A managed float is a type of exchange rate system where a currency's value is primarily determined by the foreign exchange market but occasionally adjusted by the central bank to prevent excessive fluctuations. This approach balances market forces with regulatory interventions to maintain economic stability and competitiveness. Discover how a managed float can impact your investments and global trade by reading the full article.

Table of Comparison

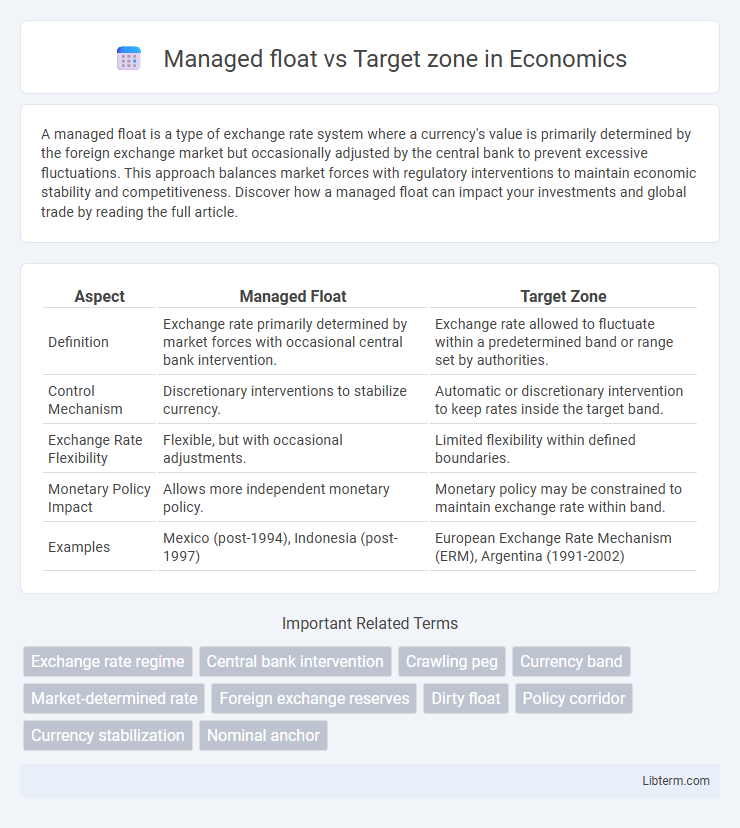

| Aspect | Managed Float | Target Zone |

|---|---|---|

| Definition | Exchange rate primarily determined by market forces with occasional central bank intervention. | Exchange rate allowed to fluctuate within a predetermined band or range set by authorities. |

| Control Mechanism | Discretionary interventions to stabilize currency. | Automatic or discretionary intervention to keep rates inside the target band. |

| Exchange Rate Flexibility | Flexible, but with occasional adjustments. | Limited flexibility within defined boundaries. |

| Monetary Policy Impact | Allows more independent monetary policy. | Monetary policy may be constrained to maintain exchange rate within band. |

| Examples | Mexico (post-1994), Indonesia (post-1997) | European Exchange Rate Mechanism (ERM), Argentina (1991-2002) |

Introduction to Exchange Rate Regimes

Managed float exchange rate regimes blend market-driven currency fluctuations with occasional central bank intervention to stabilize exchange rates, allowing flexibility while mitigating excessive volatility. Target zone regimes establish a predefined band within which the currency's exchange rate is allowed to fluctuate, requiring active policy measures to maintain the rate within set limits. Both systems aim to balance exchange rate stability with economic competitiveness, differing mainly in the extent and mechanisms of government influence on currency values.

Defining Managed Float

Managed float refers to a currency exchange system where the value of a currency is primarily determined by market forces but is periodically adjusted by the central bank through interventions to stabilize or influence exchange rates. This approach allows flexibility in response to external economic shocks while preventing excessive volatility. In contrast, a target zone sets predefined upper and lower exchange rate limits within which the currency value is allowed to fluctuate, with central banks actively intervening to maintain the currency within these boundaries.

Understanding Target Zone

Target zone exchange rates allow a currency to fluctuate within a predetermined band, offering stability while permitting limited market-driven adjustments. This system mitigates exchange rate volatility more effectively than a pure managed float, as central banks intervene only when rates approach the upper or lower bounds of the zone. Understanding target zones is crucial for assessing currency risk management and monetary policy flexibility in emerging and developed economies.

Key Differences Between Managed Float and Target Zone

Managed float allows currency values to fluctuate within a broad, flexible range influenced by market forces, whereas the target zone fixes exchange rates within narrower bands enforced by central bank interventions. Managed float systems emphasize market-driven adjustments with occasional interventions to moderate volatility, while target zones require consistent and active monetary policies to maintain rates within strict limits. The key difference lies in the degree of exchange rate flexibility and the intensity of government involvement in stabilizing currency movements.

Mechanisms of Currency Intervention

Managed float regimes employ central bank interventions to influence currency values by buying or selling foreign reserves, aiming to reduce excessive volatility without committing to a fixed exchange rate. Target zone systems establish predetermined upper and lower currency boundaries, with authorities actively intervening to maintain the exchange rate within this band through open market operations and adjustments in interest rates. Both mechanisms rely on strategic market interventions, but target zones impose stricter limits on exchange rate fluctuations compared to the more flexible approach of managed floats.

Advantages of Managed Float

Managed float offers greater flexibility for a country's central bank to intervene in the currency market, allowing adjustments to exchange rates in response to economic fluctuations without strict adherence to fixed boundaries. This system helps mitigate excessive volatility while promoting market-driven price discovery, fostering more stability than pure floating regimes. It balances control and market forces, enabling better management of inflation and trade competitiveness compared to rigid target zones.

Benefits of Target Zone Systems

Target zone systems offer enhanced exchange rate stability by allowing currencies to fluctuate within predefined bands, reducing excessive volatility compared to pure managed floats. They provide central banks with clear intervention guidelines, promoting transparency and market confidence while preventing abrupt currency shocks. This balance supports trade predictability and economic planning, benefiting both investors and policymakers.

Challenges and Risks Involved

Managed float systems face challenges such as potential market speculation and difficulty maintaining exchange rate stability due to limited central bank intervention. Target zones involve the risk of speculative attacks when currencies approach the set boundaries, requiring substantial reserves to defend the peg. Both systems must navigate uncertainties in global economic conditions, which can exacerbate volatility and strain monetary policy effectiveness.

Historical Examples and Case Studies

Historical examples of managed float regimes include the post-1973 US dollar, which allowed currency values to fluctuate within broader limits based on market forces, promoting flexibility during economic adjustments. The European Exchange Rate Mechanism (ERM) of the 1990s serves as a prominent target zone case study, where participating currencies maintained fixed but adjustable bands to stabilize exchange rates and foster monetary cooperation before the Euro adoption. Empirical analysis of these systems highlights that target zones offer greater exchange rate stability, whereas managed floats provide adaptability in response to external shocks.

Choosing the Right Regime for an Economy

Selecting the optimal exchange rate regime depends on an economy's stability, trade openness, and inflation control needs. Managed float offers flexibility to adjust currency values in response to market conditions while preventing extreme volatility, ideal for economies with moderate external shocks. Target zones provide a clear, stable exchange rate band, fostering investor confidence and inflation anchoring, suited for economies prioritizing stability and credibility over exchange rate flexibility.

Managed float Infographic

libterm.com

libterm.com