Market value represents the current price at which an asset or company can be bought or sold in an open market, reflecting its perceived worth based on supply and demand. It is a critical metric for investors and businesses to assess financial health and investment potential. Explore the rest of the article to understand how market value impacts your financial decisions.

Table of Comparison

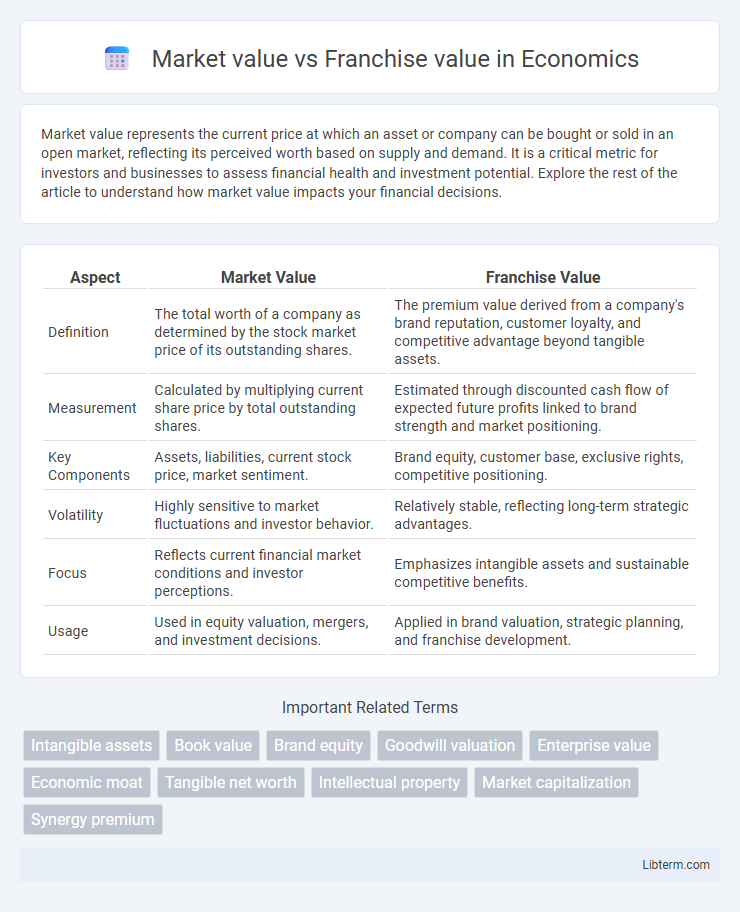

| Aspect | Market Value | Franchise Value |

|---|---|---|

| Definition | The total worth of a company as determined by the stock market price of its outstanding shares. | The premium value derived from a company's brand reputation, customer loyalty, and competitive advantage beyond tangible assets. |

| Measurement | Calculated by multiplying current share price by total outstanding shares. | Estimated through discounted cash flow of expected future profits linked to brand strength and market positioning. |

| Key Components | Assets, liabilities, current stock price, market sentiment. | Brand equity, customer base, exclusive rights, competitive positioning. |

| Volatility | Highly sensitive to market fluctuations and investor behavior. | Relatively stable, reflecting long-term strategic advantages. |

| Focus | Reflects current financial market conditions and investor perceptions. | Emphasizes intangible assets and sustainable competitive benefits. |

| Usage | Used in equity valuation, mergers, and investment decisions. | Applied in brand valuation, strategic planning, and franchise development. |

Introduction to Market Value and Franchise Value

Market value represents the total worth of a company based on its current stock price multiplied by outstanding shares, reflecting investor perception and market conditions. Franchise value captures the intangible benefits a firm enjoys, such as brand reputation, customer loyalty, and competitive advantages, often resulting in earnings beyond typical market expectations. Understanding the distinction between market value and franchise value is critical for investors seeking to evaluate a company's true financial health and growth potential.

Defining Market Value

Market value represents the current price at which an asset or company can be bought or sold in an open market, reflecting real-time supply and demand dynamics. It is influenced by factors such as financial performance, industry trends, and investor sentiment, providing a snapshot of tangible worth. Unlike franchise value, market value does not account for intangible benefits like brand reputation or customer loyalty that contribute to long-term profitability.

Understanding Franchise Value

Franchise value represents the premium a company commands due to its brand strength, customer loyalty, and competitive advantages beyond tangible assets and earnings. It reflects sustainable future cash flows derived from market positioning, intellectual property, and operational efficiency, which are not fully captured by market value. Understanding franchise value is essential for investors to assess long-term growth potential and the intrinsic worth of a business beyond its current stock price.

Key Differences Between Market Value and Franchise Value

Market value represents the current price at which an asset or company can be bought or sold in the open market, reflecting real-time supply and demand dynamics. Franchise value, on the other hand, refers to the intangible worth derived from a company's brand reputation, customer loyalty, and competitive advantages that drive future earnings beyond its market value. The key difference lies in market value being a quantitative financial metric, while franchise value encompasses qualitative factors influencing long-term profitability and business sustainability.

Factors Influencing Market Value

Market value is primarily influenced by external factors such as current stock price, investor sentiment, market conditions, and overall economic indicators, reflecting the company's perceived worth in financial markets. Franchise value depends more on internal factors like brand strength, customer loyalty, competitive advantage, and sustainable profits, which determine long-term earning potential beyond immediate market fluctuations. Understanding the distinction helps investors evaluate a company's true economic value versus its market capitalization.

Factors Shaping Franchise Value

Franchise value is shaped by factors such as brand strength, customer loyalty, and long-term revenue potential that extend beyond immediate financial metrics reflected in market value. Market value fluctuates with stock prices and market sentiment, while franchise value encompasses intangible assets like reputation, intellectual property, and strategic positioning. Effective management of these elements enhances franchise value by ensuring sustainable competitive advantage in the marketplace.

How Investors Evaluate Market Value vs Franchise Value

Investors evaluate market value by analyzing tangible assets, financial statements, and current stock prices to determine a company's worth based on present market conditions. Franchise value assessment emphasizes intangible assets such as brand strength, customer loyalty, and competitive advantages that contribute to long-term profitability. Understanding the balance between market value and franchise value helps investors predict potential growth and risks associated with the company's future performance.

Impact on Business Valuation and Strategy

Market value represents the current price at which a business can be bought or sold in the open market, reflecting investor perceptions and external economic conditions. Franchise value captures the intrinsic worth of a business's brand, customer loyalty, and competitive advantages that generate sustainable profits beyond tangible assets. Understanding the distinction between market value and franchise value is essential for accurate business valuation and strategic decision-making, guiding investment, growth initiatives, and long-term positioning.

Case Studies: Market Value vs Franchise Value in Practice

Market value and franchise value differ significantly in real-world business assessments, with market value reflecting current stock prices and franchise value capturing long-term competitive advantages. Case studies such as Apple's consistent premium market valuation demonstrate high franchise value driven by brand loyalty, innovation, and ecosystem integration. Conversely, volatile market values in companies like Tesla highlight shifts in investor sentiment despite strong franchise potentials based on technology leadership and market disruption.

Conclusion: Choosing the Right Metric for Business Decisions

Market value reflects a company's current stock price influenced by market conditions, while franchise value represents the sustainable competitive advantages and long-term profitability potential. Business decisions should prioritize franchise value when assessing strategic growth and competitive positioning, as it provides a deeper insight into enduring economic benefits beyond short-term market fluctuations. For financial reporting and investor relations, market value remains essential, but franchise value better guides long-term investment and operational choices.

Market value Infographic

libterm.com

libterm.com