Interest rate mismatch occurs when a financial institution's assets and liabilities have different interest rate terms, leading to potential risks in earnings and capital. This imbalance can affect your profitability, especially during fluctuating interest rate environments. Explore the rest of this article to understand how to manage interest rate mismatch effectively.

Table of Comparison

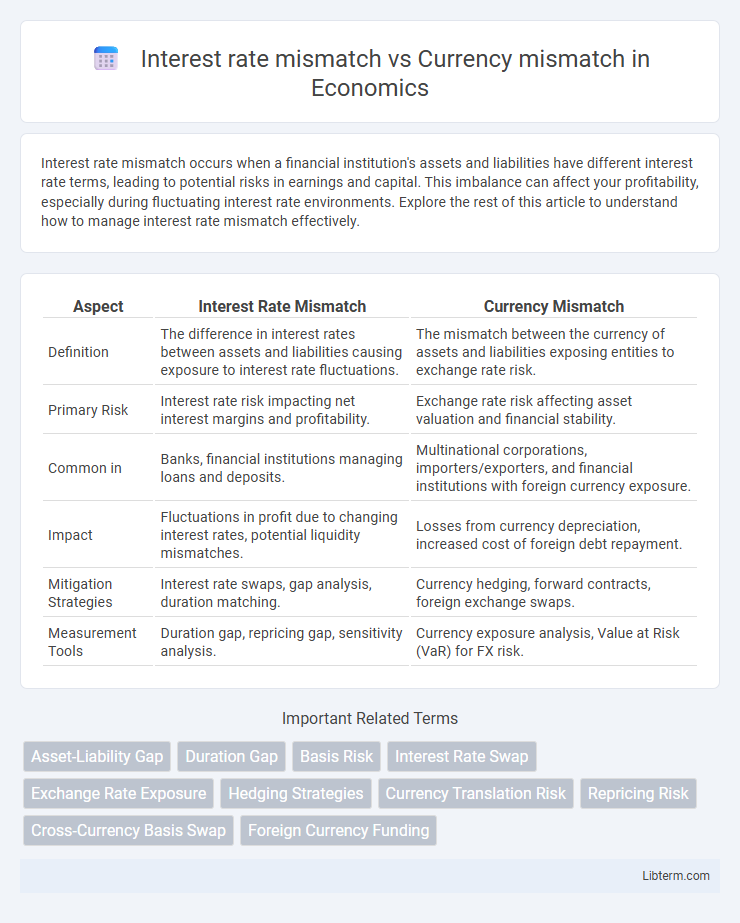

| Aspect | Interest Rate Mismatch | Currency Mismatch |

|---|---|---|

| Definition | The difference in interest rates between assets and liabilities causing exposure to interest rate fluctuations. | The mismatch between the currency of assets and liabilities exposing entities to exchange rate risk. |

| Primary Risk | Interest rate risk impacting net interest margins and profitability. | Exchange rate risk affecting asset valuation and financial stability. |

| Common in | Banks, financial institutions managing loans and deposits. | Multinational corporations, importers/exporters, and financial institutions with foreign currency exposure. |

| Impact | Fluctuations in profit due to changing interest rates, potential liquidity mismatches. | Losses from currency depreciation, increased cost of foreign debt repayment. |

| Mitigation Strategies | Interest rate swaps, gap analysis, duration matching. | Currency hedging, forward contracts, foreign exchange swaps. |

| Measurement Tools | Duration gap, repricing gap, sensitivity analysis. | Currency exposure analysis, Value at Risk (VaR) for FX risk. |

Understanding Interest Rate Mismatch

Interest rate mismatch occurs when a borrower's assets and liabilities have differing interest rate structures, such as fixed versus floating rates, leading to exposure to rate fluctuations and potential financial losses. Currency mismatch arises when assets and liabilities are denominated in different currencies, exposing the entity to foreign exchange risk. Understanding interest rate mismatch is crucial for managing interest rate risk, optimizing debt portfolios, and maintaining stable cash flows amid changing market rates.

Defining Currency Mismatch

Currency mismatch occurs when a country's liabilities are denominated in foreign currency while its assets are primarily in domestic currency, exposing it to exchange rate risk. This contrasts with interest rate mismatch, where the timing or repricing of assets and liabilities differ, impacting cash flow stability. Currency mismatch increases vulnerability to sudden devaluations, often leading to financial instability and amplified sovereign risk in emerging markets.

