Multiplier theory explains how an initial increase in spending leads to a larger overall rise in national income due to the circulating effects of increased consumption and investment. Understanding this concept helps you grasp the impact of fiscal policies and economic stimuli on growth and employment. Explore the rest of the article to see how multiplier effects shape real-world economic outcomes.

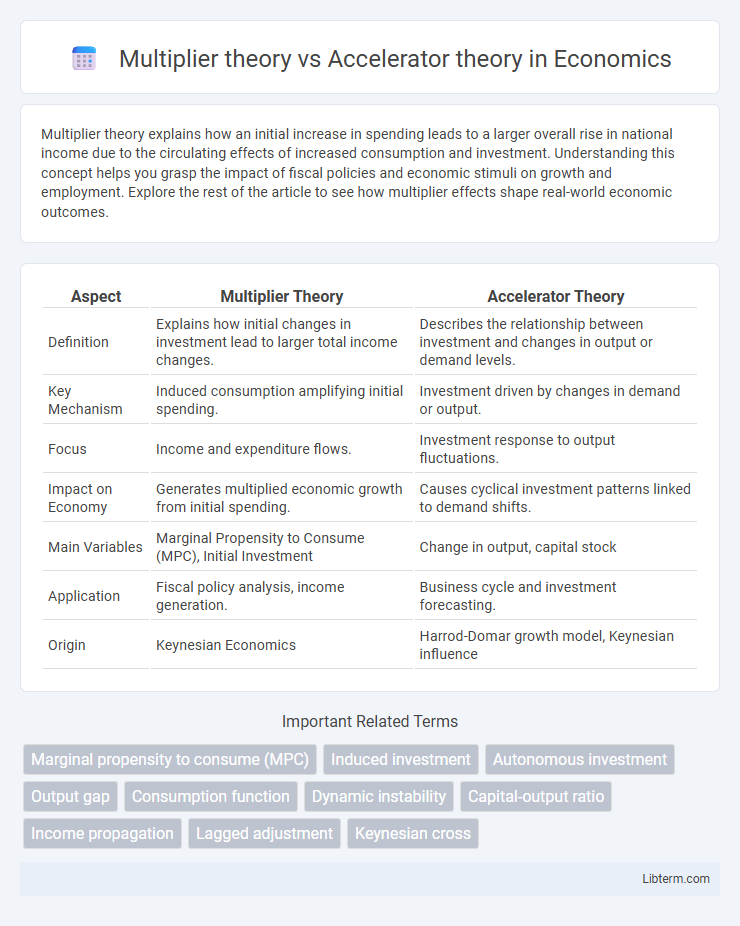

Table of Comparison

| Aspect | Multiplier Theory | Accelerator Theory |

|---|---|---|

| Definition | Explains how initial changes in investment lead to larger total income changes. | Describes the relationship between investment and changes in output or demand levels. |

| Key Mechanism | Induced consumption amplifying initial spending. | Investment driven by changes in demand or output. |

| Focus | Income and expenditure flows. | Investment response to output fluctuations. |

| Impact on Economy | Generates multiplied economic growth from initial spending. | Causes cyclical investment patterns linked to demand shifts. |

| Main Variables | Marginal Propensity to Consume (MPC), Initial Investment | Change in output, capital stock |

| Application | Fiscal policy analysis, income generation. | Business cycle and investment forecasting. |

| Origin | Keynesian Economics | Harrod-Domar growth model, Keynesian influence |

Introduction to Multiplier and Accelerator Theories

Multiplier theory explains how initial investment generates a larger increase in overall income through repeated rounds of spending, emphasizing the role of marginal propensity to consume in expanding economic output. Accelerator theory focuses on the relationship between changes in consumer demand and induced investment, highlighting how fluctuations in demand accelerate capital investment to meet new production requirements. Both theories underscore dynamic interactions between consumption, investment, and economic growth but differ in their emphasis on demand-driven investment mechanisms.

Core Concepts of the Multiplier Theory

Multiplier theory centers on the concept that an initial injection of spending leads to a more than proportional increase in overall economic output due to repeated rounds of consumption and income generation. The core concept involves the marginal propensity to consume (MPC), which determines the size of the multiplier effect by influencing how much of additional income is spent rather than saved. This theory contrasts with the accelerator theory, which emphasizes investment changes triggered by variations in demand rather than recurring consumption patterns.

