Marginal cost represents the increase in total cost that arises from producing one additional unit of a good or service, playing a crucial role in decision-making for businesses aiming to maximize profits. Understanding marginal cost helps you optimize production levels by comparing it with marginal revenue to ensure efficient resource allocation. Explore the rest of this article to learn how marginal cost influences pricing strategies and economic efficiency.

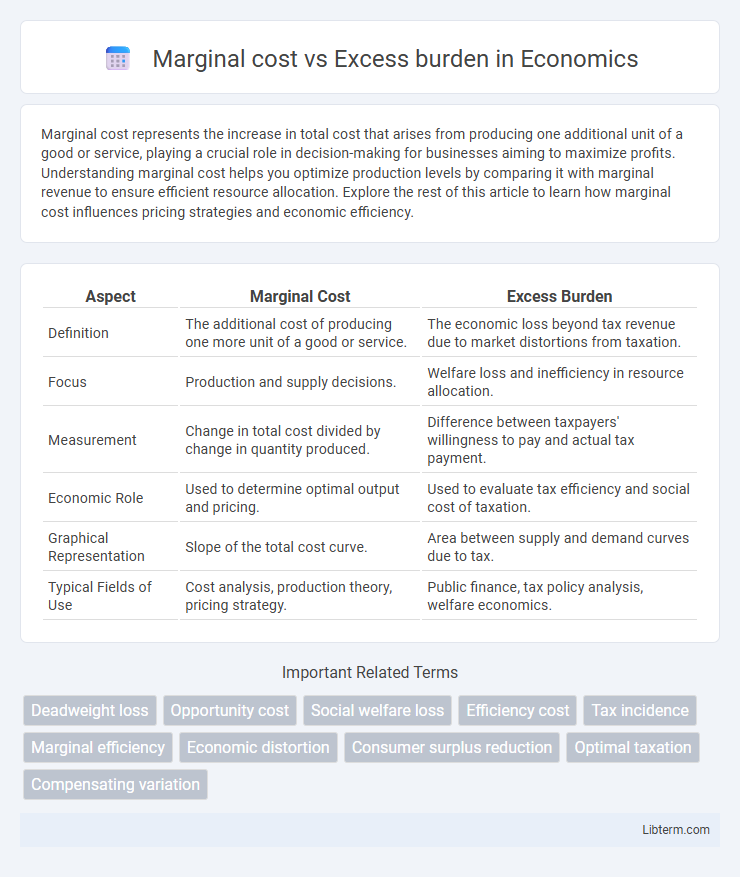

Table of Comparison

| Aspect | Marginal Cost | Excess Burden |

|---|---|---|

| Definition | The additional cost of producing one more unit of a good or service. | The economic loss beyond tax revenue due to market distortions from taxation. |

| Focus | Production and supply decisions. | Welfare loss and inefficiency in resource allocation. |

| Measurement | Change in total cost divided by change in quantity produced. | Difference between taxpayers' willingness to pay and actual tax payment. |

| Economic Role | Used to determine optimal output and pricing. | Used to evaluate tax efficiency and social cost of taxation. |

| Graphical Representation | Slope of the total cost curve. | Area between supply and demand curves due to tax. |

| Typical Fields of Use | Cost analysis, production theory, pricing strategy. | Public finance, tax policy analysis, welfare economics. |

Understanding Marginal Cost: Definition and Importance

Marginal cost represents the additional expense incurred from producing one more unit of a good or service, playing a critical role in pricing and production decisions. Understanding marginal cost is essential for businesses to optimize resource allocation and maximize profit by identifying the point where cost equals revenue from the last unit produced. It also informs economic efficiency by highlighting the cost impact of incremental output changes, contrasting with excess burden which measures welfare loss from taxation beyond its revenue.

What is Excess Burden in Economics?

Excess burden in economics refers to the loss of economic efficiency that occurs when market distortions, such as taxes or subsidies, cause consumers and producers to alter their behavior, leading to a reduction in total welfare beyond the actual revenue raised. It measures the cost to society over and above the tax revenue collected, highlighting the difference between the marginal cost of raising funds through taxation and the social cost imposed by changes in consumption and production patterns. Understanding excess burden is crucial for designing tax policies that minimize economic inefficiencies while achieving fiscal objectives.

