Thick capitalization refers to the practice of writing text in all uppercase letters to convey emphasis or urgency. This style can improve visibility and grab attention but may also be perceived as shouting or aggressive in digital communication. Explore the rest of the article to learn how to use thick capitalization effectively without overwhelming your audience.

Table of Comparison

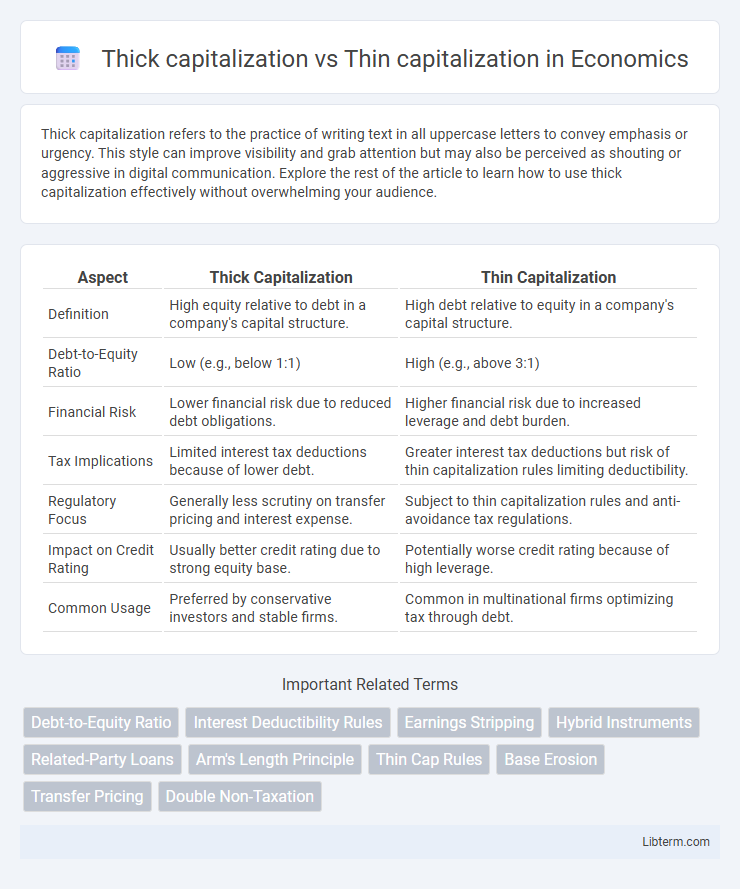

| Aspect | Thick Capitalization | Thin Capitalization |

|---|---|---|

| Definition | High equity relative to debt in a company's capital structure. | High debt relative to equity in a company's capital structure. |

| Debt-to-Equity Ratio | Low (e.g., below 1:1) | High (e.g., above 3:1) |

| Financial Risk | Lower financial risk due to reduced debt obligations. | Higher financial risk due to increased leverage and debt burden. |

| Tax Implications | Limited interest tax deductions because of lower debt. | Greater interest tax deductions but risk of thin capitalization rules limiting deductibility. |

| Regulatory Focus | Generally less scrutiny on transfer pricing and interest expense. | Subject to thin capitalization rules and anti-avoidance tax regulations. |

| Impact on Credit Rating | Usually better credit rating due to strong equity base. | Potentially worse credit rating because of high leverage. |

| Common Usage | Preferred by conservative investors and stable firms. | Common in multinational firms optimizing tax through debt. |

Introduction to Capitalization in Corporate Finance

Capitalization in corporate finance refers to the mix of debt and equity used to fund a company's operations and growth. Thick capitalization indicates a high proportion of equity relative to debt, which reduces financial risk but may limit potential returns. Thin capitalization involves a higher level of debt compared to equity, increasing leverage and potential tax benefits but also raising the risk of insolvency.

