A deflationary gap occurs when aggregate demand in an economy falls short of its aggregate supply at full employment, leading to unused resources and downward pressure on prices. This imbalance typically results in decreased output, rising unemployment, and reduced income levels. Explore this article to understand how a deflationary gap affects Your economy and what measures can address it.

Table of Comparison

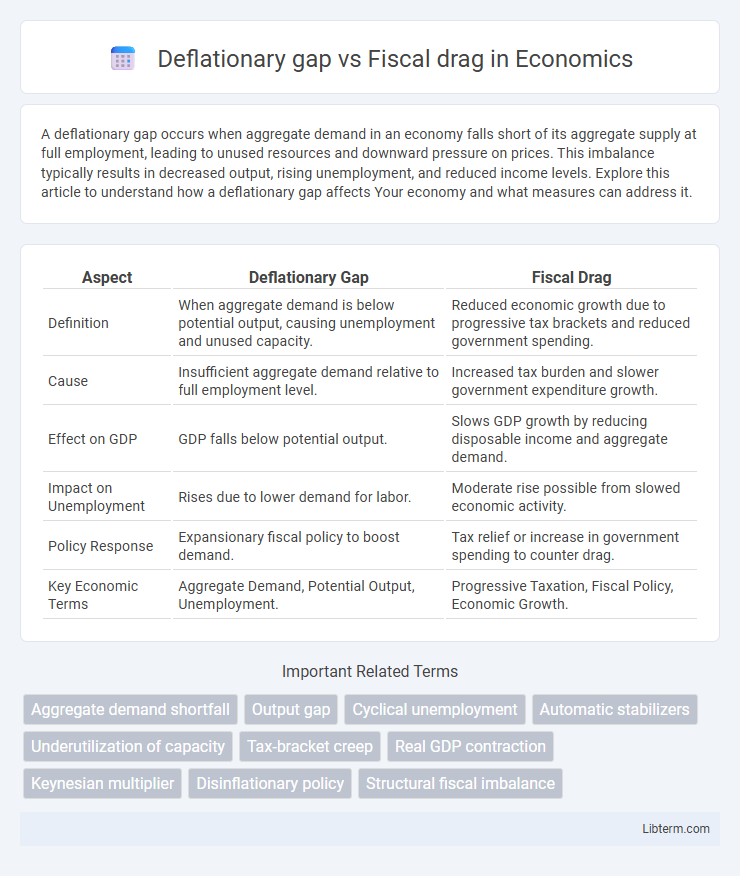

| Aspect | Deflationary Gap | Fiscal Drag |

|---|---|---|

| Definition | When aggregate demand is below potential output, causing unemployment and unused capacity. | Reduced economic growth due to progressive tax brackets and reduced government spending. |

| Cause | Insufficient aggregate demand relative to full employment level. | Increased tax burden and slower government expenditure growth. |

| Effect on GDP | GDP falls below potential output. | Slows GDP growth by reducing disposable income and aggregate demand. |

| Impact on Unemployment | Rises due to lower demand for labor. | Moderate rise possible from slowed economic activity. |

| Policy Response | Expansionary fiscal policy to boost demand. | Tax relief or increase in government spending to counter drag. |

| Key Economic Terms | Aggregate Demand, Potential Output, Unemployment. | Progressive Taxation, Fiscal Policy, Economic Growth. |

Understanding Deflationary Gap: Key Concepts

A deflationary gap occurs when aggregate demand falls short of aggregate supply, leading to unemployment and unused capacity in the economy. This gap indicates insufficient spending relative to potential output, causing downward pressure on prices and economic stagnation. Understanding the deflationary gap is crucial for implementing fiscal policies aimed at stimulating demand and closing the output gap.

What is Fiscal Drag? An Overview

Fiscal drag occurs when government tax revenues rise faster than public incomes, effectively reducing disposable income and suppressing consumer demand. This phenomenon can slow economic growth by decreasing overall spending power, even without explicit tax rate increases. Unlike a deflationary gap caused by insufficient aggregate demand, fiscal drag results from fiscal policy mechanisms that unintentionally tighten economic activity.