Key Differences Between Marginal Cost and Excess Burden

Marginal cost measures the additional expense incurred from producing one more unit of a good, reflecting direct production costs, while excess burden represents the economic inefficiency or welfare loss caused by taxation or market distortions beyond the actual tax revenue collected. Marginal cost focuses on cost increments related to output changes, whereas excess burden captures the broader social cost of interventions affecting market equilibrium. Understanding these distinctions is essential for evaluating tax policies and their impact on economic efficiency and resource allocation.

The Role of Marginal Cost in Resource Allocation

Marginal cost plays a critical role in resource allocation by indicating the additional cost incurred from producing one more unit of a good or service, guiding firms to optimize output where marginal cost equals marginal revenue. In contrast, excess burden represents the efficiency loss or welfare cost caused by taxation or distortionary policies that push production away from the socially optimal level. Understanding marginal cost enables policymakers to minimize excess burden by designing taxes and regulations that align marginal incentives with efficient resource allocation in markets.

How Excess Burden Affects Economic Efficiency

Excess burden represents the economic loss beyond the tax revenue generated, arising from distortions in consumer and producer behavior caused by taxes. It reduces economic efficiency by discouraging productive activities and resource allocation, leading to a welfare loss that exceeds the marginal cost of raising additional funds. Understanding this interplay is crucial for designing tax policies that minimize distortions and promote optimal resource use.

Marginal Cost Analysis in Policy Decision-Making

Marginal cost analysis in policy decision-making quantifies the additional cost incurred from producing one more unit of a good or service, essential for optimizing resource allocation. This approach contrasts with excess burden, which measures the economic inefficiency or welfare loss caused by taxation or distortionary policies exceeding the actual tax revenue collected. Understanding marginal costs allows policymakers to design interventions minimizing excess burden, thereby achieving efficient economic outcomes and maximizing social welfare.

Measuring Excess Burden: Common Approaches

Measuring excess burden involves assessing the efficiency loss caused by taxation beyond the actual revenue collected, often using marginal cost of public funds as a key indicator. Common approaches include calculating deadweight loss through changes in consumer and producer surplus, and employing excess burden-to-tax revenue ratios to quantify distortions in economic behavior. Empirical models frequently utilize price elasticity of supply and demand to estimate how taxes distort market equilibrium and create welfare losses.

Real-World Examples: Marginal Cost vs Excess Burden

Marginal cost represents the additional expense incurred to produce one more unit of a good, while excess burden refers to the economic loss due to market distortions such as taxation beyond the actual tax revenue collected. For example, in labor taxation, the marginal cost is the wage paid to an additional employee, but high taxes create an excess burden by discouraging work and reducing overall productivity. Similarly, in environmental policy, the marginal cost of reducing one more ton of pollution may be low, but excessive regulatory taxes can cause an excess burden by negatively impacting businesses and economic efficiency.

Strategies to Minimize Excess Burden in Taxation

Strategies to minimize excess burden in taxation target reducing the economic inefficiencies caused by tax distortions, such as implementing low marginal tax rates on labor and capital to sustain incentives for productivity and investment. Using broad-based taxes with fewer exemptions limits behavioral changes that increase excess burden, while shifting towards consumption taxes like value-added tax (VAT) can reduce distortions in savings and labor supply. Tax policy designs that incorporate marginal cost pricing ensure that taxes do not exceed the marginal social cost of public funds, thereby optimizing revenue without disproportionately discouraging economic activity.

Implications for Government and Business

Marginal cost represents the additional expense incurred from producing one more unit of a good, critical for government decisions on taxation policies to avoid inefficiencies, while excess burden reflects the economic loss due to tax-induced market distortions. Governments must balance tax rates to minimize the excess burden, ensuring that marginal costs do not outweigh revenue benefits, which can affect public service funding and economic growth. Businesses face increased operational costs under higher marginal taxes, potentially leading to reduced investment and output, thereby influencing market competitiveness and resource allocation.

Marginal cost Infographic

libterm.com

libterm.com