The Capital Market Line (CML) represents the risk-return trade-off of efficient portfolios combining a risk-free asset and the market portfolio, serving as a critical tool in modern portfolio theory to optimize investment decisions. It illustrates the highest expected return for a given level of risk, measured by portfolio standard deviation, enabling investors to balance their risk tolerance with potential rewards. Explore the full article to understand how the CML can guide Your investment strategy for improved financial outcomes.

Table of Comparison

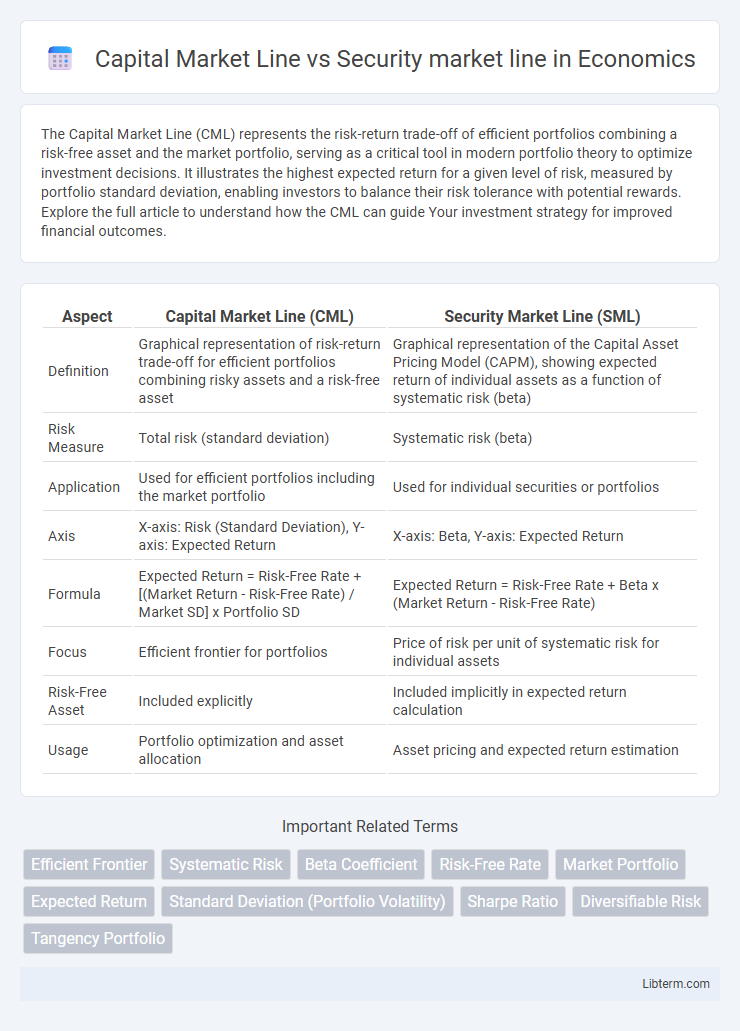

| Aspect | Capital Market Line (CML) | Security Market Line (SML) |

|---|---|---|

| Definition | Graphical representation of risk-return trade-off for efficient portfolios combining risky assets and a risk-free asset | Graphical representation of the Capital Asset Pricing Model (CAPM), showing expected return of individual assets as a function of systematic risk (beta) |

| Risk Measure | Total risk (standard deviation) | Systematic risk (beta) |

| Application | Used for efficient portfolios including the market portfolio | Used for individual securities or portfolios |

| Axis | X-axis: Risk (Standard Deviation), Y-axis: Expected Return | X-axis: Beta, Y-axis: Expected Return |

| Formula | Expected Return = Risk-Free Rate + [(Market Return - Risk-Free Rate) / Market SD] x Portfolio SD | Expected Return = Risk-Free Rate + Beta x (Market Return - Risk-Free Rate) |

| Focus | Efficient frontier for portfolios | Price of risk per unit of systematic risk for individual assets |

| Risk-Free Asset | Included explicitly | Included implicitly in expected return calculation |

| Usage | Portfolio optimization and asset allocation | Asset pricing and expected return estimation |

Introduction to Capital Market Line and Security Market Line

The Capital Market Line (CML) represents the risk-return trade-off for efficient portfolios consisting of a risk-free asset and the market portfolio, illustrating the optimal portfolio combinations in the mean-variance framework. The Security Market Line (SML) depicts the relationship between an individual security's expected return and its systematic risk, measured by beta, based on the Capital Asset Pricing Model (CAPM). While the CML applies to efficient portfolios, the SML is used to evaluate the expected return of any asset relative to market risk.

