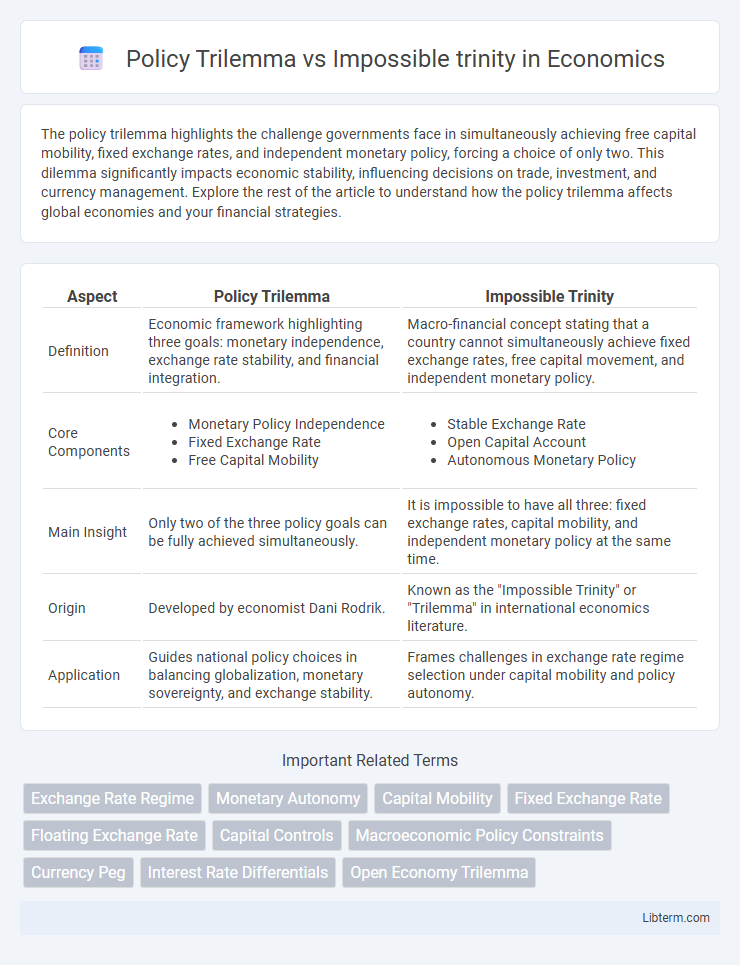

The policy trilemma highlights the challenge governments face in simultaneously achieving free capital mobility, fixed exchange rates, and independent monetary policy, forcing a choice of only two. This dilemma significantly impacts economic stability, influencing decisions on trade, investment, and currency management. Explore the rest of the article to understand how the policy trilemma affects global economies and your financial strategies.

Table of Comparison

| Aspect | Policy Trilemma | Impossible Trinity |

|---|---|---|

| Definition | Economic framework highlighting three goals: monetary independence, exchange rate stability, and financial integration. | Macro-financial concept stating that a country cannot simultaneously achieve fixed exchange rates, free capital movement, and independent monetary policy. |

| Core Components |

|

|

| Main Insight | Only two of the three policy goals can be fully achieved simultaneously. | It is impossible to have all three: fixed exchange rates, capital mobility, and independent monetary policy at the same time. |

| Origin | Developed by economist Dani Rodrik. | Known as the "Impossible Trinity" or "Trilemma" in international economics literature. |

| Application | Guides national policy choices in balancing globalization, monetary sovereignty, and exchange stability. | Frames challenges in exchange rate regime selection under capital mobility and policy autonomy. |

Introduction to the Policy Trilemma and Impossible Trinity

The Policy Trilemma, also known as the Impossible Trinity, is a fundamental concept in international economics stating that a country cannot simultaneously maintain a fixed foreign exchange rate, free capital movement, and an independent monetary policy. Policymakers must choose two of these three objectives, as pursuing all three is economically infeasible. This trade-off shapes the framework for sovereign decisions on exchange rate regimes, capital controls, and monetary autonomy.

Defining the Policy Trilemma

The Policy Trilemma, also known as the Impossible Trinity, defines the economic principle that a country cannot simultaneously maintain a fixed foreign exchange rate, free capital movement, and an independent monetary policy. Policymakers must choose two objectives, sacrificing the third due to inherent conflicts in balancing exchange rate stability, capital mobility, and monetary sovereignty. This concept is critical in international economics for understanding trade-offs in macroeconomic policy design and financial integration.