Understanding Thick Capitalization

Thick capitalization refers to a company having a high proportion of equity relative to debt in its capital structure, which strengthens financial stability and reduces insolvency risk. This approach increases creditworthiness and may result in lower borrowing costs due to reduced leverage risk. Firms practicing thick capitalization prioritize sustainable growth and long-term investment over short-term tax advantages associated with debt financing.

What is Thin Capitalization?

Thin capitalization occurs when a company is financed through a high level of debt compared to equity, often resulting in excessive interest deductions that reduce taxable income. This financial structure is common in multinational corporations seeking to minimize tax liabilities by leveraging debt in high-tax jurisdictions. Thin capitalization rules are implemented by tax authorities to limit interest expense deductions and prevent tax base erosion.

Key Differences Between Thick and Thin Capitalization

Thick capitalization involves a company having a high proportion of equity relative to debt, while thin capitalization refers to a company being financed primarily through debt rather than equity. Key differences include risk exposure, where thick capitalization lowers financial risk by reducing debt obligations, and thin capitalization increases risk due to higher debt levels. Tax implications also vary, as thin capitalization often attracts stricter regulations to limit excessive interest deductions, impacting a corporation's tax liabilities.

Advantages of Thick Capitalization

Thick capitalization enhances a company's creditworthiness by increasing equity and reducing financial risk, which attracts investors and lowers borrowing costs. It strengthens the balance sheet, improving financial stability and the ability to withstand economic downturns. Higher equity levels also prevent excessive debt accumulation, ensuring long-term solvency and regulatory compliance.

Risks and Challenges of Thin Capitalization

Thin capitalization poses significant risks including increased tax scrutiny and potential disallowance of interest deductions, leading to higher taxable income and unexpected tax liabilities. Multinational corporations face challenges balancing debt and equity to comply with varying international thin capitalization rules designed to prevent profit shifting and tax base erosion. Failure to manage thin capitalization effectively can result in penalties, limited financial flexibility, and reputational damage in global markets.

Impact on Taxation: Thick vs Thin Capitalization

Thick capitalization occurs when a company is funded more by equity than debt, resulting in higher taxable profits due to limited interest expense deductions. Thin capitalization arises when debt exceeds equity, allowing firms to maximize tax deductions through interest payments and reduce taxable income. Tax authorities often impose thin capitalization rules to prevent profit shifting and ensure appropriate taxation by limiting interest expense deductions.

Regulatory Frameworks Governing Capital Structures

Regulatory frameworks governing capital structures impose limits on debt-to-equity ratios to prevent thin capitalization, which occurs when excessive debt undermines a company's financial stability and tax obligations. Thick capitalization, characterized by substantial equity funding relative to debt, typically ensures compliance with capital adequacy requirements set by financial regulators such as Basel III for banks or local corporate laws for non-financial firms. Tax authorities enforce thin capitalization rules to restrict interest deductibility on related-party debt, aligning with transfer pricing regulations and anti-abuse measures to maintain balanced capital structures and fiscal transparency.

Best Practices for Managing Capitalization Ratios

Maintaining an optimal capitalization ratio involves balancing debt and equity to minimize financial risk and maximize tax benefits, with thick capitalization referring to high equity levels and thin capitalization indicating high debt levels. Best practices for managing these ratios include regularly monitoring interest coverage ratios, adhering to regulatory debt-to-equity limits, and structuring debt to optimize tax efficiency without compromising creditworthiness. Companies should implement robust financial policies that align with industry standards and consider transfer pricing rules to avoid thin capitalization penalties.

Conclusion: Choosing the Right Capitalization Strategy

Choosing the right capitalization strategy depends on a company's financial structure, tax implications, and regulatory environment. Thick capitalization, involving higher equity levels, improves creditworthiness and reduces interest expense risks but may dilute ownership control. Thin capitalization maximizes tax benefits through interest deductions but increases debt risk and potential regulatory scrutiny.

Thick capitalization Infographic

libterm.com

libterm.com