Constant returns to scale occur when increasing all inputs by a certain proportion results in an exact proportional increase in output, maintaining efficiency regardless of scale. This concept is essential for understanding production functions and helps businesses predict how scaling operations impacts total production. Explore the article to learn how constant returns to scale influence economic strategies and operational decisions.

Table of Comparison

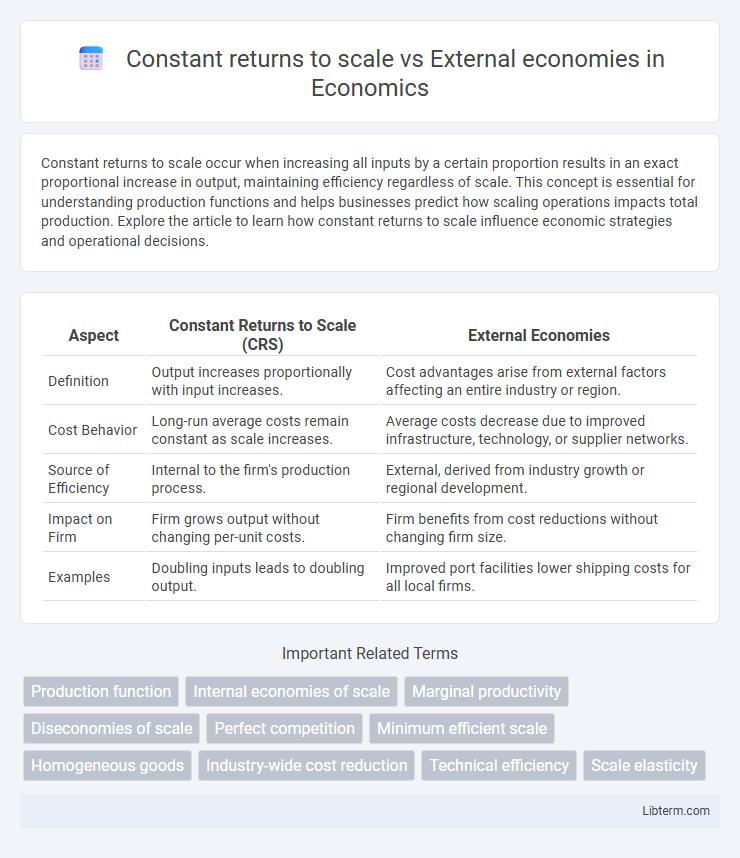

| Aspect | Constant Returns to Scale (CRS) | External Economies |

|---|---|---|

| Definition | Output increases proportionally with input increases. | Cost advantages arise from external factors affecting an entire industry or region. |

| Cost Behavior | Long-run average costs remain constant as scale increases. | Average costs decrease due to improved infrastructure, technology, or supplier networks. |

| Source of Efficiency | Internal to the firm's production process. | External, derived from industry growth or regional development. |

| Impact on Firm | Firm grows output without changing per-unit costs. | Firm benefits from cost reductions without changing firm size. |

| Examples | Doubling inputs leads to doubling output. | Improved port facilities lower shipping costs for all local firms. |

Introduction to Constant Returns to Scale and External Economies

Constant returns to scale occur when increasing all inputs by a certain proportion results in an equal proportional increase in output, reflecting a balanced efficiency in production. External economies arise from factors outside a single firm, such as industry-wide improvements or infrastructure development, which reduce costs and enhance productivity collectively. Understanding the distinction between constant returns to scale and external economies is crucial for analyzing production efficiency and industry growth dynamics.

Defining Constant Returns to Scale

Constant returns to scale occur when an increase in all input factors results in a proportional increase in output, maintaining the same efficiency level. This concept contrasts with external economies, where cost advantages arise from industry-wide improvements rather than firm-level input scaling. Understanding constant returns to scale is crucial for analyzing production functions and long-term cost behavior in economics.

Understanding External Economies

External economies arise when the cost advantages experienced by a firm result from factors outside its control but within the industry or region, such as improved infrastructure or a skilled labor pool. These benefits lead to a reduction in average costs as the entire industry expands, differentiating them from constant returns to scale where costs remain unchanged with output increases. Understanding external economies highlights how localized economic growth and shared resources enhance productivity beyond the firm's internal capabilities.

Key Differences Between the Two Concepts

Constant returns to scale refer to a firm's output increasing proportionally as all inputs are increased, maintaining efficiency without cost advantages. External economies occur when an industry's growth leads to reduced costs for all firms due to factors like improved infrastructure or skilled labor pools. The key difference is that constant returns to scale arise from internal production processes within a firm, while external economies result from factors outside the individual firm, benefiting the entire industry.

Real-World Examples of Constant Returns to Scale

Constant returns to scale occur when increasing all inputs by a certain percentage results in an equal percentage increase in output, common in manufacturing sectors like automobile assembly where doubling labor and capital precisely doubles vehicle production. In contrast, external economies arise from industry-wide benefits such as shared suppliers or infrastructure, exemplified by Silicon Valley's technology cluster boosting productivity through knowledge spillovers. Real-world instances of constant returns to scale include electronics manufacturing plants where output expansion matches input increases without efficiency loss, highlighting the difference between firm-level scalability and broader external economic influences.

Real-World Applications of External Economies

External economies occur when firms benefit from cost reductions due to factors outside their control, such as infrastructure improvements or a skilled local workforce, enhancing industry-wide productivity. Real-world applications include Silicon Valley, where businesses gain from a concentrated pool of tech talent and knowledge spillovers, driving innovation without individual firms increasing scale. Unlike constant returns to scale, where output changes proportionally with input within a firm, external economies stem from broader, regional advantages that amplify economic growth.

Impact on Industry Structure and Firm Behavior

Constant returns to scale imply that firms experience proportionate increases in output with equal increases in input, leading to stable average costs and encouraging a competitive industry structure with many firms of similar size. External economies arise from industry growth and lead to reductions in individual firm costs due to factors like improved infrastructure, skilled labor pools, and supplier networks, fostering industry clustering and potentially enabling larger firms to gain competitive advantages. The interaction of constant returns to scale and external economies shapes firm behavior by balancing scale efficiency with the benefits of agglomeration, influencing entry barriers and market concentration patterns.

Implications for Economic Growth and Development

Constant returns to scale allow firms to double output by doubling inputs, promoting steady economic growth through efficient resource utilization and optimal production techniques. External economies arise from industry-wide benefits like improved infrastructure or knowledge spillovers, leading to reduced costs and fostering innovation that accelerates regional development. Both mechanisms influence long-term growth: constant returns drive firm-level productivity, while external economies stimulate broader economic expansion by enhancing industry competitiveness and attracting investment.

Policy Considerations and Market Outcomes

Constant returns to scale imply that output increases proportionally with input, promoting stable cost structures favorable for long-term investment and efficient resource allocation. External economies arise when firms experience cost reductions due to factors outside their control, such as industry clustering or infrastructure improvements, which can lead to market concentration and regional economic disparities. Policymakers must balance fostering competitive markets while supporting external economies through targeted infrastructure, innovation incentives, and regulatory frameworks to optimize productivity and equitable growth.

Summary: Choosing Between Constant Returns to Scale and External Economies

Constant returns to scale occur when increasing input by a certain proportion results in an equal proportional increase in output, enabling consistent production efficiency. External economies, on the other hand, arise from external factors such as industry growth or technological advancements, leading to reduced costs as firms benefit from collective advantages. Choosing between constant returns to scale and external economies depends on whether a firm's growth relies on internal production efficiency or external industry-wide improvements that lower operational costs.

Constant returns to scale Infographic

libterm.com

libterm.com