A representative agent is a simplified economic concept used to model the behavior of an average individual or entity within a market or economy, assuming that this single agent's decisions reflect the aggregate behavior of all participants. This approach helps economists analyze complex systems by focusing on one decision-maker's preferences, constraints, and optimization problems. Explore the rest of the article to understand how representative agents impact economic forecasting and policy analysis.

Table of Comparison

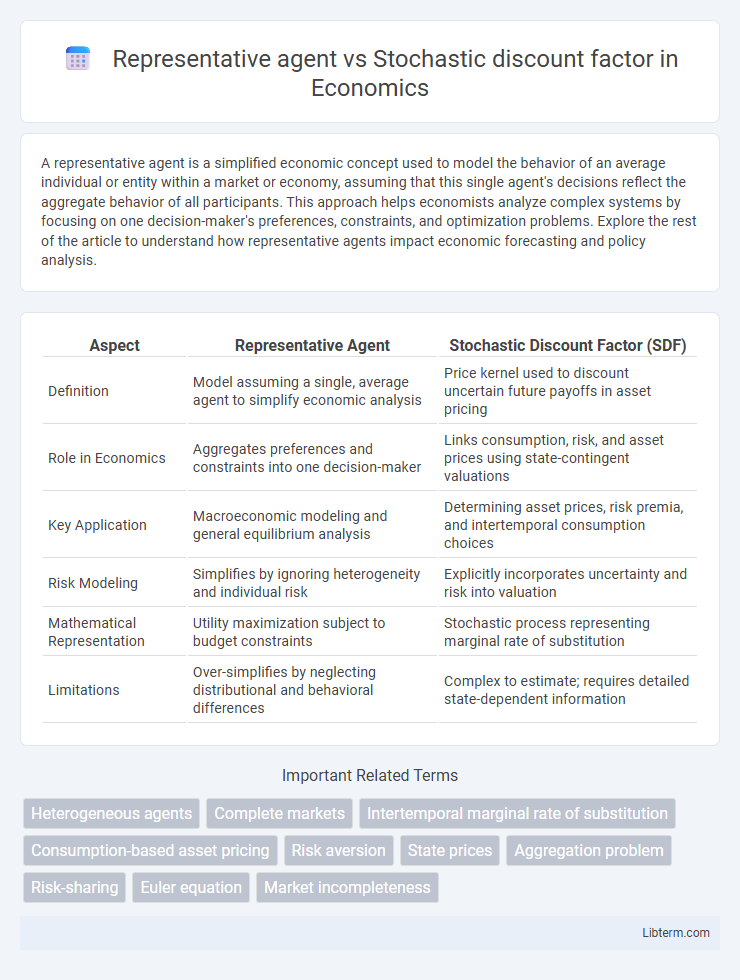

| Aspect | Representative Agent | Stochastic Discount Factor (SDF) |

|---|---|---|

| Definition | Model assuming a single, average agent to simplify economic analysis | Price kernel used to discount uncertain future payoffs in asset pricing |

| Role in Economics | Aggregates preferences and constraints into one decision-maker | Links consumption, risk, and asset prices using state-contingent valuations |

| Key Application | Macroeconomic modeling and general equilibrium analysis | Determining asset prices, risk premia, and intertemporal consumption choices |

| Risk Modeling | Simplifies by ignoring heterogeneity and individual risk | Explicitly incorporates uncertainty and risk into valuation |

| Mathematical Representation | Utility maximization subject to budget constraints | Stochastic process representing marginal rate of substitution |

| Limitations | Over-simplifies by neglecting distributional and behavioral differences | Complex to estimate; requires detailed state-dependent information |

Introduction to Asset Pricing Frameworks

The representative agent framework models asset prices by assuming a single agent whose preferences represent the entire market, simplifying the estimation of expected returns through utility maximization. The stochastic discount factor (SDF) approach directly links asset payoffs to state prices, capturing risk adjustments through a random variable that prices all assets. Both frameworks underpin modern asset pricing theories, with the SDF providing a more general and flexible tool for incorporating heterogeneous agents and various risk factors.

Defining the Representative Agent Model

The Representative Agent Model simplifies macroeconomic analysis by assuming a single agent whose preferences and decisions reflect those of the entire economy, enabling tractable predictions about consumption, investment, and asset prices. This model uses the agent's utility function to derive equilibrium conditions, linking consumption growth to returns on assets through the Euler equation. In contrast, the Stochastic Discount Factor (SDF) offers a more flexible pricing kernel that incorporates uncertainty and heterogeneous agents by discounting future payoffs according to state-contingent marginal utility.

