Cap-and-trade is an environmental policy tool designed to limit greenhouse gas emissions by setting a maximum allowable level and enabling companies to buy and sell emission allowances. This market-based approach incentivizes businesses to reduce pollution cost-effectively by creating a financial value for emission reductions. Explore this article to understand how cap-and-trade impacts industries and contributes to sustainable climate goals.

Table of Comparison

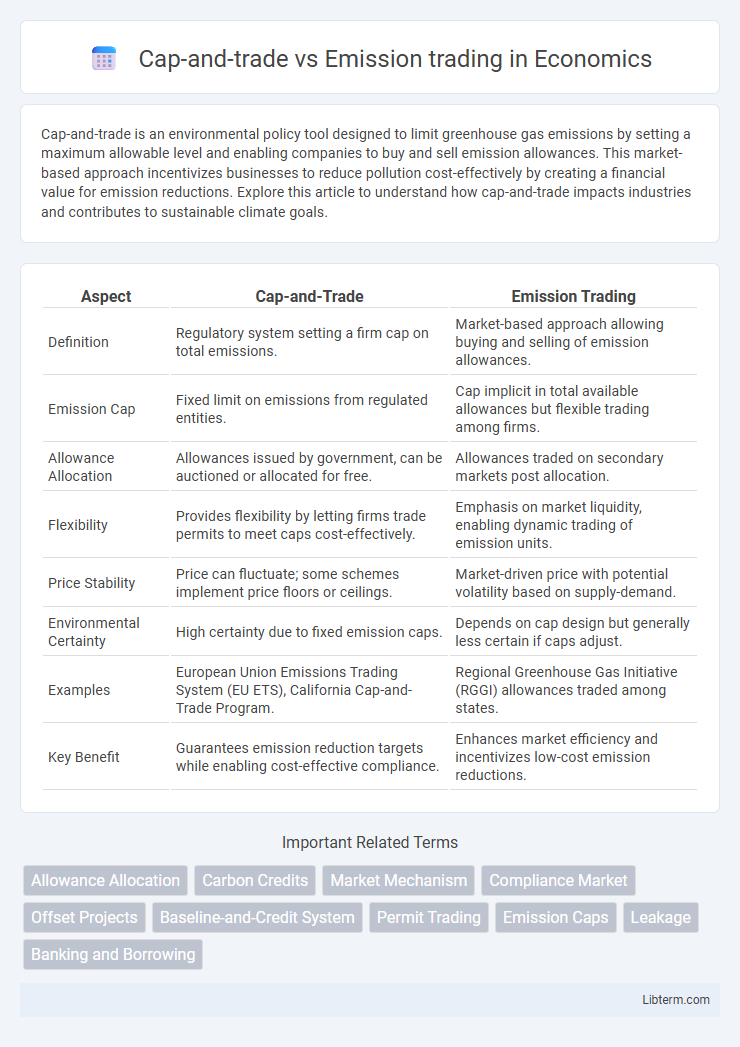

| Aspect | Cap-and-Trade | Emission Trading |

|---|---|---|

| Definition | Regulatory system setting a firm cap on total emissions. | Market-based approach allowing buying and selling of emission allowances. |

| Emission Cap | Fixed limit on emissions from regulated entities. | Cap implicit in total available allowances but flexible trading among firms. |

| Allowance Allocation | Allowances issued by government, can be auctioned or allocated for free. | Allowances traded on secondary markets post allocation. |

| Flexibility | Provides flexibility by letting firms trade permits to meet caps cost-effectively. | Emphasis on market liquidity, enabling dynamic trading of emission units. |

| Price Stability | Price can fluctuate; some schemes implement price floors or ceilings. | Market-driven price with potential volatility based on supply-demand. |

| Environmental Certainty | High certainty due to fixed emission caps. | Depends on cap design but generally less certain if caps adjust. |

| Examples | European Union Emissions Trading System (EU ETS), California Cap-and-Trade Program. | Regional Greenhouse Gas Initiative (RGGI) allowances traded among states. |

| Key Benefit | Guarantees emission reduction targets while enabling cost-effective compliance. | Enhances market efficiency and incentivizes low-cost emission reductions. |

Understanding Cap-and-Trade Systems

Cap-and-trade systems set a regulatory limit on total greenhouse gas emissions, distributing or auctioning emission allowances to firms that can trade these permits to meet individual caps. Emission trading allows companies exceeding their reduction targets to sell surplus allowances to those struggling to comply, creating a financial incentive for pollution reduction. Understanding the mechanics, allowance allocation, and market dynamics is crucial for assessing the environmental effectiveness and economic efficiency of cap-and-trade programs.