Fundamental Principles of the Accelerator Theory

The Accelerator Theory is based on the fundamental principle that investment levels are driven by changes in output or demand, emphasizing the relationship between capital formation and increases in consumer demand. This theory posits that a rise in demand for consumer goods requires proportionally greater investment in capital goods to support production capacity, with the accelerator coefficient measuring the sensitivity of investment to output changes. Unlike the Multiplier Theory, which focuses on how initial spending leads to a larger overall increase in income, the Accelerator Theory centers on how investment reacts directly to fluctuations in aggregate demand.

Historical Development of Both Theories

The Multiplier Theory originated in the 1930s, developed by economists like Richard Kahn and John Maynard Keynes to explain how initial changes in investment lead to amplified effects on national income. The Accelerator Theory emerged in the 1950s, credited to economists such as Evsey Domar and Alvin Hansen, emphasizing the impact of changes in output on induced investment levels. Both theories were foundational in shaping Keynesian economics, with the Multiplier focusing on demand-side effects and the Accelerator highlighting investment fluctuations driven by production changes.

Mathematical Formulations and Key Equations

The Multiplier Theory is mathematically expressed by the multiplier formula \( k = \frac{1}{1 - MPC} \), where \( MPC \) is the marginal propensity to consume, indicating how initial changes in investment lead to larger aggregate demand fluctuations. The Accelerator Theory's key equation is \( I_t = v \times (Y_t - Y_{t-1}) \), where \( I_t \) is the investment at time \( t \), \( v \) is the accelerator coefficient, and \( Y_t - Y_{t-1} \) represents the change in national income, emphasizing investment as a function of income growth. Combining both theories often involves integrating the multiplier \( k \) with the accelerator effect \( v \), capturing how induced consumption and income changes jointly drive economic output.

Comparative Analysis: Multiplier vs Accelerator

The Multiplier theory emphasizes the proportional increase in aggregate demand resulting from an initial injection of spending, based on marginal propensity to consume, while the Accelerator theory focuses on investment demand driven by changes in output or income levels. Multiplier effects primarily influence consumption and overall economic expansion, whereas Accelerator effects trigger capital investment as firms respond to rising demand. Combining both theories offers a comprehensive understanding of economic fluctuations, highlighting how consumer behavior and investment dynamics interact to shape growth cycles.

Real-World Applications in Economic Policy

Multiplier theory emphasizes how initial increases in spending lead to amplified overall economic growth through successive rounds of consumption, guiding fiscal stimulus policies to boost aggregate demand during recessions. Accelerator theory focuses on how changes in demand drive investment in capital goods, influencing policies that aim to stimulate business investment by creating favorable economic conditions. Policymakers use multiplier effects to justify government expenditure programs, while accelerator principles help design incentives targeting private sector investment to sustain long-term economic expansion.

Strengths and Limitations of Each Theory

Multiplier theory excels in demonstrating how initial investment boosts aggregate demand by triggering successive rounds of consumption, revealing its strength in explaining short-term economic fluctuations; however, it tends to oversimplify by assuming a constant marginal propensity to consume and ignores supply-side constraints. Accelerator theory effectively links investment decisions to changes in production output and consumer demand, capturing the dynamic relationship between investment and economic growth but often underestimates the role of external factors like interest rates and technological innovation. Both theories offer valuable insights but require integration with broader macroeconomic frameworks to address their individual limitations and enhance predictive accuracy.

Empirical Evidence and Case Studies

Empirical evidence shows that the Multiplier theory is validated in economies with significant fiscal stimulus effects, where government spending induces a more than proportional increase in aggregate demand, as observed in the post-2008 financial crisis recovery in the United States. In contrast, Accelerator theory finds strong support in industrialized economies with volatile investment patterns, exemplified by Japan's rapid industrial expansion in the 1960s, where increases in consumer demand directly triggered substantial rises in capital investment. Case studies reveal that the Multiplier effect is more prominent in service-oriented economies, while the Accelerator effect dominates in manufacturing-heavy regions, emphasizing the role of economic structure in determining the applicability of each theory.

Conclusion: Integrating Multiplier and Accelerator Approaches

Integrating the Multiplier and Accelerator theories provides a comprehensive understanding of economic growth by linking autonomous investment with induced investment responses. The Multiplier theory emphasizes how initial spending boosts overall income, while the Accelerator theory explains how changes in income stimulate additional investments in capital goods. Combining these approaches highlights the cyclical interaction between demand and investment, facilitating more accurate predictions of business cycles and economic fluctuations.

Multiplier theory Infographic

libterm.com

libterm.com