Time inconsistency occurs when preferences change over time, leading individuals to make decisions that contradict their earlier plans or commitments. This phenomenon often results in procrastination or failure to follow through on long-term goals, impacting financial planning, health, and behavioral economics. Discover how understanding time inconsistency can help you create strategies to align your actions with your future intentions in the rest of the article.

Table of Comparison

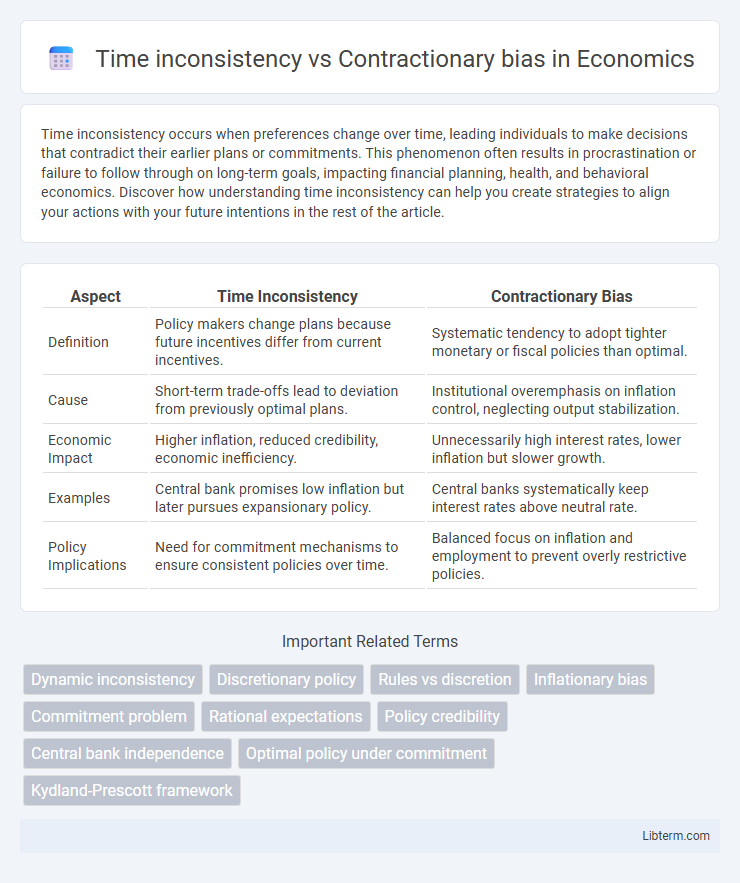

| Aspect | Time Inconsistency | Contractionary Bias |

|---|---|---|

| Definition | Policy makers change plans because future incentives differ from current incentives. | Systematic tendency to adopt tighter monetary or fiscal policies than optimal. |

| Cause | Short-term trade-offs lead to deviation from previously optimal plans. | Institutional overemphasis on inflation control, neglecting output stabilization. |

| Economic Impact | Higher inflation, reduced credibility, economic inefficiency. | Unnecessarily high interest rates, lower inflation but slower growth. |

| Examples | Central bank promises low inflation but later pursues expansionary policy. | Central banks systematically keep interest rates above neutral rate. |

| Policy Implications | Need for commitment mechanisms to ensure consistent policies over time. | Balanced focus on inflation and employment to prevent overly restrictive policies. |

Understanding Time Inconsistency: Definition and Origins

Time inconsistency occurs when a decision-maker's preferences change over time, leading to plans that are optimal in the present but suboptimal in the future, often due to shifting incentives or information. This phenomenon originates from the mismatch between short-term and long-term objectives, causing policies or commitments to be revised as new circumstances arise. Contractionary bias, a specific manifestation of time inconsistency, refers to the tendency of policymakers to pursue overly restrictive measures to maintain credibility, especially in monetary policy.

What Is Contractionary Bias in Economic Policy?

Contractionary bias in economic policy refers to the tendency of policymakers, particularly central banks, to adopt tighter monetary policies than is optimal, often to preempt inflation or maintain credibility. This bias arises from the time inconsistency problem, where policymakers face incentives to deviate from previously announced expansionary policies to avoid short-term inflationary pressures. Empirical evidence shows contractionary bias can lead to suboptimal output levels and increased economic volatility, impacting long-term growth prospects.