Causes of Deflationary Gap in Modern Economies

A deflationary gap in modern economies primarily arises from insufficient aggregate demand relative to the full employment output, often triggered by factors such as reduced consumer spending, high unemployment, and decreased investment. Fiscal drag, which occurs when increased tax revenues during economic growth reduce disposable income and dampen consumption, can further exacerbate this gap by limiting demand. Structural issues like wage rigidity and declines in business confidence also contribute to prolonged deflationary pressures by hindering spending and investment.

Fiscal Drag: Mechanisms and Triggers

Fiscal drag occurs when government tax revenues rise faster than public incomes, effectively reducing disposable income and aggregate demand, which can slow economic growth. This mechanism is often triggered by progressive tax systems where inflation or wage increases push taxpayers into higher tax brackets, increasing their tax burden despite no real income gain. Fiscal drag can also arise from automatic stabilizers like income taxes and social security contributions rising in a growing economy, dampening economic expansion by restraining consumer spending.

Measuring the Impact: Deflationary Gap vs Fiscal Drag

Measuring the impact of a deflationary gap involves analyzing the shortfall between actual and potential GDP, highlighting underutilized resources and reduced aggregate demand. Fiscal drag is assessed by examining the effect of income tax brackets and government spending policies that unintentionally restrain economic growth by increasing tax burdens as incomes rise. Comparing these metrics reveals how deflationary gaps directly reduce output and employment, while fiscal drag subtly suppresses economic expansion through policy-induced disincentives.

Economic Consequences: Growth, Employment, and Inflation

A deflationary gap occurs when aggregate demand is insufficient to reach full employment output, leading to lower economic growth and higher unemployment while exerting downward pressure on inflation. Fiscal drag, arising when tax revenues rise faster than public spending due to bracket creep or stagnant benefits, dampens disposable income, reducing consumer spending and slowing growth without necessarily causing deflation. Both phenomena suppress economic expansion and employment but differ in their impact on inflation, with deflationary gaps typically decreasing price levels and fiscal drag exerting a more neutral or stabilizing influence on inflation.

Government Policy Responses to Deflationary Gap

Government policy responses to a deflationary gap focus on stimulating aggregate demand through expansionary fiscal measures such as increased public spending and tax cuts, aiming to boost consumption and investment. Central banks may support these efforts by maintaining low interest rates to encourage borrowing and spending. These combined actions seek to close the output gap by raising real GDP to its potential level and reducing unemployment without triggering inflation.

Addressing Fiscal Drag through Tax and Spending Policies

Addressing fiscal drag involves adjusting tax rates and public spending to maintain aggregate demand and prevent economic slowdown. Reducing marginal tax rates or increasing government expenditure can counterbalance the shrinking purchasing power caused by inflation-based bracket creep. These fiscal policies help sustain consumer spending and investment, mitigating the negative effects of fiscal drag on economic growth.

Synergies and Interactions: Linking Deflationary Gap with Fiscal Drag

Deflationary gaps and fiscal drag interact through their combined impact on aggregate demand, where underutilized economic capacity from a deflationary gap is exacerbated by fiscal drag's restraint on disposable income and consumption. Fiscal drag increases tax burdens as incomes rise, limiting government's ability to stimulate demand during a deflationary gap, thus reinforcing economic slowdown. Coordinated fiscal policy adjustments targeting tax relief can mitigate fiscal drag's contractionary effect, helping to close the deflationary gap by boosting spending and investment.

Real-World Examples: Case Studies Comparing Both Phenomena

Japan's prolonged deflationary gap in the 1990s led to stagnant growth and persistent unemployment despite fiscal stimulus efforts, illustrating the limits of fiscal policy when aggregate demand remains suppressed. In contrast, the UK's fiscal drag during the 2010s, caused by rising income tax brackets failing to keep pace with inflation, slowed consumer spending and economic recovery without significantly increasing unemployment. These case studies highlight how deflationary gaps reduce overall demand and output, whereas fiscal drag subtly restrains economic expansion through tax-induced reductions in disposable income.

Deflationary gap Infographic

libterm.com

libterm.com