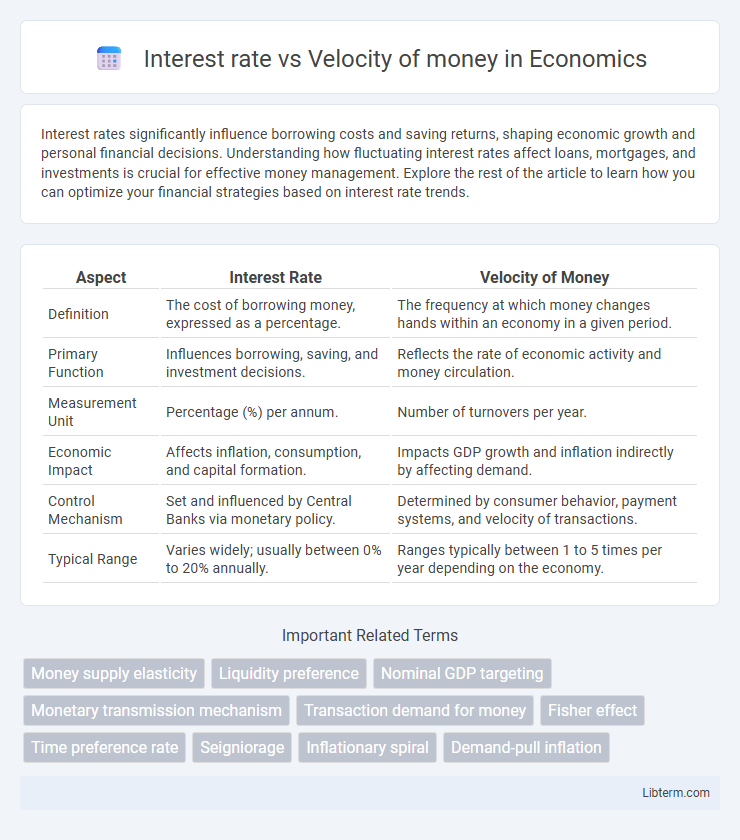

| Aspect | Interest Rate | Velocity of Money |

|---|---|---|

| Definition | The cost of borrowing money, expressed as a percentage. | The frequency at which money changes hands within an economy in a given period. |

| Primary Function | Influences borrowing, saving, and investment decisions. | Reflects the rate of economic activity and money circulation. |

| Measurement Unit | Percentage (%) per annum. | Number of turnovers per year. |

| Economic Impact | Affects inflation, consumption, and capital formation. | Impacts GDP growth and inflation indirectly by affecting demand. |

| Control Mechanism | Set and influenced by Central Banks via monetary policy. | Determined by consumer behavior, payment systems, and velocity of transactions. |

| Typical Range | Varies widely; usually between 0% to 20% annually. | Ranges typically between 1 to 5 times per year depending on the economy. |

Understanding Interest Rates: Definition and Types

Interest rates represent the cost of borrowing or the return on investment expressed as a percentage of the principal over time, influencing consumer spending and saving behaviors. Key types include nominal interest rates, which do not account for inflation, real interest rates adjusted for inflation, and fixed versus variable rates that determine payment stability or fluctuation. Understanding these distinctions is critical for analyzing how changing interest rates affect the velocity of money, or the speed at which money circulates in the economy.

Defining the Velocity of Money

The velocity of money measures the frequency at which a unit of currency circulates in the economy within a given period, reflecting economic activity and consumer spending. It is calculated by dividing the nominal GDP by the money supply, indicating how quickly money changes hands. Unlike interest rates, which influence borrowing costs and saving incentives, the velocity of money captures the rate of monetary exchanges driving overall economic flow.

The Economic Role of Interest Rates

Interest rates play a crucial economic role by influencing the cost of borrowing and the incentive to save, which directly affects consumption and investment levels. Changes in interest rates impact the velocity of money by altering how quickly money circulates within the economy; lower rates tend to increase spending and money turnover, while higher rates encourage saving and reduce velocity. Central banks use interest rate adjustments as a primary tool to manage inflation and stabilize economic growth through controlling the money supply velocity.

How Velocity of Money Impacts Economic Activity

The velocity of money, defined as the frequency at which a unit of currency circulates in the economy, directly influences economic activity by affecting aggregate demand levels. A high velocity indicates rapid spending and increased economic transactions, stimulating growth, while a low velocity reflects money hoarding, dampening consumption and slowing economic expansion. Central banks monitor velocity trends closely, as changes can alter the effectiveness of monetary policy irrespective of prevailing interest rates.

Direct vs. Indirect Relationship: Interest Rate and Money Velocity

Interest rates exhibit an indirect relationship with the velocity of money, as higher interest rates generally discourage borrowing and spending, reducing the frequency of money circulation. Conversely, lower interest rates encourage increased borrowing and expenditure, accelerating the velocity of money. This inverse correlation highlights how monetary policy adjustments influence economic activity through changes in money demand and circulation speed.

Historical Trends: Interest Rate Fluctuations and Velocity Shifts

Interest rate fluctuations historically influence the velocity of money, where lower interest rates often coincide with increased money velocity due to cheaper borrowing costs and higher consumer spending. Economic events such as the 2008 financial crisis demonstrated sharp declines in both interest rates and velocity of money, reflecting reduced lending and slower economic activity. Longer-term trends reveal periods like the 1970s, where high interest rates corresponded with lower velocity, emphasizing the inverse relationship between these two economic indicators across different monetary regimes.

Factors Influencing Interest Rates

Interest rates are primarily influenced by central bank policies, inflation expectations, and the demand for credit, which directly affect borrowing costs and investment decisions. Meanwhile, the velocity of money--how quickly money circulates in the economy--is impacted by consumer confidence, payment technologies, and economic activity levels, which can indirectly pressure interest rates through changes in monetary demand. Understanding these factors provides insight into the dynamic relationship between interest rates and the velocity of money in shaping economic growth.

Determinants Affecting the Velocity of Money

The velocity of money is primarily influenced by factors such as payment technologies, frequency of transactions, and individuals' preferences for holding cash versus spending. Interest rates indirectly affect velocity by altering the opportunity cost of holding money; higher interest rates encourage less cash holding and more spending, thus increasing velocity. Economic stability and inflation expectations also play critical roles in determining how quickly money circulates within an economy.

Policy Implications: Managing Interest Rates and Money Velocity

Managing interest rates and money velocity is critical for effective monetary policy aimed at stabilizing inflation and promoting economic growth. Central banks adjust interest rates to influence borrowing costs, thereby affecting money velocity by either encouraging or discouraging spending and investment. Policymakers must balance these tools to maintain liquidity in the economy while preventing overheating or sluggish demand.

Future Outlook: Interest Rates and Money Circulation Dynamics

Future interest rate trends significantly influence the velocity of money, as rising rates can reduce borrowing and spending, slowing money circulation. Central banks may adjust interest rates to manage inflation and economic growth, directly impacting how quickly money moves through the economy. Understanding this dynamic is crucial for forecasting financial market behavior and formulating effective monetary policies.

Interest rate Infographic

libterm.com

libterm.com