Monetarism centers on the belief that controlling the money supply is the primary method to regulate economic stability and influence inflation rates. Policies derived from this theory emphasize steady growth of the money supply to ensure price stability and avoid economic booms and busts. Discover how monetarism shapes economic policy and impacts Your financial environment in the rest of this article.

Table of Comparison

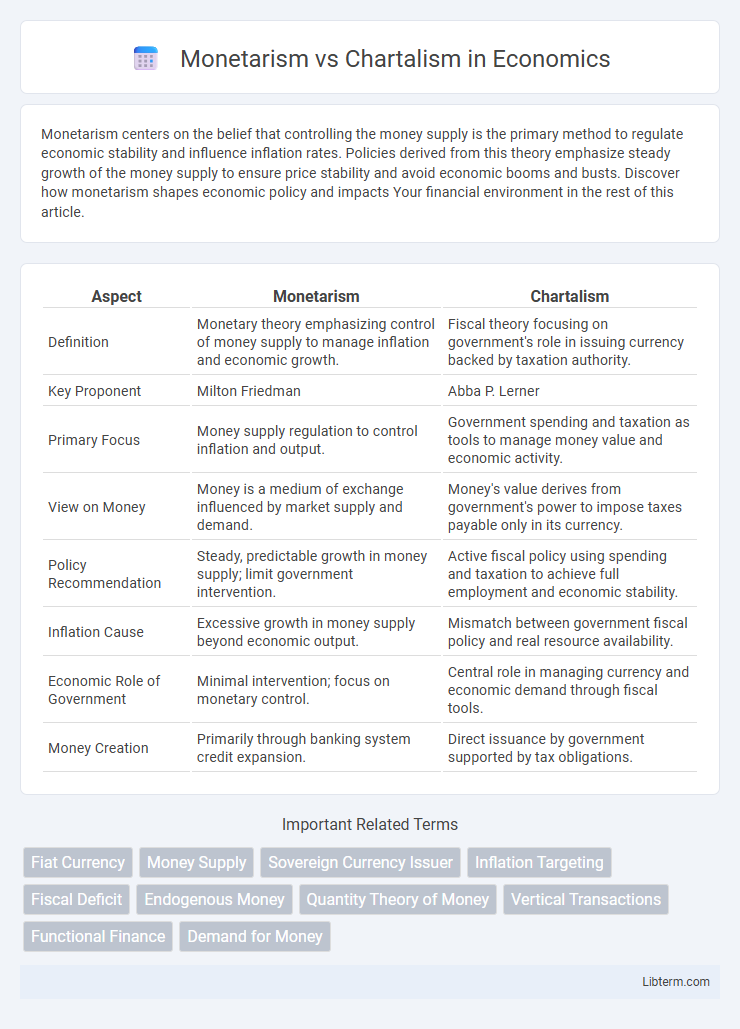

| Aspect | Monetarism | Chartalism |

|---|---|---|

| Definition | Monetary theory emphasizing control of money supply to manage inflation and economic growth. | Fiscal theory focusing on government's role in issuing currency backed by taxation authority. |

| Key Proponent | Milton Friedman | Abba P. Lerner |

| Primary Focus | Money supply regulation to control inflation and output. | Government spending and taxation as tools to manage money value and economic activity. |

| View on Money | Money is a medium of exchange influenced by market supply and demand. | Money's value derives from government's power to impose taxes payable only in its currency. |

| Policy Recommendation | Steady, predictable growth in money supply; limit government intervention. | Active fiscal policy using spending and taxation to achieve full employment and economic stability. |

| Inflation Cause | Excessive growth in money supply beyond economic output. | Mismatch between government fiscal policy and real resource availability. |

| Economic Role of Government | Minimal intervention; focus on monetary control. | Central role in managing currency and economic demand through fiscal tools. |

| Money Creation | Primarily through banking system credit expansion. | Direct issuance by government supported by tax obligations. |

Introduction to Monetarism and Chartalism

Monetarism emphasizes the role of governments in controlling the money supply to manage inflation and economic stability, championed by economist Milton Friedman who argued that variations in the money supply have major influences on national output in the short run and the price level over longer periods. Chartalism, or Modern Monetary Theory (MMT), posits that money derives its value from government authority and fiscal policy, focusing on how sovereign currency issuers can use fiscal tools to achieve full employment and price stability without relying solely on monetary control. Both theories present contrasting views on monetary sovereignty: Monetarism advocates for fixed money supply growth rates, while Chartalism stresses fiscal policy and the state's ability to create money to finance public spending.

