Sustainability-linked bonds are financial instruments designed to promote environmentally and socially responsible business practices by tying bond performance to specific sustainability metrics. These bonds incentivize issuers to achieve targets such as reducing carbon emissions or improving energy efficiency, aligning investment returns with positive impact goals. Discover how sustainability-linked bonds can enhance your portfolio while supporting global sustainability efforts in the rest of this article.

Table of Comparison

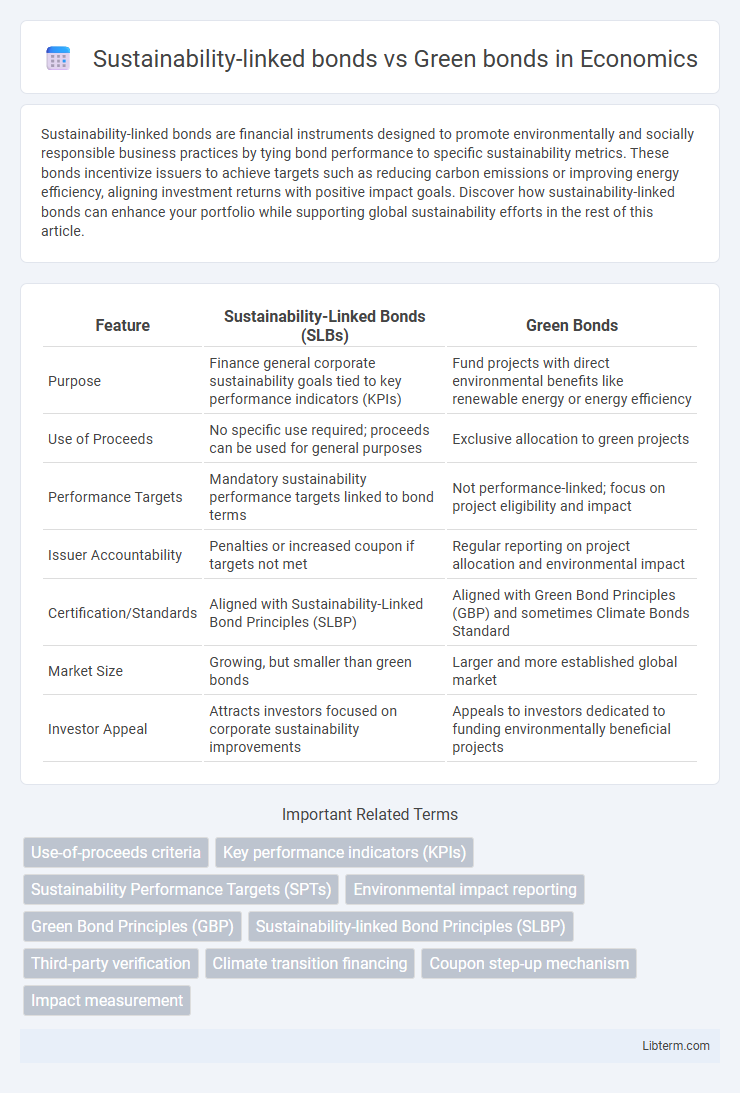

| Feature | Sustainability-Linked Bonds (SLBs) | Green Bonds |

|---|---|---|

| Purpose | Finance general corporate sustainability goals tied to key performance indicators (KPIs) | Fund projects with direct environmental benefits like renewable energy or energy efficiency |

| Use of Proceeds | No specific use required; proceeds can be used for general purposes | Exclusive allocation to green projects |

| Performance Targets | Mandatory sustainability performance targets linked to bond terms | Not performance-linked; focus on project eligibility and impact |

| Issuer Accountability | Penalties or increased coupon if targets not met | Regular reporting on project allocation and environmental impact |

| Certification/Standards | Aligned with Sustainability-Linked Bond Principles (SLBP) | Aligned with Green Bond Principles (GBP) and sometimes Climate Bonds Standard |

| Market Size | Growing, but smaller than green bonds | Larger and more established global market |

| Investor Appeal | Attracts investors focused on corporate sustainability improvements | Appeals to investors dedicated to funding environmentally beneficial projects |

Introduction to Sustainable Finance Instruments

Sustainability-linked bonds (SLBs) and green bonds are key instruments in sustainable finance designed to support environmental and social goals. SLBs link financial terms such as interest rates to the issuer's achievement of predefined sustainability performance targets, while green bonds specifically fund projects with positive environmental benefits. Both instruments enhance corporate accountability and attract investors seeking to finance sustainable development initiatives.