Overview of Modern Portfolio Theory

The Capital Market Line (CML) represents portfolios that optimally combine risk-free assets and the market portfolio, showing the highest expected return for a given level of risk under Modern Portfolio Theory (MPT). The Security Market Line (SML) depicts the expected return of individual securities based on their systematic risk, measured by beta, in the Capital Asset Pricing Model (CAPM) framework, an extension of MPT. Both lines illustrate risk-return tradeoffs, with CML focusing on efficient portfolios and SML on asset pricing relative to market risk.

Defining the Capital Market Line (CML)

The Capital Market Line (CML) represents the risk-return tradeoff of efficient portfolios that combine the risk-free asset with the market portfolio, depicting expected return as a function of total risk measured by standard deviation. Unlike the Security Market Line (SML), which plots expected return against systematic risk (beta) for individual assets, the CML applies only to efficient portfolios. The slope of the CML, known as the Sharpe ratio, indicates the highest return per unit of total risk achievable in the market.

Defining the Security Market Line (SML)

The Security Market Line (SML) represents the relationship between the expected return of an individual asset and its systematic risk, measured by beta, in the Capital Asset Pricing Model (CAPM). Unlike the Capital Market Line (CML), which plots risk-reward trade-offs for efficient portfolios based on total risk (standard deviation), the SML focuses on assets' systematic risk and expected returns relative to the market portfolio. The SML is essential for identifying whether a security is underpriced or overpriced by comparing its expected return to the return predicted by its beta on the line.

Key Differences Between CML and SML

The Capital Market Line (CML) represents the risk-return trade-off for efficient portfolios combining the risk-free asset and the market portfolio, measured by total risk (standard deviation). The Security Market Line (SML) illustrates the expected return of individual securities based on their systematic risk, represented by beta, according to the Capital Asset Pricing Model (CAPM). Key differences include CML applying to efficient portfolios with total risk, while SML applies to all assets based on systematic risk, and CML uses standard deviation as risk measure whereas SML uses beta.

Mathematical Formulas of CML and SML

The Capital Market Line (CML) equation is expressed as \( E(R_p) = R_f + \frac{E(R_m) - R_f}{\sigma_m} \sigma_p \), where \( E(R_p) \) denotes the expected return of the portfolio, \( R_f \) the risk-free rate, \( E(R_m) \) the expected return of the market portfolio, \( \sigma_m \) the standard deviation of the market portfolio, and \( \sigma_p \) the standard deviation of the portfolio. The Security Market Line (SML) formula is given by \( E(R_i) = R_f + \beta_i (E(R_m) - R_f) \), where \( E(R_i) \) represents the expected return of asset \( i \), and \( \beta_i \) is the asset's beta coefficient measuring its sensitivity to market risk. The CML relates expected portfolio returns to total risk (standard deviation), while the SML links expected asset returns to systematic risk (beta), highlighting their fundamental differences in risk measurement and application.

Interpretation of Risk and Return in CML vs SML

The Capital Market Line (CML) represents the risk-return tradeoff for efficient portfolios combining the risk-free asset and the market portfolio, measuring total risk through standard deviation. In contrast, the Security Market Line (SML) depicts expected returns of individual assets based on their systematic risk measured by beta, reflecting sensitivity to market movements. While CML applies to diversified portfolios emphasizing total risk, SML focuses on individual security risk premiums derived from market risk exposure.

Real-World Applications of CML and SML

The Capital Market Line (CML) models the risk-return tradeoff for efficient portfolios combining a risk-free asset with the market portfolio, guiding investors in optimal asset allocation to maximize returns for a given risk level. The Security Market Line (SML) represents the expected return of individual securities based on their systematic risk (beta), helping analysts evaluate whether a stock is undervalued or overvalued relative to market expectations. In real-world applications, portfolio managers use the CML to construct diversified portfolios aligned with investor risk preferences, while the SML serves as a foundational tool in equity valuation and performance assessment within asset pricing models like CAPM.

Limitations and Assumptions of CML and SML

The Capital Market Line (CML) assumes investors can borrow and lend at a risk-free rate and that all investors hold efficient portfolios, which limits its applicability in real markets with borrowing constraints and taxes. The Security Market Line (SML) relies on the assumption that systematic risk, measured by beta, fully explains expected returns, overlooking factors like liquidity and market anomalies. Both models assume market efficiency and rational investor behavior, but their limitations arise from simplified assumptions and the exclusion of real-world frictions.

Conclusion: Choosing Between CML and SML

Capital Market Line (CML) represents the risk-return trade-off for efficient portfolios combining the risk-free asset and market portfolio, while Security Market Line (SML) illustrates expected returns for individual assets based on systematic risk (beta). Select CML when analyzing portfolios to optimize diversification benefits and risk-adjusted returns; employ SML for assessing if an individual asset or security is fairly priced relative to its market risk exposure. The choice depends on whether the focus is on portfolio construction (CML) or asset pricing and performance evaluation (SML).

Capital Market Line Infographic

libterm.com

libterm.com