Risk seeking involves a preference for choices that have higher uncertainty but potentially greater rewards, often driving individuals to pursue opportunities others might avoid. This behavior can influence financial decisions, business strategies, and personal life choices, reflecting a willingness to embrace volatility for the chance of significant gains. Explore the rest of the article to understand how risk seeking shapes outcomes and what it means for your decision-making process.

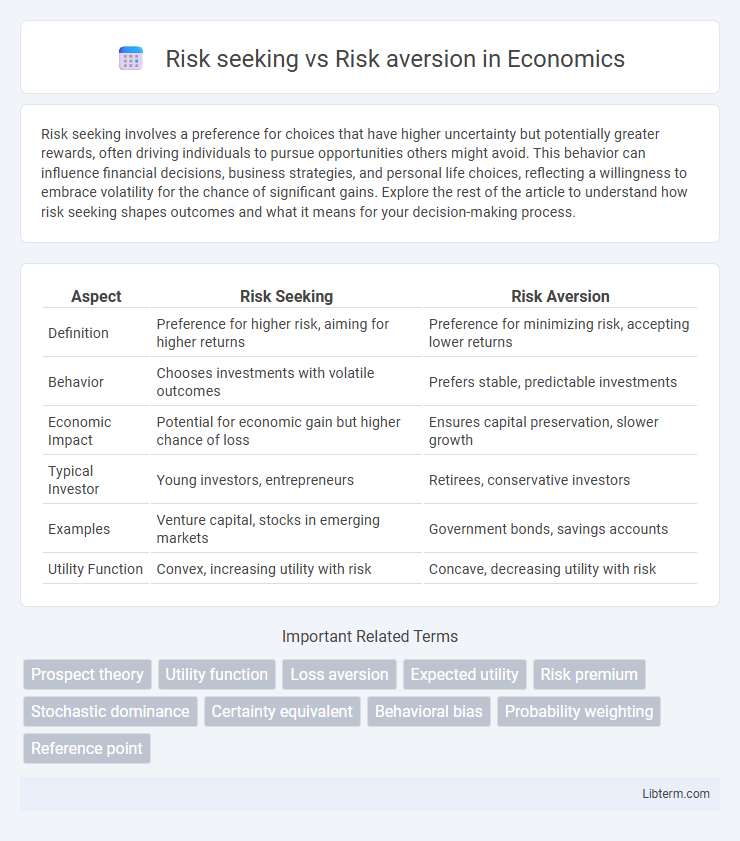

Table of Comparison

| Aspect | Risk Seeking | Risk Aversion |

|---|---|---|

| Definition | Preference for higher risk, aiming for higher returns | Preference for minimizing risk, accepting lower returns |

| Behavior | Chooses investments with volatile outcomes | Prefers stable, predictable investments |

| Economic Impact | Potential for economic gain but higher chance of loss | Ensures capital preservation, slower growth |

| Typical Investor | Young investors, entrepreneurs | Retirees, conservative investors |

| Examples | Venture capital, stocks in emerging markets | Government bonds, savings accounts |

| Utility Function | Convex, increasing utility with risk | Concave, decreasing utility with risk |

Understanding Risk: Definitions and Key Concepts

Risk seeking refers to the preference for choices with uncertain outcomes that have the potential for higher rewards, while risk aversion describes the tendency to prefer safer options with more predictable results. Key concepts include expected value, where individuals assess potential gains versus the likelihood of losses, and risk tolerance, which varies based on personal, financial, and contextual factors. Understanding these definitions helps explain behavior in investment decisions, marketing strategies, and economic models.

The Psychology Behind Risk Seeking

Risk seeking behavior emerges from psychological factors such as dopamine-driven reward sensitivity and the thrill of uncertainty, which motivate individuals to pursue high-risk, high-reward opportunities despite potential losses. Neuroeconomic studies reveal that risk seekers often exhibit lower activation in the amygdala, reducing fear responses and enhancing tolerance for uncertainty. This psychological propensity contrasts with risk aversion, where heightened sensitivity to potential negative outcomes triggers cautious decision-making and prioritization of safety.

Traits of Risk-Averse Individuals

Risk-averse individuals exhibit traits such as a preference for certainty, cautious decision-making, and a tendency to avoid investments or actions with high volatility or potential losses. They prioritize capital preservation, often opting for low-risk assets like bonds or savings accounts over stocks or speculative ventures. This mindset influences their financial behavior, driving them to seek stable returns and minimize exposure to unpredictable outcomes.

Situational Factors Influencing Risk Preferences

Situational factors influencing risk preferences include the context of the decision, time constraints, and available information. High uncertainty or potential for significant gain often encourages risk-seeking behavior, while clear negative outcomes and pressure to avoid losses foster risk aversion. Individual differences combined with environmental cues shape whether a person embraces or avoids risk in varying scenarios.

Risk Attitude in Decision-Making Processes

Risk attitude significantly influences decision-making processes by shaping how individuals or organizations evaluate potential outcomes under uncertainty. Risk-seeking behavior leads to preferences for higher-risk options with potentially greater rewards, while risk aversion drives choices toward safer, more predictable results. Understanding the risk attitude helps predict decision patterns and optimize strategies in finance, business, and behavioral economics.

Risk Seeking vs Risk Aversion in Finance

Risk seeking in finance refers to investment behaviors where individuals or entities prefer high-risk assets with the potential for substantial returns, often accepting greater volatility and uncertainty. Risk aversion, by contrast, describes a preference for lower-risk investments that prioritize capital preservation and steady, moderate returns, minimizing exposure to market fluctuations. Understanding the balance between risk seeking and risk aversion is critical for portfolio management, influencing asset allocation strategies and risk-adjusted performance outcomes.

Cultural Influences on Risk Behavior

Cultural influences significantly shape risk-seeking and risk-averse behaviors by affecting individuals' perception of uncertainty and potential losses. Societies with collectivist orientations often promote risk aversion to maintain group harmony, while individualistic cultures tend to encourage risk-seeking to foster innovation and personal achievement. Cross-cultural studies reveal that risk tolerance varies systematically across regions, highlighting the role of social norms and historical economic conditions in shaping risk preferences.

Evolutionary Roots of Risk Attitudes

Risk seeking and risk aversion behaviors stem from evolutionary adaptations that enhanced survival and reproductive success in varying environmental conditions. Early humans faced fluctuating resource availability, where risk-seeking strategies allowed for potential high rewards in uncertain contexts, while risk-averse tendencies ensured safety and resource conservation during scarcity. Neurobiological mechanisms involving the dopamine system and amygdala have been identified as evolutionary bases influencing these divergent risk attitudes across individuals.

Balancing Risk: Strategies for Optimal Outcomes

Balancing risk involves quantifying potential losses and gains to align with individual or organizational risk tolerance profiles. Employing strategies such as diversification, hedging, and scenario analysis helps optimize decision-making under uncertainty while minimizing adverse impacts. Adaptive risk management frameworks integrate continuous feedback loops to dynamically adjust risk exposure for achieving targeted outcomes.

Practical Examples of Risk Seeking and Risk Aversion

Investors who exhibit risk seeking behavior often invest in high-volatility assets like cryptocurrencies or startup ventures, aiming for substantial returns despite potential losses. Risk-averse individuals typically prefer government bonds or blue-chip stocks, prioritizing capital preservation and steady income over high returns. Entrepreneurs launching innovative products without guaranteed market acceptance exemplify risk seekers, while conservative business owners opt for established market strategies to minimize financial exposure.

Risk seeking Infographic

libterm.com

libterm.com