The average tax rate represents the percentage of your total income paid in taxes, calculated by dividing total tax paid by total income earned. Understanding this rate helps you assess your tax burden and compare it to marginal tax rates to optimize your financial planning. Explore the rest of the article to learn how the average tax rate impacts your overall tax strategy.

Table of Comparison

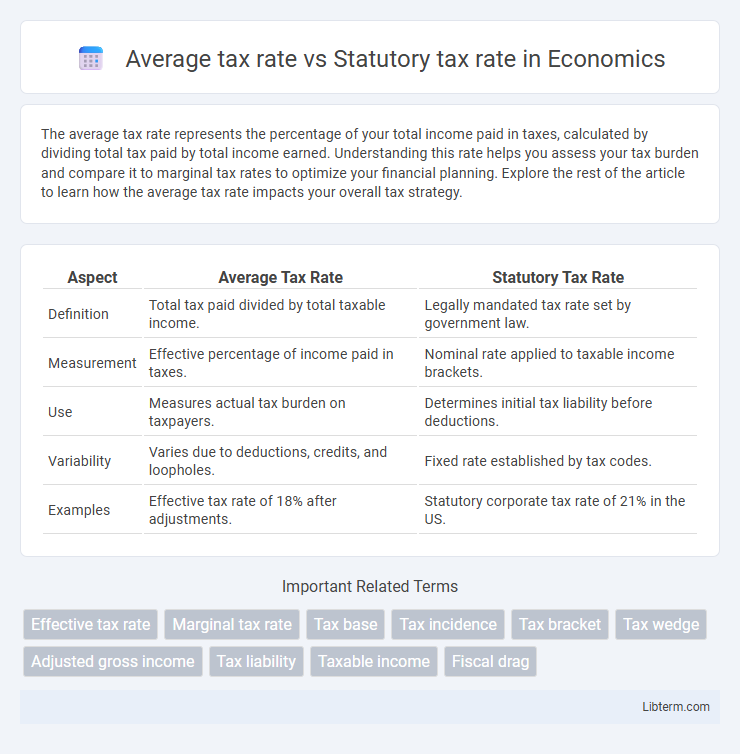

| Aspect | Average Tax Rate | Statutory Tax Rate |

|---|---|---|

| Definition | Total tax paid divided by total taxable income. | Legally mandated tax rate set by government law. |

| Measurement | Effective percentage of income paid in taxes. | Nominal rate applied to taxable income brackets. |

| Use | Measures actual tax burden on taxpayers. | Determines initial tax liability before deductions. |

| Variability | Varies due to deductions, credits, and loopholes. | Fixed rate established by tax codes. |

| Examples | Effective tax rate of 18% after adjustments. | Statutory corporate tax rate of 21% in the US. |

Introduction to Tax Rates: Average vs. Statutory

The statutory tax rate represents the legally imposed percentage applied to taxable income by law, serving as the official benchmark for taxation. The average tax rate reflects the actual proportion of total tax paid relative to total income, often differing due to deductions, credits, and progressive tax structures. Understanding the distinction between these tax rates is crucial for accurate tax planning and financial analysis.

Defining Average Tax Rate

The average tax rate represents the proportion of total income paid in taxes, calculated by dividing total tax liability by total taxable income. It differs from the statutory tax rate, which is the legally imposed rate on income within a specific tax bracket. Understanding the average tax rate helps taxpayers gauge their effective tax burden across all income levels, reflecting actual tax paid rather than the maximum rate set by law.

Understanding Statutory Tax Rate

The statutory tax rate refers to the legally imposed percentage on taxable income established by law or tax authorities, serving as the baseline rate used to calculate tax liabilities. It differs from the average tax rate, which represents the effective rate paid after deductions, credits, and other adjustments lower the overall tax burden. Understanding the statutory tax rate is crucial for assessing nominal tax obligations and comparing tax policies across jurisdictions before considering the actual tax impact reflected by the average tax rate.

Key Differences Between Average and Statutory Tax Rates

The statutory tax rate is the legally imposed rate set by tax authorities, representing the maximum percentage of income or profits subject to taxation. In contrast, the average tax rate reflects the actual rate paid, calculated by dividing total taxes paid by total taxable income, often lower due to deductions, credits, and varying tax brackets. Understanding this distinction is crucial for accurate tax planning and financial analysis, as the statutory rate does not always represent the effective tax burden on individuals or corporations.

How Average Tax Rate Is Calculated

The average tax rate is calculated by dividing the total tax paid by the total taxable income, reflecting the actual percentage of income paid in taxes. It differs from the statutory tax rate, which is the legally imposed rate set by tax laws, often a marginal rate applied to the last dollar earned. Understanding the average tax rate provides a more accurate measure of an individual's or corporation's overall tax burden compared to the statutory tax rate.

How Statutory Tax Rate Is Determined

The statutory tax rate is determined by government legislation and reflects the legally imposed percentage that businesses or individuals must pay on taxable income. This rate is typically established through tax codes and laws enacted by legislative bodies and can vary by jurisdiction and income brackets. Unlike the average tax rate, which represents the actual percentage of total income paid in taxes after deductions and credits, the statutory tax rate is the headline rate before adjustments.

Practical Examples: Average vs. Statutory Tax Rate

The statutory tax rate represents the fixed percentage set by law that a business or individual is supposed to pay on taxable income, often illustrated by a corporate tax rate of 21%. The average tax rate, calculated by dividing total taxes paid by total taxable income, frequently appears lower due to deductions, credits, and progressive tax brackets; for instance, a corporation with taxable income of $1 million paying $150,000 in taxes has an average tax rate of 15%. Practical examples show that while a company might face a statutory rate of 21%, its effective tax burden measured by the average rate could be substantially less due to various tax planning strategies and allowances.

Implications for Taxpayers and Businesses

The average tax rate reflects the actual percentage of total income paid in taxes, impacting taxpayers' disposable income and business cash flow, while the statutory tax rate is the legally imposed rate on income, often higher than the effective burden. Understanding the distinction guides financial planning, influencing decisions on investments, hiring, and pricing strategies for businesses. Taxpayers and companies benefit from comprehending how deductions, credits, and exemptions reduce the average tax rate below the statutory rate, affecting overall tax liabilities and competitiveness.

Common Misconceptions About Tax Rates

Many taxpayers confuse the average tax rate, which is the total tax paid divided by total income, with the statutory tax rate, the legally imposed rate on income brackets. The average tax rate reflects the actual tax burden considering all deductions and credits, whereas the statutory rate represents the marginal rate applied to the last dollar earned. Misunderstanding these distinctions can lead to incorrect assumptions about tax liabilities and financial planning strategies.

Summary: Choosing the Right Metric for Analysis

The average tax rate reflects the total taxes paid as a percentage of total income, providing a realistic measure of tax burden, while the statutory tax rate represents the legally mandated rate on taxable income before deductions. For accurate financial analysis and policy comparison, the average tax rate offers a more practical insight into effective tax impact on taxpayers. Statutory rates often overstate tax obligations and can mislead assessments of tax efficiency or burden in economic studies.

Average tax rate Infographic

libterm.com

libterm.com