Leverage ratio measures the level of a company's debt compared to its equity, indicating financial stability and risk exposure. Understanding your leverage ratio helps in assessing your ability to meet financial obligations and make informed investment decisions. Dive into the rest of the article to learn how leverage ratios impact your business performance and growth potential.

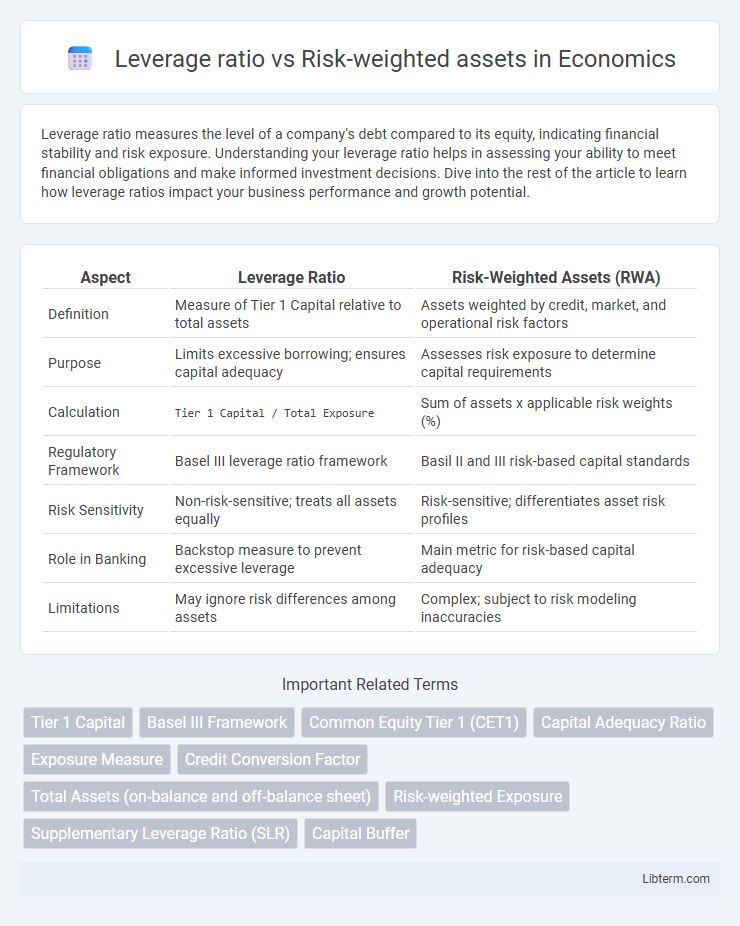

Table of Comparison

| Aspect | Leverage Ratio | Risk-Weighted Assets (RWA) |

|---|---|---|

| Definition | Measure of Tier 1 Capital relative to total assets | Assets weighted by credit, market, and operational risk factors |

| Purpose | Limits excessive borrowing; ensures capital adequacy | Assesses risk exposure to determine capital requirements |

| Calculation | Tier 1 Capital / Total Exposure |

Sum of assets x applicable risk weights (%) |

| Regulatory Framework | Basel III leverage ratio framework | Basil II and III risk-based capital standards |

| Risk Sensitivity | Non-risk-sensitive; treats all assets equally | Risk-sensitive; differentiates asset risk profiles |

| Role in Banking | Backstop measure to prevent excessive leverage | Main metric for risk-based capital adequacy |

| Limitations | May ignore risk differences among assets | Complex; subject to risk modeling inaccuracies |

Introduction to Leverage Ratio and Risk-Weighted Assets

The leverage ratio measures a bank's core capital against its total assets, providing a transparent assessment of financial stability without adjusting for asset risk levels. Risk-weighted assets (RWAs) assign varying risk values to a bank's assets, reflecting potential credit, market, and operational risks to determine capital adequacy more precisely. Comparing the leverage ratio to RWAs helps regulators balance simplicity and risk sensitivity in evaluating a bank's capital strength.

Defining Leverage Ratio in Banking

The leverage ratio in banking is a non-risk-based measure that compares a bank's Tier 1 capital to its average total consolidated assets, providing a straightforward assessment of financial strength. Unlike risk-weighted assets (RWA), which adjust asset values based on credit risk and other factors, the leverage ratio offers a simple, transparent metric to prevent excessive borrowing. Regulators use the leverage ratio to ensure banks maintain sufficient capital buffers regardless of asset risk profiles, promoting stability within the financial system.

