The New Keynesian Phillips curve explains inflation dynamics by linking current inflation to expected future inflation and real economic activity, emphasizing price stickiness and firms' price-setting behavior. It provides a framework for understanding monetary policy's impact on inflation and output in the short run. Discover how this model can deepen Your insights into inflation control by exploring the rest of the article.

Table of Comparison

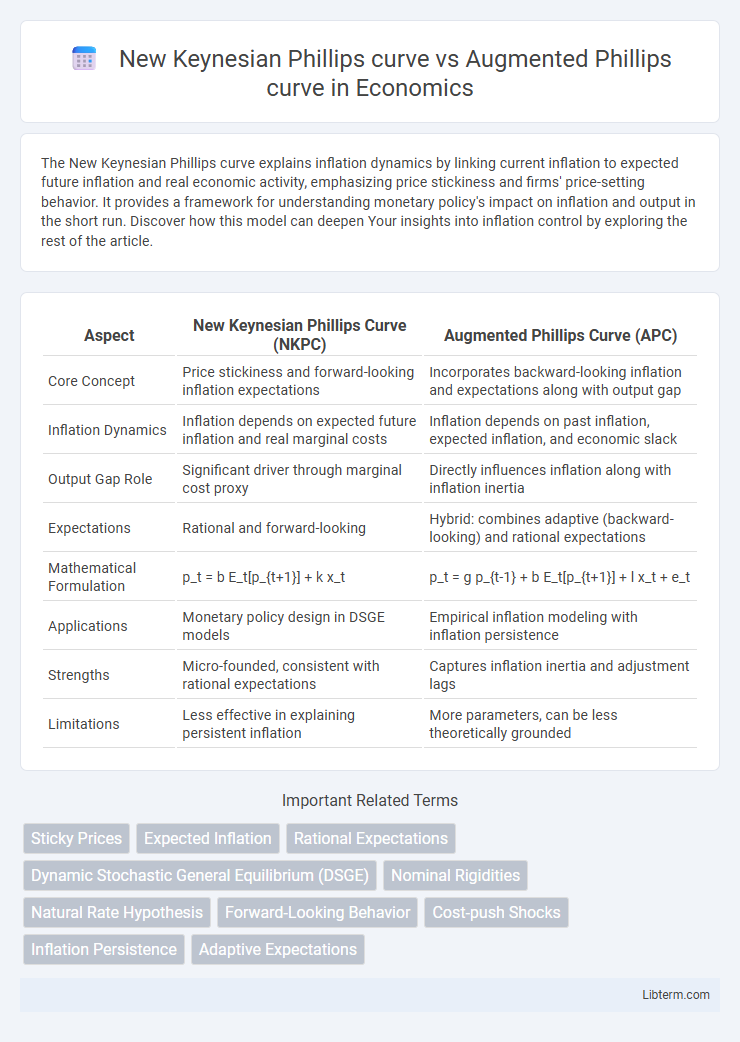

| Aspect | New Keynesian Phillips Curve (NKPC) | Augmented Phillips Curve (APC) |

|---|---|---|

| Core Concept | Price stickiness and forward-looking inflation expectations | Incorporates backward-looking inflation and expectations along with output gap |

| Inflation Dynamics | Inflation depends on expected future inflation and real marginal costs | Inflation depends on past inflation, expected inflation, and economic slack |

| Output Gap Role | Significant driver through marginal cost proxy | Directly influences inflation along with inflation inertia |

| Expectations | Rational and forward-looking | Hybrid: combines adaptive (backward-looking) and rational expectations |

| Mathematical Formulation | p_t = b E_t[p_{t+1}] + k x_t | p_t = g p_{t-1} + b E_t[p_{t+1}] + l x_t + e_t |

| Applications | Monetary policy design in DSGE models | Empirical inflation modeling with inflation persistence |

| Strengths | Micro-founded, consistent with rational expectations | Captures inflation inertia and adjustment lags |

| Limitations | Less effective in explaining persistent inflation | More parameters, can be less theoretically grounded |

Introduction to the Phillips Curve

The New Keynesian Phillips Curve (NKPC) extends the traditional Phillips Curve by incorporating forward-looking inflation expectations and real marginal costs, emphasizing microfoundations and price rigidities. The Augmented Phillips Curve builds on the original model by including additional factors such as supply shocks and output gaps, capturing a broader range of economic dynamics. Both curves aim to explain the relationship between inflation and economic activity but differ in their theoretical underpinnings and empirical applications.

Historical Evolution of the Phillips Curve

The New Keynesian Phillips curve (NKPC) represents an evolution from the traditional Phillips curve by incorporating forward-looking expectations and nominal rigidities, reflecting a more dynamic relationship between inflation and economic activity. The augmented Phillips curve builds on this by integrating supply shocks and inflation expectations more explicitly, responding to empirical shortcomings observed during the stagflation period of the 1970s. Historically, the transition from the original Phillips curve to these modern variants marks a shift toward models that better capture the complexity of inflation dynamics in open and evolving economies.

