The law of one price states that identical goods should sell for the same price in different locations, assuming no transportation costs and no differential taxes or tariffs. This principle underpins international trade and arbitrage, ensuring market efficiency by eliminating price discrepancies. Discover how the law of one price impacts your global purchasing decisions and market strategies in the rest of this article.

Table of Comparison

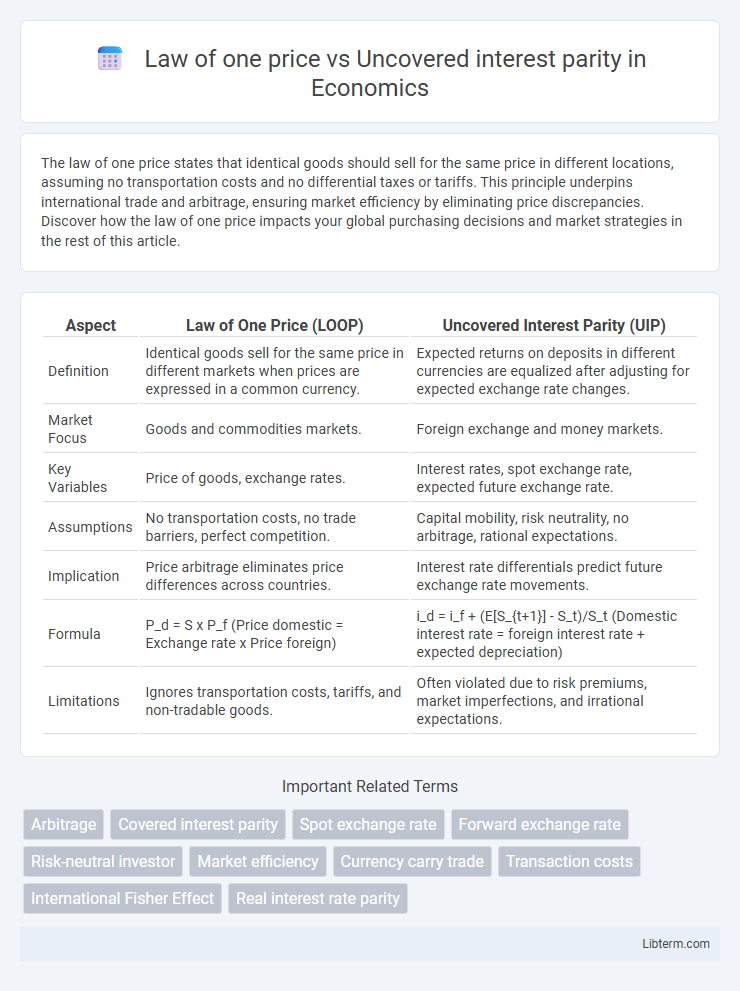

| Aspect | Law of One Price (LOOP) | Uncovered Interest Parity (UIP) |

|---|---|---|

| Definition | Identical goods sell for the same price in different markets when prices are expressed in a common currency. | Expected returns on deposits in different currencies are equalized after adjusting for expected exchange rate changes. |

| Market Focus | Goods and commodities markets. | Foreign exchange and money markets. |

| Key Variables | Price of goods, exchange rates. | Interest rates, spot exchange rate, expected future exchange rate. |

| Assumptions | No transportation costs, no trade barriers, perfect competition. | Capital mobility, risk neutrality, no arbitrage, rational expectations. |

| Implication | Price arbitrage eliminates price differences across countries. | Interest rate differentials predict future exchange rate movements. |

| Formula | P_d = S x P_f (Price domestic = Exchange rate x Price foreign) | i_d = i_f + (E[S_{t+1}] - S_t)/S_t (Domestic interest rate = foreign interest rate + expected depreciation) |

| Limitations | Ignores transportation costs, tariffs, and non-tradable goods. | Often violated due to risk premiums, market imperfections, and irrational expectations. |

Introduction: Understanding Law of One Price and Uncovered Interest Parity

The Law of One Price states that identical goods should sell for the same price in different markets when prices are expressed in a common currency, reflecting the elimination of arbitrage opportunities. Uncovered Interest Parity (UIP) posits that the difference in interest rates between two countries equals the expected change in exchange rates, implying no arbitrage in capital markets under risk-neutral assumptions. Both concepts address equilibrium conditions in international markets, with the Law of One Price focusing on goods pricing and UIP on financial asset returns.