Key Differences: Interest Rate vs Currency Mismatch

Interest rate mismatch occurs when the interest rates of a company's assets and liabilities differ, leading to exposure to fluctuations in interest costs and income, while currency mismatch involves differences in the currencies of assets and liabilities, exposing firms to foreign exchange risk. Interest rate mismatch primarily affects the cost of borrowing and investment returns within the same currency, impacting net interest margin and profitability. Currency mismatch, on the other hand, introduces risks related to exchange rate volatility, influencing the value of foreign-denominated assets and liabilities and potentially resulting in significant translation losses or gains.

Causes of Interest Rate Mismatch

Interest rate mismatch arises primarily from differences in the maturity or repricing schedules of assets and liabilities, causing timing gaps that expose financial institutions to fluctuations in interest rates. Currency mismatch, in contrast, involves assets and liabilities denominated in different currencies, leading to exchange rate risk. The main causes of interest rate mismatch include borrowing long-term funds while lending short-term, or holding fixed-rate assets funded by variable-rate liabilities, creating vulnerability to interest rate changes.

Causes of Currency Mismatch

Currency mismatch arises primarily from borrowing funds in foreign currencies while generating revenue in local currency, leading to exposure when exchange rates fluctuate. This often occurs due to limited access to local-currency financing or lower interest rates on foreign loans attracting borrowers. In contrast, interest rate mismatch involves timing differences between asset and liability interest rate adjustments, but the core cause of currency mismatch is the imbalance between currency denominations of assets and liabilities.

Impacts on Financial Stability

Interest rate mismatch occurs when financial institutions have assets and liabilities denominated in the same currency but with differing interest rate structures, leading to earnings volatility and potential liquidity stress under interest rate shocks. Currency mismatch arises when assets and liabilities are denominated in different currencies, exposing institutions to foreign exchange risk, which can exacerbate balance sheet vulnerabilities during currency depreciation and trigger sudden stops or capital outflows. Both mismatches impair financial stability by increasing systemic risk through amplified losses, reduced credit availability, and heightened contagion effects during economic or market disruptions.

Risk Management Strategies

Interest rate mismatch risk arises when assets and liabilities have differing interest rate sensitivities, requiring strategies such as interest rate swaps, caps, and duration matching to hedge exposure. Currency mismatch risk occurs when financial positions are denominated in different currencies, demanding techniques like natural hedging, forward contracts, and currency swaps to manage foreign exchange volatility. Effective risk management integrates scenario analysis and stress testing to address both mismatches, optimizing liquidity and capital adequacy under varying market conditions.

Real-world Examples: Interest Rate vs Currency Mismatch

Interest rate mismatch occurs when a company's assets and liabilities have differing interest rate terms, such as a firm borrowing at a variable rate while having fixed-rate assets, often impacting profitability during fluctuating interest rates as seen in corporations like Ford during rising U.S. rates. Currency mismatch arises when assets and liabilities are denominated in different currencies, exposing firms to exchange rate risks exemplified by Latin American countries in the 1990s borrowing heavily in U.S. dollars while earning revenues in local currencies. Real-world instances include Turkish banks facing currency mismatch losses amid lira depreciation and Japanese exporters leveraging interest rate mismatch to benefit from low domestic borrowing costs despite foreign sales.

Policy Implications and Regulatory Approaches

Interest rate mismatch occurs when assets and liabilities have different interest rate structures, increasing vulnerability to interest rate fluctuations, while currency mismatch arises from assets and liabilities being denominated in different currencies, exposing entities to exchange rate volatility. Policy implications for interest rate mismatches emphasize strengthening monetary policy frameworks and promoting the use of hedging instruments to manage interest rate risks effectively. Regulatory approaches to currency mismatches focus on enhancing foreign exchange risk management standards, enforcing capital adequacy requirements that consider currency exposures, and encouraging transparency in cross-border financial activities.

Best Practices for Mitigating Mismatches

Mitigating interest rate mismatch involves aligning asset and liability maturities through interest rate swaps and duration matching to minimize exposure to rate fluctuations. Currency mismatch can be managed by employing natural hedges, using forward contracts, and maintaining diversified currency reserves to reduce foreign exchange risk. Best practices emphasize proactive risk assessment, continuous monitoring, and integrating these strategies into a comprehensive risk management framework.

Interest rate mismatch Infographic

libterm.com

libterm.com