Securities Transfer Tax applies to the transfer of ownership in stocks, bonds, or other securities and is typically imposed at the state level. Understanding how this tax impacts your investment transactions can help you plan more efficiently and avoid unexpected costs. Explore the rest of the article to learn how Securities Transfer Tax affects your financial decisions.

Table of Comparison

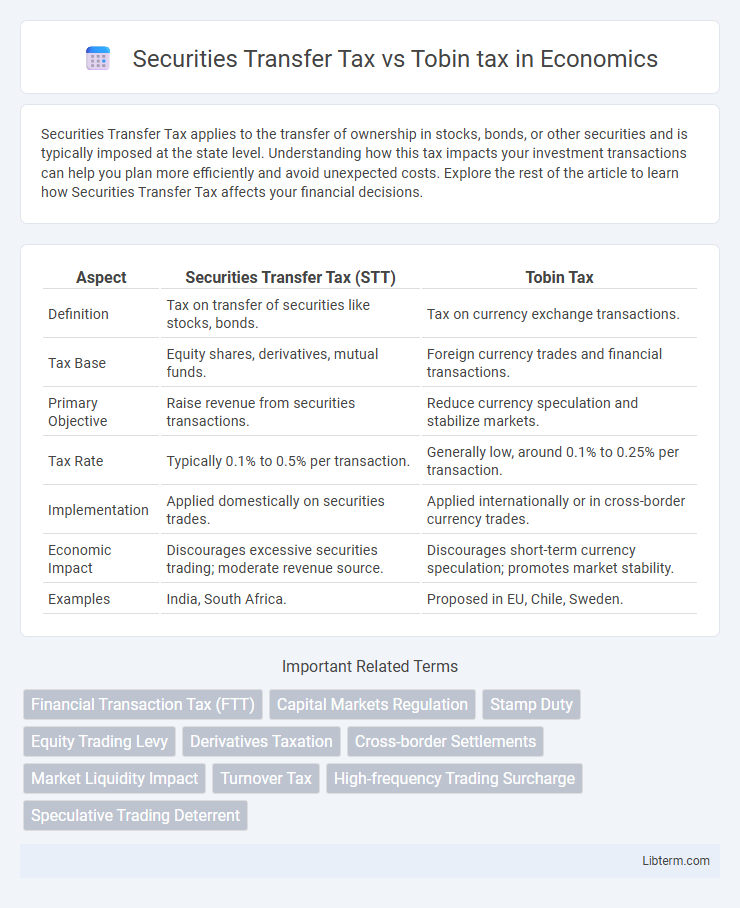

| Aspect | Securities Transfer Tax (STT) | Tobin Tax |

|---|---|---|

| Definition | Tax on transfer of securities like stocks, bonds. | Tax on currency exchange transactions. |

| Tax Base | Equity shares, derivatives, mutual funds. | Foreign currency trades and financial transactions. |

| Primary Objective | Raise revenue from securities transactions. | Reduce currency speculation and stabilize markets. |

| Tax Rate | Typically 0.1% to 0.5% per transaction. | Generally low, around 0.1% to 0.25% per transaction. |

| Implementation | Applied domestically on securities trades. | Applied internationally or in cross-border currency trades. |

| Economic Impact | Discourages excessive securities trading; moderate revenue source. | Discourages short-term currency speculation; promotes market stability. |

| Examples | India, South Africa. | Proposed in EU, Chile, Sweden. |

Introduction to Securities Transfer Tax and Tobin Tax

Securities Transfer Tax (STT) is a state-level tax imposed on the transfer of securities, including shares and bonds, during trading transactions, primarily aimed at regulating stock market activities and generating revenue. Tobin Tax is a proposed financial transaction tax on currency exchanges intended to reduce speculation and stabilize foreign exchange markets. While STT targets securities trading within domestic markets, Tobin Tax focuses on cross-border currency transactions with a broader economic stabilization purpose.

Historical Background and Evolution

The Securities Transfer Tax (STT) was first introduced in the early 20th century as a means for governments to generate revenue from the buying and selling of securities in financial markets. The Tobin tax, proposed by economist James Tobin in 1972, aimed to curb excessive speculation in foreign exchange markets by taxing short-term currency transactions. Over time, STT has evolved to encompass various financial instruments and jurisdictions, while the Tobin tax remains a debated concept, with some countries implementing versions targeting currency volatility and financial transaction taxes.