Understanding the Stochastic Discount Factor

The Stochastic Discount Factor (SDF) is a central concept in asset pricing that adjusts future payoffs for risk and time preference, reflecting the marginal utility of consumption in different states of the world. Unlike the Representative Agent model, which simplifies valuation by assuming a single agent with a utility function, the SDF captures heterogeneous agents' behavior and varying risk aversion across states, enabling more accurate pricing of risky assets. Empirical estimation of the SDF often involves using consumption growth or asset returns data to extract risk premia and understand market dynamics beyond representative preferences.

Core Assumptions in Each Approach

The representative agent model assumes a single, rational agent who maximizes utility with perfect foresight or rational expectations, implying homogeneity in preferences and beliefs across the economy. The stochastic discount factor (SDF) approach relies on the existence of a state-price density that prices all assets, embedding uncertainty and time-varying risk in asset valuation without requiring aggregation of individual behaviors. Core assumptions in the SDF framework include market completeness and no-arbitrage conditions, whereas the representative agent model focuses on utility maximization under a single preference structure.

Mathematical Formulations Compared

The representative agent model typically uses a utility function U(c_t) to maximize expected lifetime utility, resulting in a discount factor b and marginal utility of consumption U'(c_t) used in pricing assets. In contrast, the stochastic discount factor (SDF) M_t is defined as the ratio of marginal utilities across states and time, M_t = b (U'(c_{t+1})/U'(c_t)), directly linking it to asset returns via the fundamental pricing equation E_t[M_{t+1} R_{t+1}] = 1. The mathematical distinction lies in the SDF's role as a state-contingent pricing kernel capturing risk adjustments, whereas the representative agent formulation encapsulates preferences and consumption smoothing explicitly in the utility function.

Implications for Market Pricing

The representative agent framework simplifies market pricing by assuming a single investor whose preferences determine asset prices, leading to the derivation of discount factors based on expected utility. In contrast, the stochastic discount factor (SDF) approach accounts for heterogeneous agents and uncertainties by modeling discount factors as random variables that reflect state-contingent payoffs. This results in a more accurate characterization of asset price dynamics, risk premia, and market equilibrium conditions under varying economic scenarios.

Strengths and Limitations of Representative Agent Models

Representative agent models simplify economic analysis by aggregating heterogeneous agents into a single, optimizing agent, facilitating tractable solutions in macroeconomic and asset pricing contexts. These models excel in capturing average behaviors and long-term trends but suffer from limited explanatory power for empirical asset pricing puzzles and fail to incorporate agent heterogeneity, leading to oversimplified risk assessment and dynamics. In contrast, stochastic discount factor (SDF) frameworks offer a more flexible approach to pricing by directly incorporating state-dependent risks, yet they often rely on ad hoc assumptions without microfoundations, highlighting the trade-off between tractability and realism in economic modeling.

Flexibility and Applications of Stochastic Discount Factors

Stochastic discount factors (SDFs) offer greater flexibility than representative agent models by accommodating heterogeneous agents and varying risk preferences in asset pricing. Unlike the representative agent framework, SDFs can capture time-varying risk premia and non-linearities in returns, enhancing their applicability in empirical finance and macroeconomics. These features make SDFs particularly valuable for asset allocation, risk management, and evaluating contingent claims under stochastic economic environments.

Empirical Performance and Evidence

Empirical performance comparisons reveal that stochastic discount factor (SDF) models better capture asset pricing anomalies and cross-sectional variations in expected returns than representative agent models, which often rely on restrictive assumptions like homogenous risk preferences. Evidence from financial markets shows that SDF approaches accommodate heterogeneous investor behavior and time-varying risk premia, enhancing explanatory power for observed returns and volatility patterns. Studies employing consumption-based asset pricing models find that representative agent frameworks frequently fail empirical tests, whereas SDF models incorporating macroeconomic factors and investor heterogeneity improve fit and predictive accuracy.

Conclusion: Choosing the Right Framework

Selecting between the representative agent model and the stochastic discount factor framework hinges on the empirical context and research objectives. The representative agent model simplifies analysis by assuming homogeneous preferences, suitable for macroeconomic insights. The stochastic discount factor approach offers greater flexibility in capturing asset pricing dynamics and heterogeneity, making it ideal for empirical asset pricing and risk assessment studies.

Representative agent Infographic

libterm.com

libterm.com