Cross hedging helps manage risk by offsetting potential losses in one asset with gains in a related but different asset. This strategy is useful when direct hedging instruments are unavailable or illiquid, allowing you to protect your portfolio through correlated markets. Explore the rest of the article to understand how cross hedging can optimize your risk management approach.

Table of Comparison

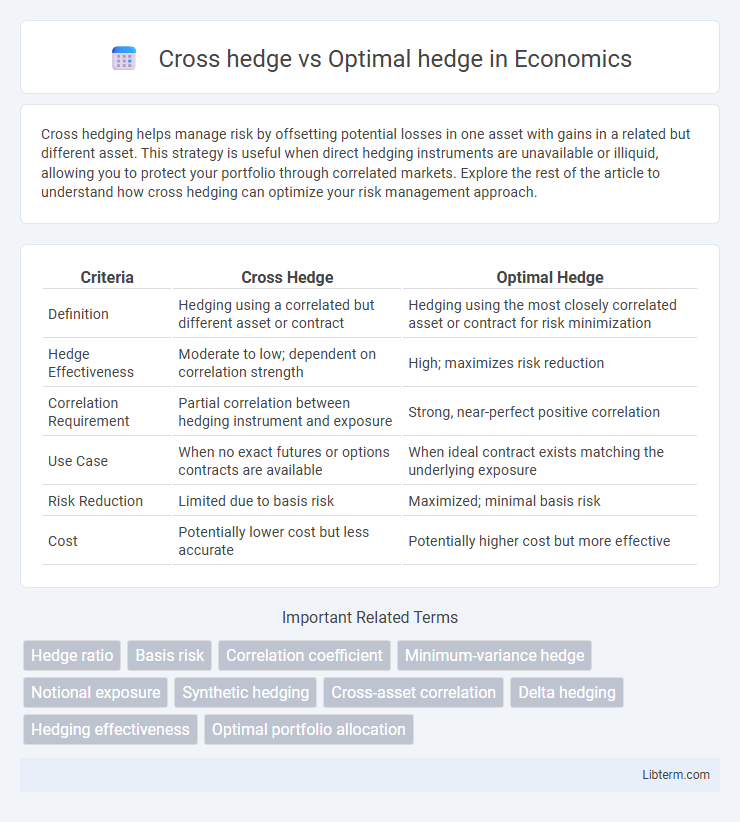

| Criteria | Cross Hedge | Optimal Hedge |

|---|---|---|

| Definition | Hedging using a correlated but different asset or contract | Hedging using the most closely correlated asset or contract for risk minimization |

| Hedge Effectiveness | Moderate to low; dependent on correlation strength | High; maximizes risk reduction |

| Correlation Requirement | Partial correlation between hedging instrument and exposure | Strong, near-perfect positive correlation |

| Use Case | When no exact futures or options contracts are available | When ideal contract exists matching the underlying exposure |

| Risk Reduction | Limited due to basis risk | Maximized; minimal basis risk |

| Cost | Potentially lower cost but less accurate | Potentially higher cost but more effective |

Introduction to Hedging Strategies

Cross hedge involves managing risk by taking a position in a related but not identical asset when the exact asset is unavailable or illiquid, leveraging positive correlation to mitigate exposure. Optimal hedge aims to minimize the variance of the hedged portfolio by carefully selecting the hedge ratio, often using statistical methods like regression analysis to determine the ideal proportion of the hedging instrument. Both strategies serve as essential tools in risk management, with cross hedge offering flexibility across correlated assets and optimal hedge providing precision in offsetting price movements.

What is a Cross Hedge?

A cross hedge involves using a futures contract or derivative on a related but different asset to offset risk, typically when a direct hedge is unavailable or illiquid. It relies on the correlation between the hedged item and the hedging instrument to manage price volatility, though it may introduce basis risk. Optimal hedge, in contrast, focuses on selecting the hedge ratio that minimizes the variance of the hedged portfolio, often using statistical methods to balance risk and efficiency.

What is an Optimal Hedge?

An optimal hedge involves selecting a position in a hedging instrument that closely matches the risk exposure of the underlying asset, minimizing potential losses due to price fluctuations. It uses the hedge ratio derived from the correlation and volatility between the asset and the hedging instrument to achieve maximum risk reduction. Cross hedge differs as it involves hedging an asset with a related but not identical instrument, often leading to less precise risk management compared to the precision of an optimal hedge.

Key Differences Between Cross Hedge and Optimal Hedge

Cross hedge involves using a hedging instrument that is correlated but not identical to the asset being hedged, often employed when a perfect hedge is unavailable, whereas optimal hedge aims to minimize the variance of the hedged position by selecting the hedge ratio that provides the best risk reduction. The key difference lies in the effectiveness and precision of risk mitigation; cross hedging typically carries basis risk due to imperfect correlation, while optimal hedging uses statistical techniques to calculate the exact hedge ratio, enhancing hedge performance. Consequently, optimal hedge strategies outperform cross hedges in achieving targeted risk exposure reduction and cost efficiency.

Advantages of Cross Hedging

Cross hedging offers significant advantages by enabling risk management when a perfect hedge instrument is unavailable, allowing investors to reduce exposure using correlated assets. It enhances portfolio flexibility and cost efficiency by leveraging related markets with similar price movements, which can be more accessible or liquid than the exact underlying asset. This strategy also diversifies risk across different, yet related, instruments, potentially improving overall hedging effectiveness in volatile or unpredictable markets.

Advantages of Optimal Hedging

Optimal hedging minimizes risk by using a hedge instrument that closely correlates with the underlying asset, improving accuracy and reducing basis risk compared to cross hedging. It maximizes portfolio protection by dynamically adjusting hedge ratios according to market conditions and volatility patterns. This strategic precision results in cost efficiency and enhanced predictability of returns, outperforming the less tailored approach of cross hedging.

Risks and Limitations of Cross Hedging

Cross hedging involves using a related but not identical asset to offset risk, leading to basis risk due to imperfect correlation between the hedge instrument and the underlying asset. This mismatch can result in suboptimal risk mitigation and unexpected losses when prices move divergently. Optimal hedging minimizes basis risk by selecting the most closely correlated instruments, enhancing the effectiveness of risk management strategies.

Calculating the Optimal Hedge Ratio

Calculating the optimal hedge ratio involves minimizing the variance of the hedged portfolio by determining the precise proportion of futures contracts to use in relation to the underlying exposure. The formula for the optimal hedge ratio (h*) is the covariance between changes in the spot price and futures price divided by the variance of the futures price changes, expressed as h* = Cov(DS, DF) / Var(DF). Cross hedging differs by using related but not identical futures contracts, which requires careful calculation of the hedge ratio to account for imperfect correlations and basis risk.

When to Choose Cross Hedge vs Optimal Hedge

Cross hedging is suitable when the exact asset to be hedged lacks a direct futures market, requiring a correlated asset to mitigate risk, especially in volatile or illiquid markets. Optimal hedge involves precise calculations using historical price relationships and variance-covariance matrices to minimize hedging error, best applied when detailed data and analytics are available for the hedged asset. Select cross hedge when practical constraints limit direct hedging, and choose optimal hedge for statistically precise risk management with reliable correlation estimates.

Conclusion: Selecting the Right Hedging Approach

Selecting the right hedging approach depends on the risk exposure and market liquidity of the underlying asset. Cross hedging provides a viable alternative when direct hedging instruments are unavailable, though it may introduce basis risk due to imperfect correlation. Optimal hedging, leveraging statistical models to minimize risk cost, generally offers more precise protection but requires accurate data and sophisticated analysis.

Cross hedge Infographic

libterm.com

libterm.com