Differential rent arises when land parcels differ in fertility or location, leading to variations in productivity and rent values. This concept explains how more fertile or better-located lands generate higher rents compared to less advantageous plots. Discover how differential rent influences land economics and property valuation in the full article.

Table of Comparison

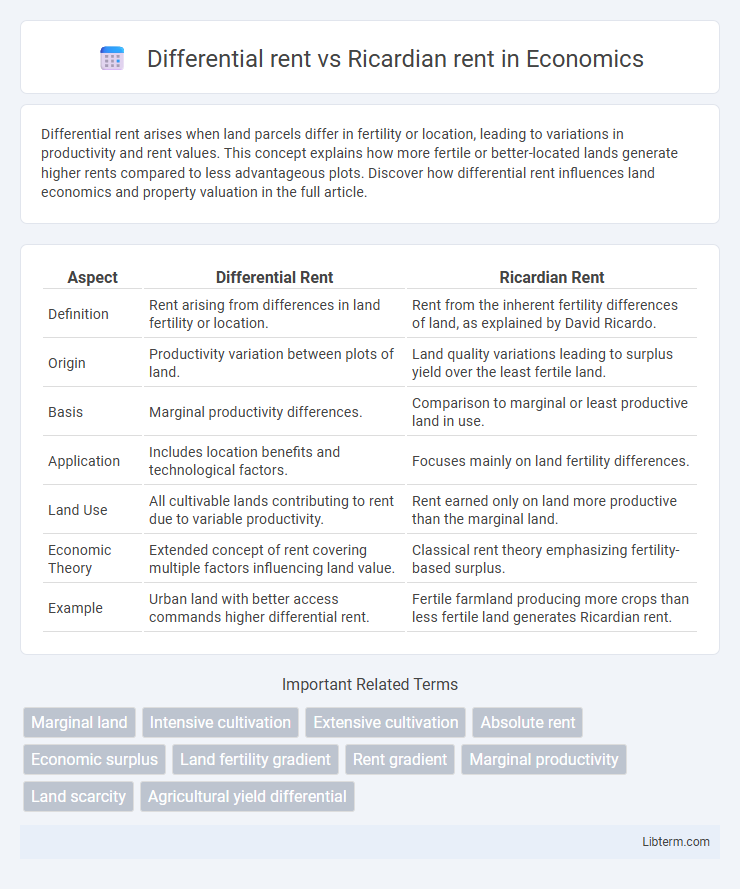

| Aspect | Differential Rent | Ricardian Rent |

|---|---|---|

| Definition | Rent arising from differences in land fertility or location. | Rent from the inherent fertility differences of land, as explained by David Ricardo. |

| Origin | Productivity variation between plots of land. | Land quality variations leading to surplus yield over the least fertile land. |

| Basis | Marginal productivity differences. | Comparison to marginal or least productive land in use. |

| Application | Includes location benefits and technological factors. | Focuses mainly on land fertility differences. |

| Land Use | All cultivable lands contributing to rent due to variable productivity. | Rent earned only on land more productive than the marginal land. |

| Economic Theory | Extended concept of rent covering multiple factors influencing land value. | Classical rent theory emphasizing fertility-based surplus. |

| Example | Urban land with better access commands higher differential rent. | Fertile farmland producing more crops than less fertile land generates Ricardian rent. |

Understanding Differential Rent: Definition and Concepts

Differential rent arises from variations in land fertility or location, leading to different levels of agricultural productivity and profitability on similar plots. Ricardian rent, a subset of differential rent, specifically refers to the surplus generated due to differences in land quality based on David Ricardo's economic theory. Understanding differential rent involves analyzing how these disparities in land attributes create economic rents that influence land use and distribution in agricultural economics.

Ricardian Rent Explained: Origin and Theory

Ricardian rent, originating from economist David Ricardo's theory of economic rent, arises from differences in land fertility and location, leading to varying productivity without additional labor or capital input. This rent reflects the surplus earned by more productive land compared to the least productive land in use, highlighting the impact of natural advantages on agricultural output. In contrast, differential rent encompasses broader factors affecting land value, including market demand and improvements, extending beyond Ricardian principles.