What is the Impossible Trinity?

The Impossible Trinity, also known as the Policy Trilemma, is a fundamental concept in international economics stating that a country cannot simultaneously achieve a fixed foreign exchange rate, free capital movement, and an independent monetary policy. Policymakers must prioritize two of these three goals, as attempting to attain all three invariably leads to economic instability. This trilemma highlights the trade-offs nations face in managing exchange rates, capital flows, and monetary sovereignty.

Core Components: Exchange Rate, Monetary Policy, Capital Mobility

The Policy Trilemma, also known as the Impossible Trinity, highlights the trade-offs among three core components: exchange rate stability, independent monetary policy, and capital mobility, where only two can be achieved simultaneously. Fixed exchange rates require sacrificing monetary policy autonomy if capital mobility is high, while flexible exchange rates allow monetary policy freedom but limit exchange rate stability with open capital flows. Capital controls can maintain exchange rate stability and monetary policy independence but at the cost of restricting capital mobility.

Historical Origins and Economic Theories

The Policy Trilemma, often referred to as the Impossible Trinity, originated from the Mundell-Fleming model in the 1960s, which describes the trade-offs between fixed exchange rates, monetary policy independence, and capital mobility. Robert Mundell and Marcus Fleming independently contributed to this foundational economic theory, emphasizing that a country cannot simultaneously achieve all three policy goals without facing economic instability. This framework remains pivotal in international economics, shaping monetary policy decisions and exchange rate management worldwide.

Key Differences Between Policy Trilemma and Impossible Trinity

The Policy Trilemma and Impossible Trinity both address the challenge of achieving three main objectives in international economics, but they differ in scope and application. The Impossible Trinity highlights the difficulty of simultaneously maintaining fixed exchange rates, free capital movement, and independent monetary policy, emphasizing external policy constraints. In contrast, the Policy Trilemma focuses on balancing growth, equity, and stability within domestic economic policy, highlighting internal trade-offs.

Real-World Examples: Policy Choices and Trade-Offs

The policy trilemma, also known as the impossible trinity, states that a country cannot simultaneously maintain a fixed foreign exchange rate, free capital movement, and an independent monetary policy. For example, during the European Exchange Rate Mechanism crisis in 1992, the UK chose to maintain capital mobility and a floating exchange rate, sacrificing exchange rate stability. Similarly, China prioritizes exchange rate stability and monetary policy control by imposing capital controls, illustrating the trade-offs policymakers face in managing currency regimes, capital flows, and domestic economic goals.

Policy Implications for Emerging and Developed Economies

The Policy Trilemma and Impossible Trinity both highlight the trade-offs between exchange rate stability, monetary policy autonomy, and capital mobility, but their implications differ for emerging and developed economies. Emerging economies often face higher volatility and capital flow risks, making it challenging to maintain fixed exchange rates while preserving monetary autonomy and open capital markets. Developed economies benefit from deeper financial markets and more credible institutions, allowing greater flexibility to navigate these trade-offs with less economic disruption.

Criticisms and Limitations of the Trilemma/Trinity Concept

The Policy Trilemma, or Impossible Trinity, faces criticism for its oversimplification of complex economic realities by assuming only three policy goals can be pursued simultaneously: fixed exchange rates, monetary autonomy, and capital mobility. Critics highlight that this framework does not account for the diversity of policy tools and institutional frameworks that can mitigate these trade-offs, such as capital controls or macroprudential regulations. Its static nature also limits applicability in dynamic economic environments where technological advancements and global financial integration evolve rapidly.

Conclusion: Navigating the Dilemma in Global Economics

The Policy Trilemma, or Impossible Trinity, highlights the inherent trade-offs between monetary policy independence, exchange rate stability, and capital mobility, forcing policymakers to sacrifice one to uphold the other two. Successfully navigating this dilemma requires strategic prioritization aligned with a country's economic goals and market conditions, often leading to tailored compromises rather than one-size-fits-all solutions. Global economic stability depends on adaptive frameworks that recognize these constraints while fostering international cooperation and resilience.

Policy Trilemma Infographic

libterm.com

libterm.com