Momentum is a fundamental concept in physics describing the quantity of motion an object possesses, calculated as the product of its mass and velocity. Understanding momentum helps explain how objects interact during collisions, conserving total momentum in isolated systems. Explore the rest of the article to learn how momentum impacts everyday phenomena and your practical knowledge of motion.

Table of Comparison

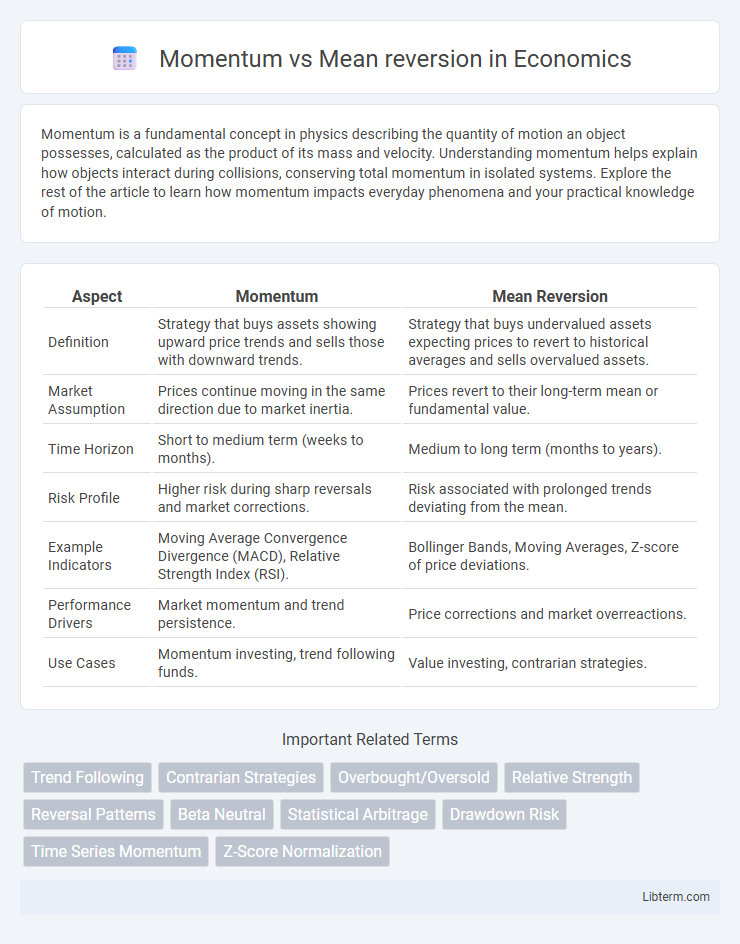

| Aspect | Momentum | Mean Reversion |

|---|---|---|

| Definition | Strategy that buys assets showing upward price trends and sells those with downward trends. | Strategy that buys undervalued assets expecting prices to revert to historical averages and sells overvalued assets. |

| Market Assumption | Prices continue moving in the same direction due to market inertia. | Prices revert to their long-term mean or fundamental value. |

| Time Horizon | Short to medium term (weeks to months). | Medium to long term (months to years). |

| Risk Profile | Higher risk during sharp reversals and market corrections. | Risk associated with prolonged trends deviating from the mean. |

| Example Indicators | Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI). | Bollinger Bands, Moving Averages, Z-score of price deviations. |

| Performance Drivers | Market momentum and trend persistence. | Price corrections and market overreactions. |

| Use Cases | Momentum investing, trend following funds. | Value investing, contrarian strategies. |

Understanding Momentum and Mean Reversion

Momentum trading capitalizes on the continuation of existing price trends, relying on the premise that assets with strong recent performance will maintain their upward trajectory. Mean reversion investing assumes that asset prices will eventually return to their historical averages, identifying opportunities when prices deviate significantly from long-term mean levels. Understanding the fundamental principles behind momentum and mean reversion enables traders to select strategies aligned with market conditions and risk tolerance.

