A budget surplus occurs when a government's revenue exceeds its expenditures within a fiscal period, signifying strong financial health and effective economic management. This surplus can be utilized to reduce public debt, fund future projects, or save for economic downturns, directly impacting your country's economic stability and growth prospects. Explore the rest of the article to understand how budget surpluses influence national economies and your financial future.

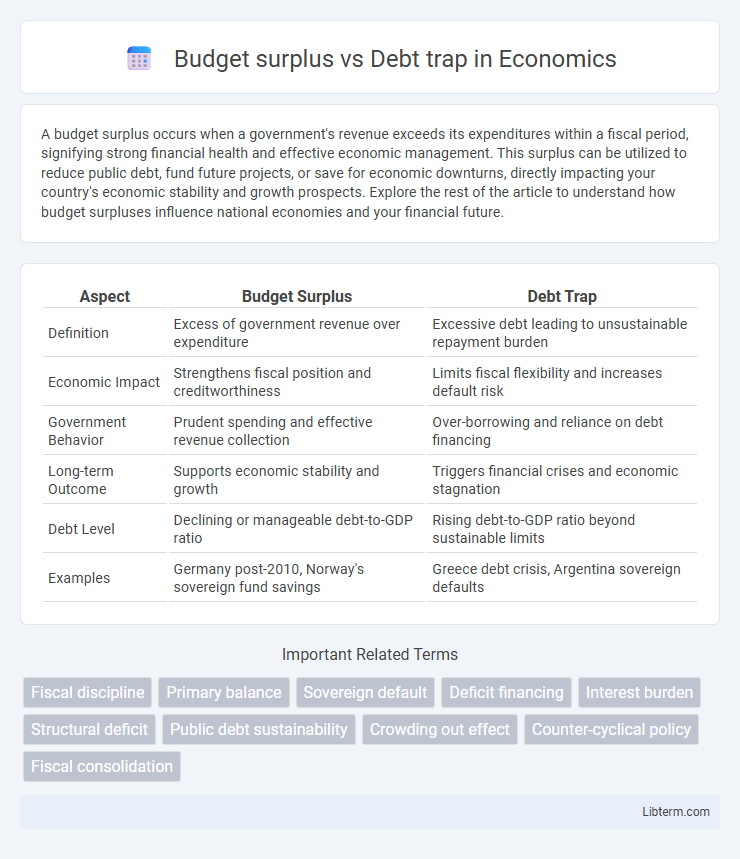

Table of Comparison

| Aspect | Budget Surplus | Debt Trap |

|---|---|---|

| Definition | Excess of government revenue over expenditure | Excessive debt leading to unsustainable repayment burden |

| Economic Impact | Strengthens fiscal position and creditworthiness | Limits fiscal flexibility and increases default risk |

| Government Behavior | Prudent spending and effective revenue collection | Over-borrowing and reliance on debt financing |

| Long-term Outcome | Supports economic stability and growth | Triggers financial crises and economic stagnation |

| Debt Level | Declining or manageable debt-to-GDP ratio | Rising debt-to-GDP ratio beyond sustainable limits |

| Examples | Germany post-2010, Norway's sovereign fund savings | Greece debt crisis, Argentina sovereign defaults |

Understanding Budget Surplus: Definition and Significance

A budget surplus occurs when government revenues exceed expenditures within a fiscal period, reflecting efficient fiscal management and economic stability. This surplus enables debt reduction, increased public investment, or savings for future contingencies, enhancing a nation's financial health and creditworthiness. Understanding budget surplus significance is crucial for policymakers aiming to avoid debt traps, which arise from continuous deficits and unsustainable borrowing.

What Constitutes a Debt Trap? Key Indicators

A debt trap occurs when a borrower continuously incurs debt to repay existing obligations, leading to unsustainable financial burdens. Key indicators include escalating interest payments surpassing revenue growth, an increasing debt-to-GDP ratio, and reliance on short-term loans to cover long-term liabilities. Persistent budget deficits despite rising borrowing costs highlight the imminent risk of falling into a debt trap.