Defining Green Bonds

Green bonds are fixed-income financial instruments specifically designed to fund projects with clear environmental benefits, such as renewable energy, energy efficiency, and sustainable waste management. These bonds require issuers to allocate proceeds exclusively to environmentally sustainable initiatives, adhering to frameworks like the Green Bond Principles for transparency and impact reporting. Unlike sustainability-linked bonds, which tie financial terms to overall ESG performance targets, green bonds concentrate solely on financing green projects with measurable environmental outcomes.

Understanding Sustainability-Linked Bonds

Sustainability-linked bonds (SLBs) differ from green bonds by linking financial terms to a company's overall sustainability performance rather than funding specific environmental projects. SLBs typically include key performance indicators (KPIs) tied to targets such as reducing greenhouse gas emissions or improving energy efficiency, with penalties like higher coupon rates if goals are not met. This flexible structure allows companies to integrate sustainability into their broader business strategies, offering investors returns aligned with real-world environmental and social impact.

Key Differences: Green Bonds vs Sustainability-Linked Bonds

Green bonds finance specific environmentally beneficial projects, such as renewable energy infrastructure or pollution control, with proceeds strictly allocated to these initiatives. Sustainability-linked bonds tie financial terms to a company's overall ESG performance targets, allowing flexibility in project use while incentivizing broader sustainability improvements. Unlike green bonds, sustainability-linked bonds emphasize measurable outcome-based targets, aligning issuer accountability with environmental and social goals beyond project-level impact.

Use of Proceeds: Project-Specific vs Performance-Based

Sustainability-linked bonds (SLBs) tie the use of proceeds to overall corporate sustainability performance targets, allowing issuers flexibility in deploying funds across general business activities. Green bonds, in contrast, require strict allocation of proceeds to specific environmentally beneficial projects, ensuring direct funding for initiatives like renewable energy or energy efficiency. This project-specific approach in green bonds contrasts with the performance-based nature of SLBs, where bond terms depend on achieving predefined sustainability key performance indicators (KPIs).

Market Growth and Trends

Sustainability-linked bonds (SLBs) exhibit rapid market growth driven by their performance-based targets across environmental, social, and governance (ESG) factors, attracting diverse issuers seeking flexible use of proceeds. Green bonds continue to dominate with a strong emphasis on funding specific environmental projects, maintaining steady growth supported by increased investor demand for transparency and impact reporting. Market trends indicate rising integration of SLBs and green bonds within ESG frameworks, with notable expansion in emerging markets and regulatory support enhancing issuance volumes and investor confidence.

Impact Measurement and Reporting Standards

Sustainability-linked bonds (SLBs) require issuers to meet pre-defined sustainability performance targets (SPTs), with impact measurement tied to key performance indicators (KPIs) aligned with frameworks like the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD). Green bonds focus exclusively on financing environmentally beneficial projects, with impact measurement and reporting adhering to standards such as the Green Bond Principles (GBP) and the Climate Bonds Initiative (CBI) taxonomy. Both bond types emphasize transparency through third-party verification and annual impact reports, but SLBs integrate broader sustainability metrics beyond environmental outcomes, enhancing holistic accountability.

Risks and Challenges in Sustainable Bond Issuances

Sustainability-linked bonds (SLBs) face risks related to the issuer's ability to meet predefined sustainability performance targets, with failure potentially affecting bond pricing and reputation. Green bonds require rigorous project verification and impact reporting, posing challenges in ensuring transparency and preventing greenwashing. Both instruments encounter regulatory uncertainty and evolving standards, increasing complexity and investor due diligence in sustainable bond issuances.

Investor Perspectives and Demand Drivers

Sustainability-linked bonds attract investors by offering flexible use-of-proceeds and linking financial performance to broad ESG targets, appealing to those prioritizing corporate accountability and measurable impact across environmental, social, and governance dimensions. Green bonds primarily draw demand from investors focused on financing specific environmentally beneficial projects, such as renewable energy or clean transportation, ensuring transparency and targeted impact. Investor preference often hinges on the desired balance between project-specific impact and corporate-wide sustainability performance, driving differentiated demand dynamics in the sustainable finance market.

Future Outlook for Sustainable Bond Markets

Sustainability-linked bonds (SLBs) and green bonds represent rapidly growing segments within sustainable finance, with market projections indicating exponential growth driven by increasing investor demand for ESG-compliant assets. Future outlooks emphasize the integration of more robust ESG criteria, enhanced transparency, and stricter reporting standards to ensure accountability and performance alignment with sustainability goals. The evolution of regulatory frameworks and innovative financial instruments is expected to further catalyze capital flows towards projects addressing climate change, social equity, and environmental resilience.

Sustainability-linked bonds Infographic

libterm.com

libterm.com