The Augmented Phillips Curve: Definition and Formula

The Augmented Phillips Curve extends the traditional Phillips Curve by incorporating expectations of inflation alongside unemployment rates, improving the explanation of inflation dynamics over time. Its formula is typically expressed as p_t = p_t^e - b(u_t - u_n) + v_t, where p_t represents current inflation, p_t^e denotes expected inflation, u_t is actual unemployment, u_n is the natural rate of unemployment, b is a sensitivity parameter, and v_t captures supply shocks. This augmentation allows the model to account for adaptive or rational expectations and supply-side disturbances, offering a more accurate framework than the New Keynesian Phillips Curve in certain economic contexts.

New Keynesian Phillips Curve: Core Concepts

The New Keynesian Phillips Curve (NKPC) emphasizes forward-looking inflation dynamics driven by expected future inflation and real marginal costs, integrating price-setting behavior under nominal rigidities. It contrasts with the Augmented Phillips Curve by incorporating microfoundations such as Calvo pricing and rational expectations, making inflation persistence endogenous rather than exogenous. Core concepts include the role of sticky prices, the discount factor in firms' pricing decisions, and the impact of output gaps on inflation pressure.

Theoretical Foundations Compared

The New Keynesian Phillips Curve (NKPC) is grounded in microfoundations, emphasizing price stickiness and forward-looking expectations based on rational behavior, integrating nominal rigidities and Calvo pricing models. The Augmented Phillips Curve (APC) expands the traditional Phillips curve by incorporating inflation expectations and supply shocks, capturing real rigidities and adaptive expectations more explicitly. Both models aim to explain inflation dynamics, but NKPC relies on intertemporal optimization and imperfect competition, while APC integrates empirical adjustments to better fit observed inflation persistence.

Role of Expectations in Each Model

The New Keynesian Phillips Curve (NKPC) incorporates forward-looking expectations, highlighting how anticipated future inflation influences current inflation dynamics through firms' price-setting behavior. In contrast, the Augmented Phillips Curve combines both backward-looking and forward-looking expectations, accounting for past inflation inertia alongside expectations about future inflation, which provides a more comprehensive framework to capture inflation persistence. This difference in the treatment of expectations significantly affects monetary policy implications, with the NKPC emphasizing the importance of managing expectations to control inflation.

Inflation Dynamics: New Keynesian vs. Augmented

The New Keynesian Phillips curve emphasizes forward-looking inflation dynamics, where current inflation depends on expected future inflation and real marginal costs, reflecting price rigidities and nominal rigidities in the economy. In contrast, the Augmented Phillips curve incorporates backward-looking elements, blending past inflation and expectations, capturing more persistent inflation inertia often observed in empirical data. This augmentation allows the model to better fit inflation persistence and the gradual adjustment of inflation to economic shocks.

Empirical Evidence and Policy Implications

Empirical evidence suggests the New Keynesian Phillips Curve (NKPC) better captures inflation dynamics by incorporating forward-looking expectations and real marginal costs, showing stronger predictive power in modern macroeconomic data compared to the Augmented Phillips Curve, which includes lagged inflation terms to account for inflation inertia. Policy implications of the NKPC emphasize the importance of managing expectations through credible monetary policy and forward guidance, while the Augmented Phillips Curve supports policies targeting both current economic slack and inflation persistence. Central banks relying on NKPC frameworks often prioritize proactive communication and inflation targeting, whereas strategies based on the Augmented Phillips Curve may focus more on gradual adjustments to policy in response to observed inflation trends.

Criticisms and Limitations of Both Approaches

The New Keynesian Phillips Curve (NKPC) faces criticism for its heavy reliance on forward-looking expectations, which often leads to empirical inconsistencies such as poor inflation forecasting and limited explanatory power for price rigidity in real-world data. The Augmented Phillips Curve attempts to address some of these issues by incorporating factors like inflation inertia and supply shocks, but it struggles with identification problems and parameter instability across different economic environments. Both models are limited by their assumptions of homogenous agent behavior and simplified dynamics, which fail to capture the complexities of inflation formation and the diverse responses of firms and consumers to monetary policy changes.

Conclusion: Relevance in Modern Macroeconomics

The New Keynesian Phillips Curve (NKPC) remains central in modern macroeconomics by explicitly incorporating forward-looking expectations and price stickiness, which account for inflation dynamics under nominal rigidities. The Augmented Phillips Curve expands this framework by including backward-looking components and real activity variables, enhancing empirical fit and policy implications for inflation persistence. Both models are crucial for understanding inflation behavior, guiding monetary policy under different economic conditions and expectations formation mechanisms.

New Keynesian Phillips curve Infographic

libterm.com

libterm.com