Causes of Budget Surpluses in Modern Economies

Budget surpluses in modern economies often result from higher-than-expected tax revenues driven by robust economic growth and effective tax collection systems. Government austerity measures that reduce public spending also contribute significantly to generating a surplus by maintaining fiscal discipline. Additionally, surpluses may arise from windfalls such as increased commodity prices or strategic fiscal policies aimed at debt reduction.

Common Triggers Leading to National Debt Traps

Common triggers leading to national debt traps include excessive government borrowing to finance budget deficits, reliance on short-term loans with high-interest rates, and unrestrained public spending without corresponding revenue growth. Economic shocks such as sudden commodity price drops or currency devaluations exacerbate debt burdens, making repayment difficult and leading to reliance on new borrowing. Poor fiscal management, lack of transparent budgeting, and failure to implement structural reforms further accelerate the transition from manageable budget deficits to unsustainable debt traps.

Fiscal Policies: From Surplus to Sustainable Growth

Fiscal policies that shift from budget surplus to sustainable growth prioritize balanced revenue collection and strategic public spending to avoid debt traps. Effective management of budget surpluses enables governments to invest in infrastructure, education, and health, fostering long-term economic stability and reducing reliance on borrowing. Implementing transparent fiscal rules and strengthening institutional frameworks ensures that surplus funds contribute to sustainable development rather than short-term financial constraints.

Economic Risks of Persistent Debt Accumulation

Persistent debt accumulation increases the risk of falling into a debt trap, where high-interest payments crowd out essential public investments and economic growth. A budget surplus, in contrast, strengthens fiscal stability and provides a buffer against economic shocks by reducing reliance on external borrowing. Economic risks of ongoing debt include increased default probability, reduced credit ratings, and heightened vulnerability to financial crises.

Comparing Short-Term Gains vs Long-Term Fiscal Health

Budget surplus reflects a government's ability to generate excess revenue beyond expenditures, offering short-term fiscal flexibility and opportunities for investment or debt reduction. In contrast, a debt trap occurs when borrowing costs escalate and debt levels become unsustainable, compromising long-term economic stability and growth prospects. Prioritizing short-term gains through budget surplus may support immediate needs, but long-term fiscal health requires balanced debt management and sustainable economic policies.

Role of Governance in Preventing Debt Traps

Effective governance plays a crucial role in preventing debt traps by enforcing transparent fiscal policies and ensuring prudent budget management to maintain a budget surplus or balanced deficit. Strong institutional frameworks help monitor public debt levels, promote accountability, and implement strategic borrowing aligned with sustainable economic growth. Adequate oversight and policy discipline reduce dependency on external debt, minimizing the risk of financial crises and preserving long-term economic stability.

Real-World Examples: Countries with Surpluses vs Debt Trap Cases

Germany exemplifies a budget surplus scenario, maintaining consistent fiscal discipline with a surplus of approximately 1.2% of GDP in 2023, enabling strong investment in infrastructure and social programs. Conversely, Greece represents a debt trap case, burdened by debt exceeding 180% of GDP, resulting in prolonged austerity measures and dependency on international bailouts. South Korea offers a middle ground with a moderate surplus alongside prudent debt management, avoiding pitfalls seen in heavily indebted nations.

Strategies for Transitioning from Debt Vulnerability to Fiscal Stability

Implementing fiscal consolidation measures such as reducing non-essential expenditures and enhancing revenue collection through tax reforms strengthens budget surplus efforts. Prioritizing debt restructuring and negotiating favorable terms with creditors alleviates immediate fiscal pressure, enabling gradual decline in debt-to-GDP ratios. Establishing transparent public financial management systems and promoting economic growth through investment in infrastructure and innovation supports sustainable transition from debt vulnerability to long-term fiscal stability.

Budget surplus Infographic

libterm.com

libterm.com