Historical Background of Rent Theories

Differential rent and Ricardian rent theories both trace their origins to classical economics, with David Ricardo's 1817 work laying the foundation for Ricardian rent by explaining land rent as a function of fertility and location. Differential rent theory evolved later, incorporating more nuanced factors such as varying land quality and cultivation methods to expand on Ricardo's original concepts. These historical rent theories significantly influenced land economics by linking agricultural productivity with economic rent and resource allocation.

Key Differences Between Differential Rent and Ricardian Rent

Differential rent arises from differences in land fertility or location, leading to varying productivity levels and rent based on relative advantages, while Ricardian rent specifically refers to the surplus generated by the most productive land compared to the least productive land in use. Differential rent incorporates multiple grades of land and their comparative yields, whereas Ricardian rent is strictly tied to the incremental advantage of superior land quality over marginal land. The key difference lies in differential rent's emphasis on a spectrum of land qualities influencing rent, contrasting with Ricardian rent's focus on rent derived from inherent land productivity differences.

Factors Influencing Differential Rent

Differential rent arises primarily due to variations in land fertility, location advantages, and differences in capital investment, which enhance productivity and yield higher returns compared to average land. In contrast, Ricardian rent is generated solely from differences in land fertility, reflecting surplus income earned by superior quality land over marginal land. Factors influencing differential rent include soil quality, proximity to markets, infrastructure development, and specific improvements made by tenants or landlords that increase land productivity.

Determinants of Ricardian Rent

Ricardian rent is primarily determined by the differential fertility of land and its location relative to the market, reflecting the surplus generated due to limited and heterogeneous land quality. This rent arises when more productive land produces yields exceeding those of the least productive land in use, which only earns enough to cover production costs. In contrast, differential rent considers variations in land productivity and input intensity but is broader, including rent differences caused by investments increasing land value beyond natural fertility.

Applications in Modern Economic Analysis

Differential rent and Ricardian rent play crucial roles in modern economic analysis by explaining land use efficiency and resource allocation. Differential rent illustrates how varying land fertility impacts agricultural productivity and real estate valuation, influencing urban planning and agricultural policy. Ricardian rent underpins rent-seeking behavior theories and provides insights into economic rent distribution in monopolistic and competitive markets, shaping taxation and land reform strategies.

Real-world Examples of Differential and Ricardian Rent

Differential rent arises from variations in land fertility or location, such as prime agricultural lands yielding higher crop outputs compared to less fertile areas in the US Midwest, generating surplus profits for landowners. Ricardian rent, named after economist David Ricardo, occurs when land of differing quality is used sequentially, illustrated by mining operations in South Africa where richer ore deposits command higher rents than marginal mines. Both rent types highlight the impact of inherent land characteristics on economic returns in sectors like agriculture and mining.

Criticisms and Limitations of Both Rent Theories

Differential rent faces criticism for its reliance on the assumption of uniform land fertility, oversimplifying real-world variations and ignoring factors like capital investment and technological change. Ricardian rent is limited by its focus on the margin of cultivation, neglecting dynamic market forces and the role of demand in land value. Both theories struggle to account for contemporary urban land use complexity and fail to fully integrate environmental and socio-economic variables affecting rent determination.

Conclusion: Implications for Land Use and Policy

Differential rent arises from variations in land fertility or location, incentivizing optimal land use by rewarding more productive plots, while Ricardian rent reflects scarcity and inherent land qualities regardless of improvements. Understanding these distinctions guides land policy, promoting efficient allocation and taxation that encourages sustainable agricultural practices without penalizing productivity. Effective land policies incorporate differential rent concepts to enhance urban planning and resource management, balancing economic efficiency with equity.

Differential rent Infographic

libterm.com

libterm.com