Local currency plays a crucial role in everyday transactions, influencing the economic stability and purchasing power within a region. Understanding how local currency functions and fluctuates can help you make informed decisions when traveling or investing abroad. Explore the rest of the article to learn more about managing and optimizing your finances with local currency.

Table of Comparison

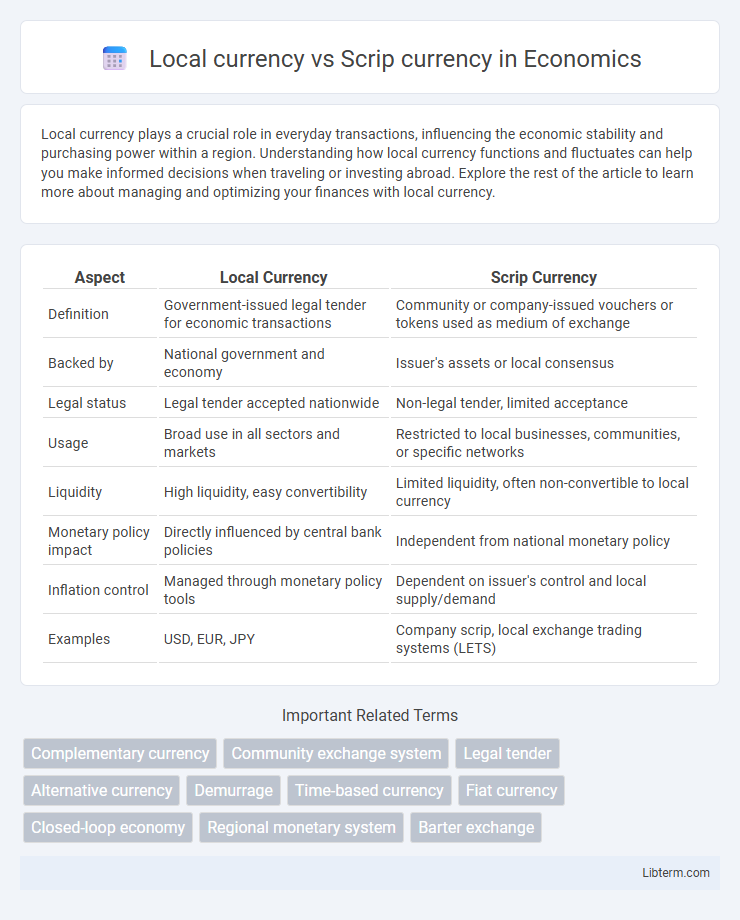

| Aspect | Local Currency | Scrip Currency |

|---|---|---|

| Definition | Government-issued legal tender for economic transactions | Community or company-issued vouchers or tokens used as medium of exchange |

| Backed by | National government and economy | Issuer's assets or local consensus |

| Legal status | Legal tender accepted nationwide | Non-legal tender, limited acceptance |

| Usage | Broad use in all sectors and markets | Restricted to local businesses, communities, or specific networks |

| Liquidity | High liquidity, easy convertibility | Limited liquidity, often non-convertible to local currency |

| Monetary policy impact | Directly influenced by central bank policies | Independent from national monetary policy |

| Inflation control | Managed through monetary policy tools | Dependent on issuer's control and local supply/demand |

| Examples | USD, EUR, JPY | Company scrip, local exchange trading systems (LETS) |

Introduction to Local Currency and Scrip Currency

Local currency refers to the official legal tender issued and regulated by a country's central bank, used for everyday transactions within its borders. Scrip currency, on the other hand, is a substitute form of money issued by private entities, communities, or organizations, often for limited use or specific purposes such as company towns or local trade. While local currency has widespread acceptance and government backing, scrip currency typically functions as a complementary or emergency medium of exchange with restricted validity.