Historical Context: Evolution of Time Inconsistency and Contractionary Bias

Time inconsistency and contractionary bias emerged as central concepts in macroeconomic policy analysis during the 1970s, shaped by the inability of policymakers to commit credibly to future actions, as highlighted by Kydland and Prescott's seminal 1977 work. The evolution of time inconsistency reflects the challenge of dynamic policy commitment and its impact on inflation expectations, while contractionary bias explains the tendency of policymakers to implement tighter-than-optimal policies to preempt inflationary pressures, rooted in the political-economy framework of central bank behavior. The historical context underscores the shift from passive monetary regimes to institutional reforms promoting central bank independence as a response to mitigate these biases and improve policy credibility.

Key Economic Theories Addressing Time Inconsistency

Key economic theories addressing time inconsistency focus on the divergence between long-term optimal plans and short-term incentives, where policymakers may deviate from previously announced policies, leading to suboptimal outcomes. The Kydland-Prescott model highlights how discretionary policy without commitment can cause inflation bias due to time inconsistency, while Rogoff's conservative central banker theory suggests appointing policymakers with preferences for low inflation to mitigate contractionary bias. These frameworks illustrate the trade-offs between credibility, commitment, and policy flexibility in managing inflation expectations and stabilizing the economy.

Root Causes and Mechanisms of Contractionary Bias

Time inconsistency arises when policymakers prefer short-term benefits over long-term goals, leading to decisions that deviate from initially planned policies. Contractionary bias stems from the tendency of policymakers, especially central banks, to implement tighter monetary policies repeatedly due to fears of inflation, driven by asymmetric information and reputational concerns. This bias is reinforced by mechanisms such as political pressure to maintain credibility and the anticipation of public overreaction to expansionary measures, causing persistent contractionary policy stances despite economic slack.

Time Inconsistency vs. Contractionary Bias: A Comparative Analysis

Time inconsistency and contractionary bias represent distinct challenges in economic policy, with time inconsistency leading policymakers to deviate from previously optimal plans due to shifting incentives, undermining credibility and effectiveness. Contractionary bias occurs when policymakers consistently favor restrictive monetary or fiscal policies, often to build reputational credibility or control inflation expectations, resulting in suboptimal economic growth. Comparing these concepts reveals that while time inconsistency disrupts policy commitment, contractionary bias reflects a systematic preference for tightening measures, shaping inflation dynamics and economic stability differently.

Policy Implications: Central Bank Strategies and Credibility

Time inconsistency challenges central banks to maintain credible policies that prevent short-term incentives from undermining long-term goals, often leading to unexpected inflation. Contractionary bias explains a central bank's tendency to adopt overly tight monetary policies to signal commitment against inflation, which can delay economic recovery. Effective strategies include transparent communication and rule-based frameworks that enhance credibility, minimizing the gap between announced and actual policies while stabilizing inflation expectations.

Case Studies: Real-World Examples of Each Phenomenon

Time inconsistency is evident in the 1970s U.S. inflation crisis, where policymakers' short-term stimulus measures led to long-term inflationary spirals. Contractionary bias appears in Germany's post-reunification fiscal policy, characterized by persistent austerity to maintain credibility despite prolonged economic stagnation. Both cases highlight the tension between political incentives and optimal economic policy design.

Solutions and Mitigation: Commitment Devices and Institutional Reforms

Commitment devices such as binding contracts, automatic enrollment schemes, and penalty clauses are effective solutions to counteract time inconsistency by aligning short-term actions with long-term goals. Institutional reforms including the establishment of independent central banks, transparent policy frameworks, and credible rule-based fiscal policies help mitigate contractionary bias by reducing political influence and enhancing policy credibility. These approaches strengthen commitment mechanisms and improve the predictability of economic policies, fostering sustained economic stability and growth.

Future Directions: Research Gaps and Policy Recommendations

Research gaps in time inconsistency versus contractionary bias include the need for empirical studies on how digital currencies influence central banks' commitment credibility. Policy recommendations suggest integrating adaptive frameworks that incorporate behavioral insights to mitigate contractionary bias while enhancing transparency and accountability in monetary policy. Future research should explore algorithmic rule-based policies to reduce time inconsistency and better manage expectations in dynamic economic environments.

Time inconsistency Infographic

libterm.com

libterm.com