Debt currency mismatch occurs when a borrower's liabilities are denominated in a different currency than their revenue or assets, exposing them to exchange rate risks that can increase repayment burdens. This situation often leads to financial instability, especially in emerging markets where currency fluctuations can be volatile. Explore the rest of this article to understand the risks and strategies for managing debt currency mismatch effectively.

Table of Comparison

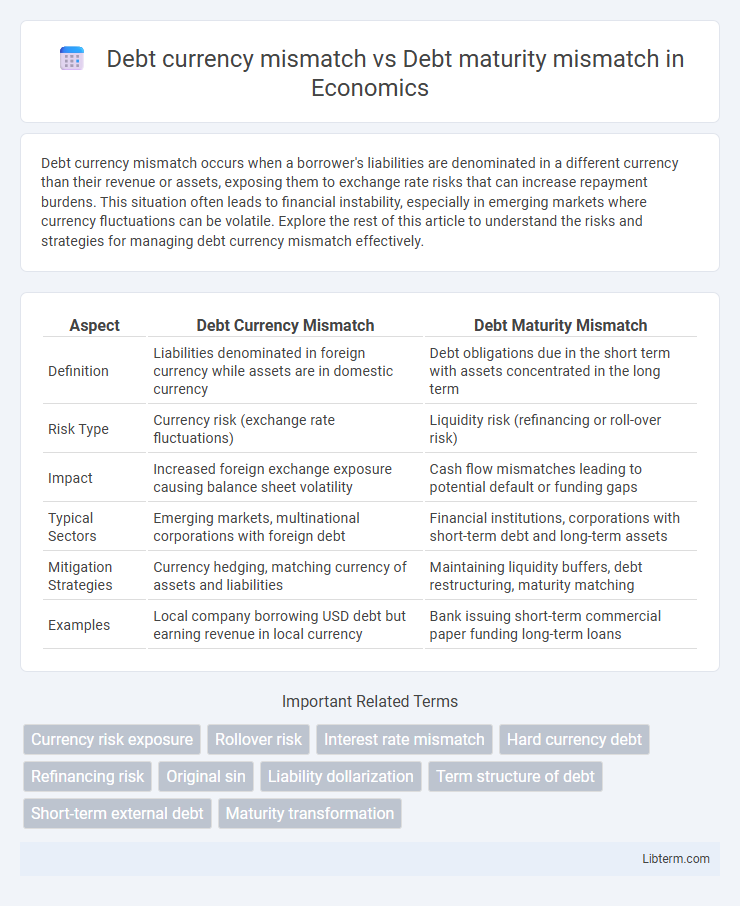

| Aspect | Debt Currency Mismatch | Debt Maturity Mismatch |

|---|---|---|

| Definition | Liabilities denominated in foreign currency while assets are in domestic currency | Debt obligations due in the short term with assets concentrated in the long term |

| Risk Type | Currency risk (exchange rate fluctuations) | Liquidity risk (refinancing or roll-over risk) |

| Impact | Increased foreign exchange exposure causing balance sheet volatility | Cash flow mismatches leading to potential default or funding gaps |

| Typical Sectors | Emerging markets, multinational corporations with foreign debt | Financial institutions, corporations with short-term debt and long-term assets |

| Mitigation Strategies | Currency hedging, matching currency of assets and liabilities | Maintaining liquidity buffers, debt restructuring, maturity matching |

| Examples | Local company borrowing USD debt but earning revenue in local currency | Bank issuing short-term commercial paper funding long-term loans |

Understanding Debt Currency Mismatch

Debt currency mismatch occurs when a company's liabilities are denominated in a different currency than its revenues or assets, exposing it to foreign exchange risk that can increase the cost of debt repayment if the local currency depreciates. This risk contrasts with debt maturity mismatch, where the timing of debt obligations does not align with the cash flow generation, creating liquidity challenges. Understanding debt currency mismatch is critical for multinational firms to manage exchange rate volatility impacts and maintain financial stability by using appropriate hedging strategies.

What Is Debt Maturity Mismatch?

Debt maturity mismatch occurs when a company's short-term liabilities exceed its short-term assets, creating risk that it cannot meet its debt obligations as they come due. This contrasts with debt currency mismatch, where the currency denomination of assets and liabilities differs, leading to exchange rate risk. Effective management of debt maturity maturity mismatch is crucial to maintaining liquidity and financial stability.