Core Definitions and Concepts

Securities Transfer Tax (STT) is a tax levied on the transfer of securities such as stocks and bonds, imposed at the point of transaction to regulate trading and generate government revenue. Tobin tax, proposed by economist James Tobin, is a small tax on currency conversions designed to discourage short-term speculation in foreign exchange markets and stabilize global financial systems. While STT targets equity and debt securities transactions within domestic markets, Tobin tax specifically addresses currency exchange activities at a global level to reduce volatility and speculative capital flows.

Key Differences Between Securities Transfer Tax and Tobin Tax

Securities Transfer Tax (STT) is a tax levied on the transfer of securities within a specific jurisdiction, primarily targeting stock transactions and designed to generate revenue for governments. Tobin Tax is a broader financial transaction tax aimed at curbing speculative currency trading and stabilizing foreign exchange markets by imposing a small tax on currency conversions. Key differences include their scope--STT applies to securities like stocks and bonds while Tobin Tax targets currency trades--and their primary purposes, with STT focused on government revenue and Tobin Tax intended to reduce market volatility.

Primary Objectives and Policy Rationales

Securities Transfer Tax primarily aims to generate government revenue by taxing the transfer of securities, thereby regulating market transactions and discouraging excessive speculation. Tobin Tax is designed to stabilize financial markets by imposing a levy on short-term currency transactions, reducing volatility and curbing speculative trading that can disrupt economic stability. Both taxes serve distinct policy rationales: Securities Transfer Tax supports fiscal objectives through steady revenue streams, while Tobin Tax focuses on enhancing market integrity and protecting economies from rapid capital flight.

Application Scope: Markets and Instruments Covered

Securities Transfer Tax (STT) primarily applies to equity transactions and derivatives traded on recognized stock exchanges, targeting the transfer of shares and securities within regulated markets. Tobin tax extends its scope to currency transactions in the foreign exchange market, aiming to curb excessive short-term currency speculation across global financial markets. While STT focuses on the domestic securities market, Tobin tax addresses international forex trading, reflecting their distinct application scopes and market coverage.

Economic Impacts and Market Reactions

Securities Transfer Tax (STT) primarily affects liquidity by imposing a small fee on stock transactions, often leading to reduced short-term trading and slightly increased market volatility. Tobin Tax targets currency transactions, aiming to curb excessive speculation and stabilize exchange rates, but can result in lower foreign exchange market liquidity and increased bid-ask spreads. Both taxes influence market behavior by discouraging rapid trading, potentially stabilizing prices but also impacting market efficiency and investor participation.

International Examples and Case Studies

Securities Transfer Tax (STT) is a tax imposed on the transfer of securities such as stocks and bonds, commonly applied in countries like India and South Africa to regulate trading activities and generate revenue from capital market transactions. The Tobin tax, proposed by economist James Tobin, is a tax on currency conversions aimed at reducing speculation in foreign exchange markets, with experimental implementations in countries like France and Brazil targeting financial market stability. Case studies from Sweden's 1980s financial transaction tax failure and Chile's successful short-term capital flow tax demonstrate contrasting outcomes influencing modern approaches to securities transfer and Tobin tax frameworks globally.

Criticisms and Challenges Associated with Each Tax

Securities Transfer Tax (STT) faces criticism for potentially reducing market liquidity and increasing transaction costs, which may hinder trading volumes and investor participation. Tobin tax is challenged by concerns over economic slowdown and its limited effectiveness in curbing speculative financial flows due to easy circumvention through offshore markets. Both taxes struggle with enforcement complexities and the risk of driving transactions to untaxed jurisdictions, undermining revenue goals and market stability.

Future Prospects and Policy Considerations

Securities Transfer Tax (STT) primarily targets equity transactions within domestic markets, generating predictable revenue streams crucial for regulatory bodies, while Tobin tax aims at curbing short-term currency speculation globally, potentially stabilizing exchange rates but facing implementation challenges. Future prospects for STT involve integration with digital trading platforms to enhance compliance and reduce evasion, whereas Tobin tax discussions emphasize international cooperation to avoid market distortions and capital flight. Policy considerations must balance revenue generation, market liquidity, and economic impact, with STT offering targeted taxation on securities trades and Tobin tax demanding multilateral frameworks to ensure effectiveness and fairness in global financial markets.

Securities Transfer Tax Infographic

libterm.com

libterm.com