Public interest theory explains how government intervention aims to protect and benefit society by addressing market failures and promoting overall welfare. It emphasizes transparency, accountability, and fairness in policymaking to ensure that public needs are prioritized over private interests. Discover how public interest theory shapes regulations and impacts your everyday life in the rest of this article.

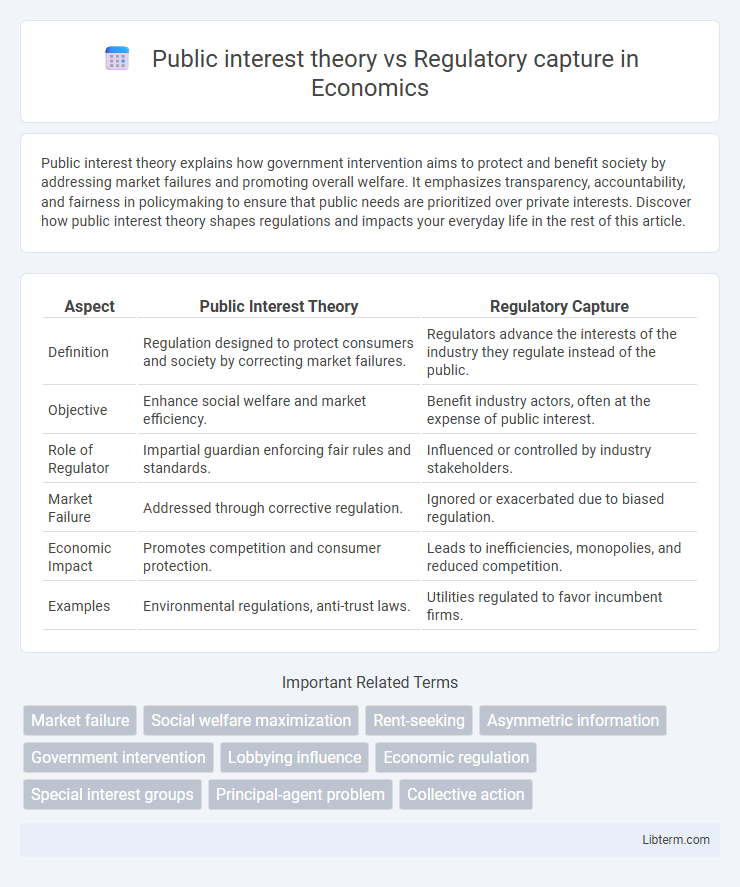

Table of Comparison

| Aspect | Public Interest Theory | Regulatory Capture |

|---|---|---|

| Definition | Regulation designed to protect consumers and society by correcting market failures. | Regulators advance the interests of the industry they regulate instead of the public. |

| Objective | Enhance social welfare and market efficiency. | Benefit industry actors, often at the expense of public interest. |

| Role of Regulator | Impartial guardian enforcing fair rules and standards. | Influenced or controlled by industry stakeholders. |

| Market Failure | Addressed through corrective regulation. | Ignored or exacerbated due to biased regulation. |

| Economic Impact | Promotes competition and consumer protection. | Leads to inefficiencies, monopolies, and reduced competition. |

| Examples | Environmental regulations, anti-trust laws. | Utilities regulated to favor incumbent firms. |

Introduction to Regulatory Theories

Public interest theory asserts that regulation serves to protect and benefit society by addressing market failures and ensuring fair practices. Regulatory capture theory argues that regulatory agencies can become dominated by the very industries they regulate, prioritizing private interests over the public good. Understanding these contrasting regulatory theories is essential for analyzing the effectiveness and challenges of government intervention in markets.

Defining Public Interest Theory

Public Interest Theory posits that government regulation aims to protect and benefit society by correcting market failures, ensuring fair competition, and promoting social welfare. It assumes regulators act as neutral agents working in the collective interest to address externalities, information asymmetries, and monopolistic practices. This theory contrasts with Regulatory Capture, where regulators prioritize industry interests over public welfare due to influence and lobbying.

