Specific risk refers to the potential for loss resulting from factors unique to a particular company or industry, such as management decisions, product recalls, or regulatory changes. Unlike market risk, which affects all investments, specific risk can be mitigated through diversification across different sectors and assets. Explore the rest of the article to understand how managing specific risk can protect your investment portfolio effectively.

Table of Comparison

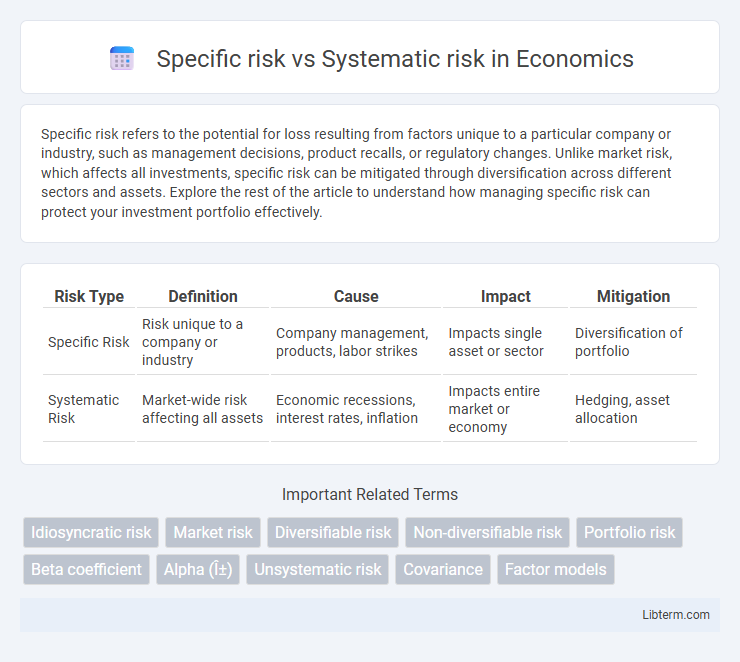

| Risk Type | Definition | Cause | Impact | Mitigation |

|---|---|---|---|---|

| Specific Risk | Risk unique to a company or industry | Company management, products, labor strikes | Impacts single asset or sector | Diversification of portfolio |

| Systematic Risk | Market-wide risk affecting all assets | Economic recessions, interest rates, inflation | Impacts entire market or economy | Hedging, asset allocation |

Understanding Specific Risk: Definition and Examples

Specific risk, also known as unsystematic risk, refers to the potential for loss resulting from factors unique to a particular company or industry, such as management decisions, product recalls, or regulatory changes. Examples include a sudden CEO resignation impacting stock price or a factory shutdown disrupting production. Unlike systematic risk, specific risk can be mitigated through diversification across different asset classes and sectors.

Systematic Risk: Meaning and Key Characteristics

Systematic risk, also known as market risk, refers to the inherent uncertainty affecting the entire market or a broad segment of the economy, driven by factors such as economic recessions, interest rate changes, and geopolitical events. Unlike specific risk, which impacts individual assets or companies, systematic risk cannot be eliminated through diversification and poses a fundamental challenge for investors in portfolio management. Key characteristics include its pervasive nature, correlation with overall market movements, and its influence on asset prices across sectors.

Key Differences Between Specific and Systematic Risk

Specific risk, also known as unsystematic risk, affects a particular company or industry, such as management decisions, product recalls, or labor strikes. Systematic risk, or market risk, impacts the entire market or economy, driven by factors like interest rate changes, inflation, or geopolitical events. Diversification effectively reduces specific risk but cannot eliminate systematic risk, which is inherent to market exposure.

Sources of Specific Risk in Investments

Specific risk in investments arises from factors unique to a particular company or industry, including management decisions, product recalls, regulatory changes, and competitive pressures. Unlike systematic risk, which stems from macroeconomic forces such as interest rate fluctuations or geopolitical events, specific risk is tied to individual asset characteristics. Diversification strategies primarily address specific risk by spreading exposure across multiple securities to mitigate company-specific uncertainties.

Common Causes of Systematic Risk in Markets

Systematic risk in markets arises from macroeconomic factors such as inflation rates, interest rate changes, and political instability that affect the entire financial system. Market-wide events like recessions, natural disasters, and global pandemics also contribute to systematic risk by impacting overall market volatility and investor confidence. Unlike specific risk, which is tied to individual companies or industries, systematic risk cannot be diversified away through portfolio management.

Measuring Specific Risk: Tools and Techniques

Measuring specific risk involves tools such as Value at Risk (VaR), which quantifies potential losses from individual assets or portfolios under normal market conditions. Beta coefficients help isolate systematic risk, allowing analysts to focus on the residual variance attributed to specific factors unique to a company or sector. Techniques like scenario analysis and stress testing further refine the estimation of specific risk by modeling adverse events impacting a single asset's returns independently from market-wide fluctuations.

Assessing Systematic Risk: Popular Indicators

Systematic risk, also known as market risk, affects the entire market and cannot be diversified away, making its assessment crucial for investment decisions. Popular indicators for evaluating systematic risk include Beta, which measures a stock's volatility relative to the overall market, and the VIX index, often referred to as the "fear gauge," reflecting expected market volatility. Other key metrics include interest rate movements, inflation rates, and geopolitical events that influence broad market trends.

Impact of Diversification on Specific Risk

Specific risk, also known as idiosyncratic risk, affects individual assets and can be significantly reduced through diversification by holding a varied portfolio of uncorrelated assets. Systematic risk, or market risk, impacts the entire market and cannot be eliminated by diversification, as it stems from macroeconomic factors like interest rate changes or geopolitical events. Diversification primarily mitigates specific risk, leading to a more stable portfolio return without influencing the inherent exposure to systematic risk.

Hedging Strategies for Systematic Risk Mitigation

Hedging strategies for systematic risk mitigation often involve diversification through asset classes like government bonds, commodities, and international equities to offset market-wide fluctuations. Utilizing derivatives such as options and futures on broad market indices provides effective protection against systematic risk by allowing investors to hedge against market declines. Risk management frameworks emphasize combining these instruments with strategic asset allocation to reduce exposure to macroeconomic and geopolitical factors impacting overall market volatility.

Real-World Cases: Specific vs. Systematic Risk Analysis

The 2008 financial crisis exemplifies systematic risk, as global markets collapsed due to widespread mortgage-backed securities failures, affecting nearly all asset classes. In contrast, the Volkswagen emissions scandal illustrates specific risk, where the company's stock plummeted after internal fraud was revealed, while the broader automotive industry remained relatively stable. Investors mitigate systematic risk through diversification and hedging, whereas specific risk is addressed by thorough company analysis and selective asset allocation.

Specific risk Infographic

libterm.com

libterm.com