The quantity of money in an economy influences inflation rates, interest levels, and overall economic growth by controlling purchasing power. Central banks regulate this through monetary policy tools to maintain price stability and support sustainable development. Explore the rest of the article to understand how the money supply impacts your financial well-being.

Table of Comparison

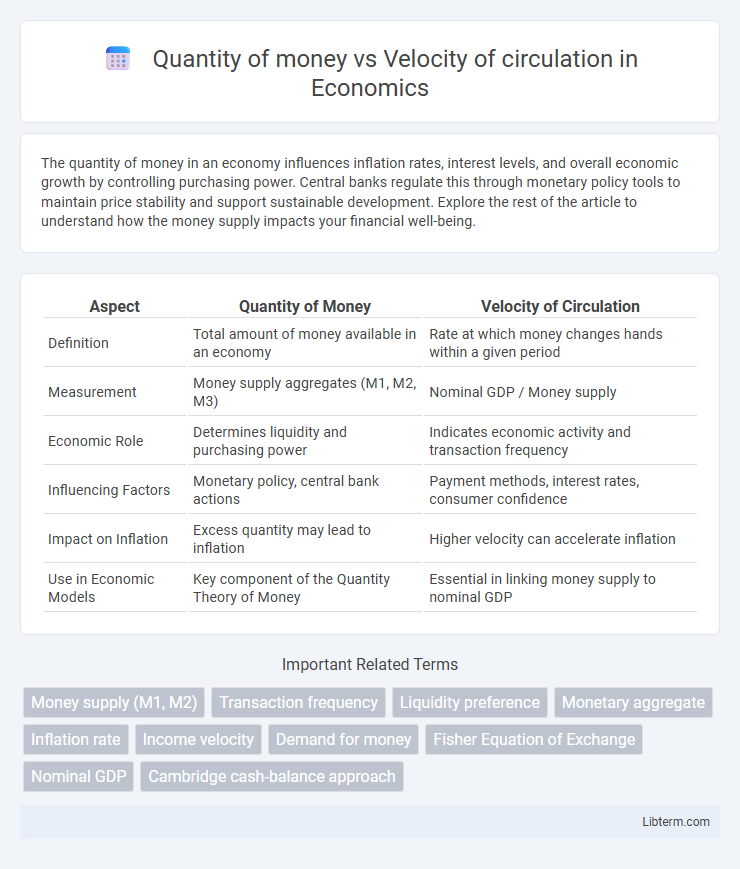

| Aspect | Quantity of Money | Velocity of Circulation |

|---|---|---|

| Definition | Total amount of money available in an economy | Rate at which money changes hands within a given period |

| Measurement | Money supply aggregates (M1, M2, M3) | Nominal GDP / Money supply |

| Economic Role | Determines liquidity and purchasing power | Indicates economic activity and transaction frequency |

| Influencing Factors | Monetary policy, central bank actions | Payment methods, interest rates, consumer confidence |

| Impact on Inflation | Excess quantity may lead to inflation | Higher velocity can accelerate inflation |

| Use in Economic Models | Key component of the Quantity Theory of Money | Essential in linking money supply to nominal GDP |

Introduction to Money Supply and Velocity

The quantity of money refers to the total amount of monetary assets available in an economy at a specific time, while velocity of circulation measures how frequently money changes hands within a defined period. Money supply consists primarily of cash, checking deposits, and easily accessible funds, influencing overall economic activity and price levels. Velocity plays a critical role in determining the real value of money flow, as higher velocity indicates faster transactions and greater economic turnover.

Defining Quantity of Money

Quantity of money refers to the total amount of monetary assets available in an economy at a specific time, encompassing cash, coins, and demand deposits. This measure is crucial for understanding economic activity because it serves as a core component in the equation of exchange: MV = PQ, where M represents quantity of money, V is velocity of circulation, P is price level, and Q is output. Changes in the quantity of money can influence inflation, interest rates, and overall economic growth, making it a key variable for monetary policy decisions.

Understanding Velocity of Circulation

Velocity of circulation measures how quickly money exchanges hands within an economy over a specific period, indicating the effectiveness of money in facilitating transactions. A higher velocity suggests increased economic activity as each unit of currency is used more frequently, while a lower velocity points to money being held rather than spent. Understanding velocity helps economists assess liquidity demand and predict inflationary pressures linked to changes in the money supply.

The Relationship Between Money Supply and Velocity

The relationship between money supply and velocity of circulation highlights how changes in the quantity of money impact the frequency at which money is used for transactions within an economy. When the money supply increases, velocity often decreases as individuals and businesses hold onto additional cash rather than spending it immediately, reducing turnover speed. Conversely, a stable or shrinking money supply typically correlates with higher velocity, as limited funds circulate more rapidly to support economic activity.

The Quantity Theory of Money Explained

The Quantity Theory of Money explains the relationship between money supply and the velocity of circulation, stating that the product of money supply (M) and velocity (V) equals the nominal GDP (P x T). This theory suggests that if the velocity of money remains constant, changes in the money supply directly impact price levels and economic output. Central banks monitor money supply growth carefully to control inflation, assuming velocity fluctuations are predictable or stable.

Factors Influencing Velocity of Circulation

Velocity of circulation depends on the frequency with which money changes hands within a given period, influenced by factors such as payment technologies, consumer confidence, and interest rates. Digital payment systems and technological advancements typically increase velocity by enabling faster transactions, while higher consumer confidence leads to more frequent spending rather than saving. Interest rates affect the opportunity cost of holding money; higher rates incentivize spending or investment, thereby accelerating the velocity of circulation.

Economic Impacts of Changes in Money Supply

Changes in the quantity of money directly influence inflation rates and aggregate demand, affecting overall economic growth. When the money supply expands rapidly, velocity of circulation may decline if consumers and businesses hold onto cash due to uncertainty, dampening the intended stimulative effect. Conversely, a stable or increasing velocity amplifies the impact of money supply changes, accelerating economic activity and price level adjustments.

Velocity Fluctuations During Economic Cycles

Velocity of circulation fluctuates significantly during economic cycles, often accelerating in periods of economic expansion due to increased consumer spending and business investment. During recessions, velocity typically declines as liquidity preference rises and transactions slow down, reducing the frequency money changes hands. These fluctuations in velocity impact the effectiveness of monetary policy and can amplify or dampen changes in the overall money supply.

Policy Implications for Central Banks

Central banks must carefully balance the quantity of money supply with the velocity of circulation to maintain price stability and control inflation. An increase in money supply without a corresponding rise in velocity can lead to excess liquidity and inflationary pressures, whereas a decrease in velocity may signal reduced economic activity, requiring monetary stimulus. Understanding the interaction between these variables is crucial for optimizing interest rate policies and quantitative easing measures to support sustainable economic growth.

Conclusion: Balancing Money Quantity and Circulation Velocity

Effective economic management requires balancing the quantity of money with its velocity of circulation to maintain stable inflation and promote growth. Excessive money supply without corresponding velocity can lead to stagnation, while high velocity with limited supply risks inflationary pressure. Policymakers must monitor both factors, adjusting monetary policies to sustain equilibrium for optimal economic performance.

Quantity of money Infographic

libterm.com

libterm.com