Origins and Evolution of Public Interest Theory

Public Interest Theory originated in the early 20th century, rooted in the belief that government regulation serves to protect consumers and the public from market failures and monopolistic practices. It evolved through the Progressive Era as a response to corporate abuses, emphasizing regulation as a tool for promoting social welfare and economic fairness. Over time, critiques of the theory led to alternative models like Regulatory Capture, which suggest that regulatory agencies may be dominated by the industries they oversee, compromising public interests.

Key Principles of Regulatory Capture

Regulatory capture occurs when regulatory agencies act in favor of the interests they regulate rather than the public, undermining the core principle of protecting public welfare. Key principles include the influence of industry expertise, revolving door employment between regulators and firms, and information asymmetry that benefits regulated entities. This dynamic often leads to compromised regulations, reduced market competition, and weakened enforcement of safety or consumer protections.

Distinguishing Features: Public Interest Theory vs. Regulatory Capture

Public Interest Theory posits that regulations are designed to benefit society by correcting market failures and promoting welfare, emphasizing transparency, accountability, and fair competition. In contrast, Regulatory Capture occurs when regulatory agencies are dominated by the industries they oversee, resulting in policies that favor private interests over public good. Key distinguishing features include the intent behind regulation--public welfare versus industry advantage--and the degree of stakeholder influence shaping regulatory outcomes.

Historical Case Studies of Public Interest Regulation

Historical case studies of public interest regulation illustrate the tension between Public Interest Theory, which asserts regulators act to maximize societal welfare, and Regulatory Capture, where industries unduly influence regulatory agencies. Notable examples include the Interstate Commerce Commission in the early 20th century, initially established to curb monopolistic practices but later criticized for being dominated by railroad interests. The environmental regulation of the Environmental Protection Agency (EPA) during the 1970s also highlights efforts to serve public health despite industry pushback, reflecting ongoing challenges in maintaining regulatory integrity.

Examining Real-World Regulatory Capture Examples

Regulatory capture occurs when regulatory agencies prioritize industry interests over public welfare, undermining effective oversight. Notable cases include the 2008 financial crisis where the U.S. Securities and Exchange Commission failed to regulate major banks effectively, and the opioid epidemic linked to lax FDA approvals influenced by pharmaceutical companies. Public interest theory contrasts by emphasizing regulations designed to protect consumers and promote societal good rather than serving powerful business lobbies.

Impacts on Policy Outcomes and Society

Public interest theory aims to design policies that maximize social welfare by addressing market failures and protecting consumers, resulting in equitable and efficient outcomes. Regulatory capture occurs when regulators advance the interests of the industries they oversee, leading to policies that favor specific firms or sectors at the expense of broader societal benefits. The divergence between these two dynamics shapes the effectiveness, fairness, and public trust in regulatory frameworks, ultimately influencing economic stability and social equity.

Criticisms and Limitations of Both Theories

Public interest theory faces criticism for assuming regulators always act altruistically, ignoring self-interest and political pressures, which limits its practical applicability. Regulatory capture theory is criticized for overemphasizing the influence of special interest groups, potentially underestimating the role of public oversight and the diversity of regulatory motivations. Both theories struggle to fully address the complexity of regulatory behavior, often overlooking factors like bureaucratic incentives, institutional constraints, and the dynamic interplay between regulators and stakeholders.

Future Directions in Regulatory Governance

Future directions in regulatory governance emphasize strengthening mechanisms to prevent regulatory capture by promoting transparency, stakeholder engagement, and independent oversight bodies aligned with public interest theory principles. Advancements in digital monitoring and data analytics enable regulators to detect conflicts of interest and enhance accountability, fostering policies that serve broader societal welfare. Embracing adaptive regulatory frameworks can balance innovation and public protections, mitigating risks of capture while promoting dynamic governance responsive to evolving market conditions.

Public interest theory Infographic

libterm.com

libterm.com