Understanding Risk-Weighted Assets (RWAs)

Risk-weighted assets (RWAs) measure the total assets held by a financial institution, adjusted for credit, market, and operational risks, reflecting their potential risk exposure. RWAs are crucial for calculating capital adequacy ratios, as they determine the minimum capital banks must hold to cover potential losses. Understanding RWAs helps assess the risk profile and financial stability of banks compared to the leverage ratio, which does not adjust assets for risk but evaluates capital relative to total exposure.

Key Differences Between Leverage Ratio and RWAs

Leverage ratio measures a bank's capital relative to its total exposure without adjusting for risk, providing a straightforward metric of financial strength. Risk-weighted assets (RWAs) assign varying weights to assets based on their risk profiles, reflecting potential losses and influencing capital requirements under Basel III regulations. The key difference lies in leverage ratio offering a non-risk-based safeguard against excessive leverage, while RWAs create risk-sensitive capital buffers tailored to asset quality.

Importance of Leverage Ratio in Financial Regulation

The leverage ratio serves as a critical non-risk-based measure in financial regulation, providing a straightforward assessment of a bank's capital adequacy by comparing Tier 1 capital to total exposure without adjusting for risk weights. Unlike risk-weighted assets (RWAs), which can be subject to model-based variability and potential underestimation of risks, the leverage ratio offers a transparent and consistent safeguard against excessive leverage and financial instability. Regulatory frameworks like Basel III emphasize the leverage ratio to enhance the resilience of banks, ensuring they maintain sufficient capital buffers to absorb losses during economic downturns.

Role of RWAs in Capital Adequacy Assessment

Risk-weighted assets (RWAs) play a critical role in capital adequacy assessment by quantifying the risk exposure of a bank's assets, which directly influences the minimum capital requirements under regulatory frameworks like Basel III. Unlike the leverage ratio that measures Tier 1 capital against total assets without risk differentiation, RWAs adjust asset values by risk levels, ensuring that capital buffers adequately cover potential losses from risky exposures. This risk-sensitive approach enhances the precision of capital adequacy evaluations, encouraging banks to maintain sufficient capital relative to the desired risk profile and protecting the financial system from insolvency risks.

Pros and Cons of Leverage Ratio

The leverage ratio, calculated as Tier 1 capital divided by total exposures, offers a straightforward measure of a bank's capital adequacy, providing a clear and non-risk-based assessment that limits excessive borrowing. Its main advantage lies in simplicity and resistance to manipulation through risk-weighting models, promoting financial stability by setting a firm capital floor. However, its limitation is the lack of risk sensitivity, as it treats all assets equally regardless of their risk profiles, potentially leading to inefficient capital allocation compared to risk-weighted assets that adjust capital requirements based on asset riskiness.

Advantages and Limitations of Risk-Weighted Assets

Risk-weighted assets (RWA) provide a nuanced assessment of a bank's credit risk by assigning different risk weights to various asset classes, enabling more precise capital adequacy measurement compared to the leverage ratio's simple total asset approach. The advantage of RWA lies in its risk sensitivity, which promotes better risk management and regulatory capital allocation tailored to asset risk profiles. However, RWA limitations include complexity in calculation, reliance on potentially subjective risk models, and susceptibility to regulatory arbitrage, which can lead to inconsistent risk assessment across institutions.

Regulatory Standards: Basel III and Global Implications

The leverage ratio and risk-weighted assets are critical metrics under Basel III regulatory standards, designed to enhance bank resilience by ensuring sufficient capital buffers. The leverage ratio provides a non-risk-based measure of capital adequacy, while risk-weighted assets adjust asset values based on credit, market, and operational risk to determine minimum capital requirements. Globally, Basel III implementation harmonizes these metrics, reducing systemic risk and promoting financial stability across diverse banking systems.

Conclusion: Choosing the Right Metric for Bank Stability

Leverage ratio provides a straightforward measure of a bank's core capital relative to its total assets, offering a clear indicator of financial strength without relying on risk assessments. Risk-weighted assets (RWA) adjust asset values based on their risk profiles, delivering a nuanced evaluation but potentially allowing risk underestimation through model assumptions. For robust bank stability, regulators and institutions often prioritize the leverage ratio for its simplicity and resistance to manipulation while using RWA for detailed risk management and capital allocation decisions.

Leverage ratio Infographic

libterm.com

libterm.com