Key Differences Between Currency and Maturity Mismatches

Debt currency mismatch occurs when a firm's liabilities are denominated in a different currency than its revenues, exposing it to foreign exchange risk and potential losses from currency depreciation. Debt maturity mismatch arises when the timing of debt repayments does not align with the firm's cash flow schedule, leading to liquidity risks and refinancing challenges. Key differences lie in the nature of risk exposure: currency mismatch centers on exchange rate fluctuations, while maturity mismatch focuses on the timing of cash outflows versus inflows, impacting financial stability and risk management strategies differently.

Economic Risks of Currency Mismatched Debt

Debt currency mismatch occurs when a country's liabilities are primarily denominated in foreign currencies while its revenues are in domestic currency, exposing it to exchange rate fluctuations that can increase debt servicing costs and trigger balance of payments crises. In contrast, debt maturity mismatch arises when short-term debt dominates over long-term debt, creating refinancing risks and potential liquidity shortfalls. Economic risks of currency mismatched debt include increased vulnerability to currency depreciation, higher debt burden in local currency terms, reduced investor confidence, and heightened likelihood of sovereign default or financial instability.

Financial Implications of Maturity Mismatched Debt

Debt currency mismatch occurs when a borrower's liabilities are denominated in a foreign currency while revenues are in domestic currency, exposing the firm to exchange rate risk and potential solvency issues. Debt maturity mismatch arises when short-term liabilities finance long-term assets, creating refinancing risk if the firm cannot roll over debt at maturity, leading to liquidity crises. Maturity mismatched debt can force firms into fire sales of assets or expensive refinancing, increasing the cost of capital and potentially triggering default during economic downturns.

Historical Examples of Currency vs. Maturity Mismatches

Debt currency mismatch occurs when a country's liabilities are denominated in foreign currencies, exposing it to exchange rate risk, whereas debt maturity mismatch involves short-term debt financing long-term assets, increasing refinancing risk. Historical examples include the Latin American debt crisis of the 1980s, where currency mismatches intensified losses during peso devaluations, and the 1997 Asian financial crisis, where maturity mismatches led to sudden withdrawal of short-term capital, triggering liquidity crises. These episodes highlight how currency mismatches exacerbate balance sheet vulnerabilities through exchange rate swings, while maturity mismatches amplify rollover risks under tightening credit conditions.

Impact on Emerging Markets and Developing Economies

Debt currency mismatch in emerging markets increases vulnerability to exchange rate fluctuations, as liabilities in foreign currencies can escalate debt burdens when local currencies depreciate. Debt maturity mismatch creates refinancing risks, especially when short-term debts need renewal amid volatile capital flows, potentially triggering sudden stops and balance of payments crises. Both mismatches exacerbate financial instability, reduce investor confidence, and hamper sustainable economic growth in developing economies.

Managing Risks: Strategies for Policymakers

Managing risks associated with debt currency mismatch involves adopting strategies such as promoting local currency borrowing, developing deep domestic capital markets, and implementing hedging instruments to mitigate foreign exchange volatility. To address debt maturity mismatch, policymakers prioritize extending debt maturities through long-term bond issuances and building contingency reserves to buffer rollover risks. Integrating these approaches enhances overall sovereign debt sustainability by reducing vulnerability to currency depreciation and refinancing shocks.

Debt Mismatch Effects on Corporate Balances

Debt currency mismatch arises when corporate liabilities are denominated in foreign currencies while revenues are primarily in domestic currency, increasing exposure to exchange rate fluctuations and potential balance sheet volatility. Debt maturity mismatch occurs when short-term debt obligations outpace liquid assets or cash flows, posing refinancing risks and potential liquidity crises for corporations. Both mismatches significantly impact corporate balance sheets by amplifying financial vulnerability, increasing funding costs, and elevating default risk under adverse market conditions.

Future Trends in Debt Management and Mismatch Prevention

Future trends in debt management emphasize integrating advanced analytics and real-time monitoring tools to address debt currency mismatch by optimizing foreign exchange risk hedging strategies and aligning liabilities with cash flow currency profiles. Innovations in dynamic liability management enable institutions to mitigate debt maturity mismatch through staggered refinancing plans and adaptive repayment schedules, reducing rollover risk and enhancing liquidity resilience. Enhanced regulatory frameworks and international cooperation promote transparency and standardized reporting, facilitating early detection and proactive correction of both currency and maturity mismatches in sovereign and corporate debt portfolios.

Debt currency mismatch Infographic

libterm.com

libterm.com