What is Emission Trading?

Emission trading is a market-based approach designed to reduce greenhouse gas emissions by setting a cap on total emissions and allowing companies to buy and sell emission allowances. This system incentivizes businesses to lower their emissions cost-effectively by trading permits, creating a financial motivation for pollution control. Emission trading schemes, such as the European Union Emission Trading System (EU ETS), play a crucial role in global climate change mitigation efforts.

Key Components of Cap-and-Trade

Cap-and-trade systems set a firm limit on total greenhouse gas emissions by issuing a fixed number of allowances that can be bought and sold, ensuring environmental targets are met. Key components include the cap, allowance allocation (either auctioned or freely distributed), monitoring and reporting mechanisms, and enforcement penalties for non-compliance. The market-based approach incentivizes emission reductions while providing flexibility for companies to trade allowances, optimizing overall cost-effectiveness in achieving emission goals.

How Emission Trading Schemes Work

Emission Trading Schemes (ETS) operate by setting a cap on the total allowable emissions and distributing or auctioning emission allowances to companies. Firms that reduce their emissions below their allocated allowances can sell excess permits to others exceeding their limits, creating a financial incentive for emission reductions. This market-driven approach ensures overall emissions stay within the cap while promoting cost-effective environmental compliance and innovation.

Comparing Cap-and-Trade and Emission Trading

Cap-and-trade and emission trading both aim to reduce greenhouse gas emissions by setting a limit on total emissions and allowing trading of permits. Cap-and-trade establishes a firm cap on emissions and allocates allowances that companies can buy or sell, creating a market-driven incentive to reduce pollution efficiently. Emission trading, a broader concept, includes various systems for buying and selling emission reductions, but cap-and-trade is the most common and structured form focused explicitly on enforceable caps.

Environmental Impact: Cap-and-Trade vs Emission Trading

Cap-and-trade and emission trading both set limits on greenhouse gas emissions, but cap-and-trade imposes a strict overall cap, ensuring environmental goals are met by reducing total emissions. Emission trading allows companies to buy and sell emission allowances, providing flexibility and economic incentives to lower pollution efficiently. The environmental impact of cap-and-trade is typically stronger due to its enforceable cap, while emission trading's effectiveness depends on the rigor of the emissions limits and market design.

Economic Implications for Industries

Cap-and-trade and emission trading systems both impose limits on greenhouse gas emissions, creating a market for companies to buy and sell emission allowances that directly influences operational costs and investment decisions in industries. The cap-and-trade approach sets a firm emissions ceiling, encouraging industries to innovate for cost-effective reductions while providing economic incentives through allowance trading, balancing environmental outcomes with financial performance. Emission trading enhances flexibility for businesses by enabling market-driven compliance, potentially lowering the overall cost of emission reductions and fostering competitive advantages in sectors heavily reliant on fossil fuels or energy-intensive processes.

Regulatory Frameworks and Policies

Cap-and-trade and emission trading systems both serve as regulatory frameworks designed to limit greenhouse gas emissions by assigning a maximum emission cap and allowing entities to trade emission allowances. Cap-and-trade establishes a firm emissions ceiling set by regulators, creating scarcity for emission permits, whereas emission trading broadly encompasses mechanisms that facilitate the buying and selling of emission rights within various policy structures. Regulatory policies for cap-and-trade typically involve strict compliance monitoring, periodic caps reduction, and government-issued permits, while emission trading policies may include flexible market designs and integration with other climate strategies under international protocols like the Kyoto Protocol and the Paris Agreement.

Global Case Studies and Success Stories

Cap-and-trade systems set a firm limit on emissions and allow trading of allowances, successfully reducing greenhouse gases as seen in the European Union Emissions Trading System (EU ETS), which cut emissions by 35% since 2005. Emission trading programs like California's Global Warming Solutions Act demonstrated economic growth alongside a 15% reduction in carbon emissions through market-driven incentives. Global case studies highlight that well-designed cap-and-trade schemes integrate robust monitoring, reporting, and verification to ensure transparency and environmental integrity, driving successful climate mitigation efforts worldwide.

Future Trends in Carbon Markets

Carbon markets are increasingly shifting towards integrated cap-and-trade systems that offer flexibility and robustness in limiting greenhouse gas emissions. Future trends emphasize digitalization through blockchain technology to enhance transparency and compliance tracking in emission trading schemes. Market expansion into voluntary and compliance sectors signals growing global commitment to carbon pricing and sustainable investment strategies.

Cap-and-trade Infographic

libterm.com

libterm.com