Historical Background of Monetary Theories

Monetarism emerged in the mid-20th century, prominently advanced by economist Milton Friedman, emphasizing the role of money supply control in regulating economic activity and inflation. Chartalism, with roots tracing back to early 20th-century German economist Georg Friedrich Knapp, focuses on the state's authority to issue currency and its legal value, highlighting money as a creation of government fiscal policy rather than a commodity. The historical debate between these theories reflects contrasting views on money's origin and function, shaping modern monetary policy frameworks and economic thought.

Core Principles of Monetarism

Monetarism emphasizes the regulation of the money supply to control inflation and stabilize the economy, asserting that changes in the money supply have direct, predictable effects on price levels and economic output. It advocates for a fixed or steadily increasing money supply growth rate, minimizing government intervention in monetary policy to maintain long-term economic stability. Monetarist core principles include the natural rate of unemployment, the quantity theory of money, and the neutrality of money in the long run.

Key Tenets of Chartalism

Chartalism asserts that money derives its value from the state's authority to impose taxes and require its use for tax payments, highlighting the central role of government in currency creation and demand. It emphasizes the sovereign power of the state to issue fiat money without dependence on commodity backing, distinguishing it from Monetarism's focus on money supply control and market equilibrium. Chartalism highlights fiscal policy's primacy over monetary policy, arguing that government spending drives economic activity and that money serves as a unit of account and a means to extinguish tax liabilities.

Money Creation: Central Bank vs Government

Monetarism emphasizes money creation through central banks controlling the monetary base, primarily by regulating interest rates and open market operations to influence inflation and economic growth. Chartalism argues that money is created by government spending, where the state issues currency to fund expenditures before collecting taxes, highlighting the role of fiscal policy over monetary control. This fundamental difference shapes policies: Monetarists prioritize central bank independence, while Chartalists advocate for coordinated government budgeting and currency issuance.

Fiscal Policy Perspectives: Monetarist vs Chartalist Views

Monetarists emphasize controlling the money supply to manage inflation and economic stability, advocating limited fiscal intervention and prioritizing central bank independence to regulate monetary policy. Chartalists argue that sovereign governments with fiat currency can strategically use fiscal policy to achieve full employment and economic growth, viewing government spending and taxation as tools to manage aggregate demand directly. The fundamental difference lies in monetarists' preference for monetary mechanisms versus chartalists' focus on active fiscal policy to influence macroeconomic outcomes.

Inflation Control Mechanisms

Monetarism emphasizes controlling inflation through regulating the money supply, asserting that excessive growth leads to price instability, with policy tools like open market operations and interest rate adjustments to maintain money supply growth at a steady rate. Chartalism focuses on the state's role in issuing currency and managing inflation by controlling fiscal policy, using taxation and government spending to regulate demand and anchor the value of money. While Monetarism advocates for central bank-driven monetary restraint, Chartalism relies on sovereign fiscal authority to modulate inflationary pressures through strategic public finance.

Real-world Case Studies and Policy Outcomes

Monetarism, championed by Milton Friedman, emphasizes controlling the money supply to manage inflation and economic growth, as evidenced by the Federal Reserve's policies during the 1980s that successfully curbed stagflation in the United States. Chartalism, or Modern Monetary Theory (MMT), suggests that sovereign currency issuers can fund government spending without relying on taxes or borrowing, demonstrated by Japan's sustained deficit spending alongside low inflation and stable bond yields. Real-world policy outcomes reveal monetarism's strength in inflation control, while chartalism highlights fiscal flexibility in achieving full employment without immediate inflationary pressure.

Criticisms and Limitations of Each Approach

Monetarism faces criticism for its reliance on the stable relationship between money supply and inflation, which can be disrupted by financial innovation and velocity changes. Chartalism is often challenged for underestimating the importance of real resources and private sector behavior, risking inflation if government spending is unchecked. Both frameworks exhibit limitations in addressing dynamic economic complexities and the influence of external shocks on monetary policy efficacy.

Future Implications for Economic Policy

Monetarism emphasizes controlling money supply to manage inflation and stabilize the economy, suggesting future policies should prioritize strict monetary rules and inflation targeting. Chartalism, or Modern Monetary Theory, argues that sovereign governments can create currency to finance spending without solvency constraints, advocating for policies focused on full employment and public investment regardless of deficits. Future economic policy debates will likely center on balancing Monetarist caution on inflation with Chartalist flexibility in fiscal expansion to address economic inequality and climate change challenges.

Monetarism Infographic

libterm.com

libterm.com