Historical Background of Local and Scrip Currencies

Local currencies originated as community-based monetary systems to encourage regional economic activity and foster local resilience, often emerging during economic crises or currency shortages. Scrip currencies, historically issued by companies or institutions, functioned as substitutes for official money to pay workers and were commonly used in isolated settings such as mining towns or company-owned plantations in the 19th and early 20th centuries. The historical background of both types reflects responses to economic instability, with local currencies emphasizing community sustainability and scrip currencies focusing on controlled economic environments within corporate systems.

Key Differences between Local and Scrip Currency

Local currency is officially issued by a country's central bank and used as legal tender for all transactions within that nation, whereas scrip currency is a substitute form of money often issued by private entities, companies, or during emergencies with limited acceptance. Local currency maintains consistent value backed by government authority and is universally recognized in its economy, while scrip currency typically functions as a restricted medium limited to specific communities or businesses and may lack stable value. The key differences lie in legality, acceptance scope, and backing authority, with local currency offering broader utility and financial stability compared to the often temporary and localized nature of scrip currency.

Advantages of Local Currency Systems

Local currency systems enhance regional economic resilience by encouraging spending within the community, which boosts local businesses and job creation. These currencies reduce dependence on national monetary policies and global market fluctuations, providing greater financial stability. Local currency transactions often have lower fees, facilitating smoother, cost-effective trade among small and medium enterprises.

Benefits and Limitations of Scrip Currency

Scrip currency offers localized economic benefits by promoting spending within a specific community or business, enhancing local business resilience and customer loyalty. However, its limitations include restricted acceptance outside designated areas, limited liquidity, and potential regulatory challenges, which can hinder broader economic integration and reduce flexibility for users. Managing scrip currency requires careful oversight to prevent fraud and maintain trust among participants.

Economic Impact on Communities

Local currency strengthens community economies by encouraging residents to spend within their area, boosting small businesses and keeping wealth circulating locally. Scrip currency often emerges during economic crises as a temporary substitute for national money, enabling limited trade but potentially isolating communities from broader economic systems. The use of local currency fosters economic resilience and social cohesion, whereas scrip currency can alleviate short-term liquidity issues but may hinder long-term economic integration.

Adoption and Acceptance Among Businesses

Local currency enjoys widespread acceptance and legality, facilitating seamless transactions among businesses and consumers within a sovereign economy. Scrip currency, often issued by private entities or local groups, faces limited adoption due to restrictions and lack of legal tender status, confining its use to specific communities or purposes. Businesses favor local currency for its stability and universal recognition, while scrip currency adoption depends heavily on community trust and the issuer's credibility.

Government Regulations and Legal Considerations

Local currency is typically issued and regulated by a central bank under government monetary policies, ensuring legal tender status and compliance with national financial regulations. Scrip currency, often issued by private entities or during emergencies, lacks the same legal backing and may be subject to restrictions or outright bans by governments due to concerns over monetary control and fraud. Legal considerations for scrip currency include limitations on its acceptance for tax payments and potential conflicts with anti-counterfeiting laws, making regulatory scrutiny a key factor in its circulation.

Case Studies: Successful Local and Scrip Currency Models

The Ithaca Hours in Ithaca, New York successfully stimulated local economic activity by encouraging residents to trade services using a time-based local currency, enhancing community resilience and supporting small businesses. In contrast, the Worgl experiment in Austria during the 1930s demonstrated the effective use of scrip as a tool to overcome economic depression, where scrip currency issued by the municipality boosted employment and local spending. Both models highlight the importance of community trust and targeted circulation in sustaining alternative currency systems that complement national currency frameworks.

Future Trends and Challenges in Alternative Currencies

Local currency systems, such as community currencies tied to specific geographic areas, enhance economic resilience by stimulating local trade but face scalability challenges compared to scrip currencies, which are often issued for limited use within organizations or events. Future trends indicate increasing adoption of digital local currencies leveraging blockchain technology to improve transparency and trust, yet regulatory uncertainty and integration with national monetary systems remain significant hurdles. The evolution of alternative currencies will depend on balancing user accessibility, security, and systemic stability amid growing global interest in decentralized finance solutions.

Local currency Infographic

libterm.com

libterm.com