Core Principles of Momentum Investing

Momentum investing relies on the principle that stocks exhibiting strong recent performance will continue to perform well in the near term due to investor behavior and market trends. This strategy captures the persistence of asset price trends driven by factors such as investor herding, underreaction to new information, and reinforcement of price patterns. Momentum investors prioritize assets with upward price momentum, often trading based on relative strength indicators and trend analysis to capitalize on sustained price movements.

Fundamentals of Mean Reversion Strategies

Mean reversion strategies are based on the principle that asset prices tend to revert to their historical average or intrinsic value over time, driven by fundamental factors such as earnings, cash flow, and book value. These strategies utilize statistical metrics like moving averages, Bollinger Bands, and z-scores to identify when prices deviate significantly from their mean, signaling potential buy or sell opportunities. The effectiveness of mean reversion relies on market inefficiencies, behavioral biases, and the assumption that price anomalies caused by temporary shocks will correct as fundamentals reassert themselves.

Key Differences Between Momentum and Mean Reversion

Momentum strategies capitalize on the continuation of existing price trends, assuming that assets with recent gains will keep rising, while mean reversion assumes prices will return to their historical average after deviations. Momentum trading typically involves buying high and selling higher, whereas mean reversion involves buying undervalued assets and selling overvalued ones to exploit price corrections. These key differences affect risk profiles, time horizons, and the choice of technical indicators used for trade execution and portfolio management.

Historical Performance: Momentum vs Mean Reversion

Historical performance shows momentum strategies often outperform mean reversion during strong trending markets, capitalizing on sustained price movements over weeks to months. Mean reversion strategies historically excel in range-bound or sideways markets, profiting from price corrections back to average values over shorter timeframes. Empirical studies reveal momentum yields higher cumulative returns but with greater drawdowns, while mean reversion provides more consistent but lower returns, highlighting distinct risk-reward profiles between the two approaches.

Factors Influencing Each Strategy’s Success

Momentum strategies thrive in trending markets where asset prices exhibit persistent directional moves driven by strong investor sentiment and macroeconomic tailwinds. Mean reversion strategies perform better in range-bound or volatile markets with frequent price corrections influenced by overreactions and liquidity fluctuations. Key factors influencing the success of each include market regime, volatility levels, trading volume, and the time horizon of price movements.

Risk Management in Momentum and Mean Reversion

Risk management in momentum strategies emphasizes controlling drawdowns by setting strict stop-loss orders and dynamically adjusting position sizes based on volatility and trend strength. Mean reversion strategies focus on managing risk by identifying statistical boundaries and exit points to prevent prolonged adverse price movements beyond expected ranges. Both approaches require continuous monitoring of market conditions and adaptive risk controls to optimize returns while minimizing potential losses.

Popular Indicators for Detecting Momentum and Mean Reversion

Popular indicators for detecting momentum include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and rate of change (ROC), which measure the strength and speed of price movements. In contrast, mean reversion strategies often rely on Bollinger Bands and the Stochastic Oscillator to identify overbought or oversold conditions suggesting price reversal. Combining these indicators enhances accuracy in distinguishing between sustained trends and potential reversals in financial markets.

Choosing the Right Approach for Your Portfolio

Selecting the right approach between momentum and mean reversion strategies depends on market conditions and portfolio goals. Momentum strategies capitalize on continuing trends by buying assets showing upward price movement, while mean reversion strategies aim to exploit price corrections by purchasing undervalued securities expected to revert to their historical averages. Investors should analyze volatility patterns, risk tolerance, and time horizons to determine which method aligns best with their investment objectives and market outlook.

Future Trends in Quantitative Investing

Momentum strategies capitalize on the persistence of asset price trends, while mean reversion exploits the tendency of prices to revert to their historical averages. Future trends in quantitative investing emphasize hybrid models integrating machine learning to dynamically switch between momentum and mean reversion signals for enhanced risk-adjusted returns. Advanced alternative data sources and real-time analytics are driving more adaptive, context-aware strategies, improving prediction accuracy and portfolio robustness.

Momentum Infographic

libterm.com

libterm.com