Defining the Law of One Price

The Law of One Price states that identical goods should sell for the same price in different markets when prices are expressed in a common currency, assuming no transportation costs or trade barriers. This principle underpins arbitrage opportunities and ensures price consistency across international markets. In contrast, Uncovered Interest Parity relates to the expected returns on financial assets and exchange rate movements rather than direct goods pricing.

Explaining Uncovered Interest Parity (UIP)

Uncovered Interest Parity (UIP) is a fundamental concept in international finance stating that the expected returns on deposits in different currencies should be equal when adjusted for exchange rate changes. It implies that the interest rate differential between two countries equals the expected change in exchange rates, preventing arbitrage opportunities. Unlike the Law of One Price, which applies to goods and assumes identical prices across markets, UIP deals with financial assets and currency risk without requiring covered forward contracts.

Theoretical Foundations: Assumptions and Models

The Law of One Price (LOOP) assumes identical goods and frictionless markets, asserting that the same product should sell for the same price across different locations when prices are expressed in a common currency. In contrast, Uncovered Interest Parity (UIP) relies on assumptions of perfect capital mobility and rational expectations, positing that the expected returns on comparable financial assets should equalize once adjusted for exchange rate changes. Both models depend on market efficiency but differ fundamentally in their application: LOOP addresses goods pricing, while UIP focuses on financial asset returns and exchange rate dynamics.

Comparative Analysis: Similarities and Differences

Both the Law of One Price (LoOP) and Uncovered Interest Parity (UIP) are fundamental principles in international finance that address price equilibrium mechanisms, with LoOP focusing on the equalization of identical goods' prices across markets after accounting for exchange rates and UIP explaining the expected relationship between interest rate differentials and exchange rate movements. While LoOP emphasizes arbitrage conditions in product markets leading to price convergence, UIP centers on financial markets where risk-neutral investors adjust for interest rate exposure through expected currency depreciation or appreciation. The primary difference lies in LoOP's tangible goods framework against UIP's forward-looking, speculative nature, incorporating market expectations and risk premia, thus highlighting their complementary roles in understanding global market integration.

Real-World Applications of Law of One Price

The Law of One Price (LOOP) asserts that identical goods should sell for the same price globally when prices are expressed in a common currency, assuming no transportation costs or trade barriers, making it essential for arbitrage strategies in international trade and finance. This principle helps multinational corporations in pricing strategies and currency exposure management by identifying potential deviations that suggest arbitrage opportunities or market inefficiencies. Real-world applications of LOOP are evident in commodity markets, where price convergence across locations validates efficient markets, and in foreign exchange markets through the linkage between goods prices and exchange rates.

Empirical Evidence for Uncovered Interest Parity

Empirical evidence for Uncovered Interest Parity (UIP) often reveals systematic deviations, as exchange rate changes frequently fail to offset interest rate differentials fully. Studies employing panel data and time-series analyses indicate that UIP may hold in the long run but is challenged by short-term risk premiums and market frictions. Contrastingly, the Law of One Price finds more consistent support in goods markets, highlighting the complexity of applying parity conditions to financial assets.

Factors Leading to Deviations in Both Theories

Deviations from the Law of One Price arise due to factors such as transportation costs, tariffs, and market segmentation, which prevent identical goods from trading at a uniform price across different locations. In contrast, deviations from Uncovered Interest Parity (UIP) can occur because of risk premiums, transaction costs, and differences in capital controls or investor behavior that affect currency expectations and returns. Both theories are influenced by market frictions and expectations, but while the Law of One Price centers on goods arbitrage, UIP focuses on financial assets and exchange rate risk.

Implications for International Trade and Investment

The Law of One Price ensures that identical goods sell for the same price internationally when transportation costs and tariffs are negligible, promoting efficient resource allocation and trade equilibrium. Uncovered Interest Parity (UIP) links expected currency depreciation to interest rate differentials, influencing cross-border capital flows and investment decisions. Together, these principles affect international trade by stabilizing prices across markets and guiding investors in currency risk assessment, ultimately impacting global capital allocation and economic integration.

Conclusion: Synthesis and Policy Perspectives

The Law of One Price ensures price convergence across markets, while Uncovered Interest Parity links exchange rates to interest rate differentials, both underpinning efficient market theories. Together, they highlight the interconnectedness of goods and financial markets, emphasizing the importance of stable arbitrage conditions for optimal market functioning. Policymakers should focus on reducing market frictions and enhancing transparency to support these equilibrium relationships, fostering international trade and capital flows.

Law of one price Infographic

libterm.com

libterm.com