Monetarism emphasizes the role of governments in controlling the amount of money in circulation as a primary method for regulating economic activity and inflation. It advocates for steady, predictable growth in the money supply rather than frequent intervention. Explore the rest of this article to understand how monetarism influences economic policies and affects your financial environment.

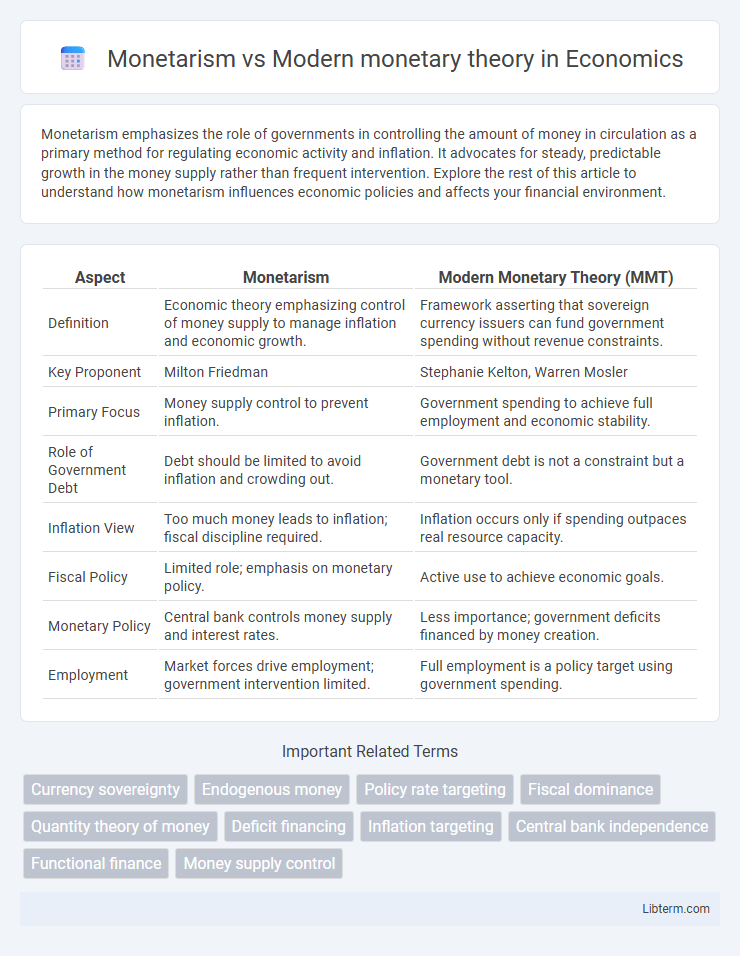

Table of Comparison

| Aspect | Monetarism | Modern Monetary Theory (MMT) |

|---|---|---|

| Definition | Economic theory emphasizing control of money supply to manage inflation and economic growth. | Framework asserting that sovereign currency issuers can fund government spending without revenue constraints. |

| Key Proponent | Milton Friedman | Stephanie Kelton, Warren Mosler |

| Primary Focus | Money supply control to prevent inflation. | Government spending to achieve full employment and economic stability. |

| Role of Government Debt | Debt should be limited to avoid inflation and crowding out. | Government debt is not a constraint but a monetary tool. |

| Inflation View | Too much money leads to inflation; fiscal discipline required. | Inflation occurs only if spending outpaces real resource capacity. |

| Fiscal Policy | Limited role; emphasis on monetary policy. | Active use to achieve economic goals. |

| Monetary Policy | Central bank controls money supply and interest rates. | Less importance; government deficits financed by money creation. |

| Employment | Market forces drive employment; government intervention limited. | Full employment is a policy target using government spending. |

Understanding Monetarism: Core Principles

Monetarism centers on the principle that controlling the money supply is the most effective way to regulate economic stability and inflation, emphasizing a fixed rate of money supply growth aligned with real GDP. The theory, championed by economist Milton Friedman, argues that excessive monetary expansion leads to inflation while limited growth restrains economic output. Monetarism advocates for predictable, rule-based monetary policies to avoid the destabilizing effects of discretionary fiscal interventions.

Key Tenets of Modern Monetary Theory

Modern Monetary Theory (MMT) asserts that sovereign governments controlling their own fiat currency can never run out of money in the same way businesses or households do, emphasizing that such governments fund spending by creating money rather than relying on taxes or borrowing. It highlights the use of fiscal policy, especially government spending and taxation, to manage economic demand, control inflation, and achieve full employment, diverging from Monetarism's focus on controlling the money supply to manage inflation and economic growth. MMT also posits that inflation, not solvency, is the primary constraint on government spending, advocating for strategic taxation to balance demand and avoid inflationary pressures.

Historical Evolution of Monetary Policy Frameworks

Monetarism, championed by Milton Friedman in the 1960s, emphasized controlling money supply to manage inflation and stabilize the economy, shaping monetary policy frameworks for decades. Modern Monetary Theory (MMT), emerging in the late 20th and early 21st centuries, challenges traditional views by prioritizing government fiscal capacity over money supply constraints, influencing contemporary debates on deficit spending and unemployment. The historical evolution of monetary policy reflects a shift from strict money supply targets toward flexible, policy-mix approaches integrating fiscal and monetary tools.

Central Bank Roles: Monetarist vs MMT Perspectives

Monetarism emphasizes the central bank's role in controlling inflation by regulating the money supply, advocating for predictable and limited growth to maintain price stability. Modern Monetary Theory (MMT) views the central bank as a facilitator of government spending through currency issuance, prioritizing full employment and economic growth over inflation control. While monetarists stress monetary policy as a tool to curb inflation, MMT proponents highlight fiscal policy's coordination with central banking to achieve macroeconomic objectives.

Inflation Control: Contrasting Approaches

Monetarism emphasizes controlling inflation through strict regulation of money supply growth, advocating for predictable and steady increases to avoid demand-pull inflation. Modern Monetary Theory (MMT) argues that inflation control relies more on managing real resources and fiscal policy rather than money supply limits, suggesting government spending should be adjusted according to the economy's productive capacity. Monetarists prioritize monetary policy tools like interest rate adjustments, while MMT proponents focus on taxation and public investment to balance inflation risks.

Fiscal Policy in Monetarism and MMT

Fiscal policy in Monetarism emphasizes controlling government spending and taxation to manage inflation and stabilize economic growth, advocating for limited fiscal intervention alongside a predictable monetary supply growth. In contrast, Modern Monetary Theory supports expansive fiscal policy, suggesting governments with sovereign currencies can finance deficits through money creation without immediate inflation risks, prioritizing full employment and public investment. Monetarists view fiscal discipline as crucial for long-term stability, whereas MMT treats fiscal policy as a primary tool for achieving macroeconomic goals beyond traditional budget constraints.

Unemployment and Economic Stability

Monetarism emphasizes controlling the money supply to manage unemployment and maintain economic stability, arguing that inflation results from excessive growth in money supply and that unemployment is minimized when the economy operates at its natural rate. Modern Monetary Theory (MMT) posits that a sovereign currency issuer can use fiscal policy to achieve full employment by adjusting government spending without fearing budget deficits, asserting that economic stability is ensured through targeted resource utilization rather than monetary constraints. Empirical data suggest Monetarism supports limited government intervention to prevent inflation-driven unemployment spikes, while MMT advocates a proactive fiscal approach to eliminate cyclical unemployment and stabilize output.

Critics and Controversies Surrounding Monetarism

Critics of Monetarism argue its strict emphasis on controlling money supply as a tool for managing inflation oversimplifies complex economic dynamics and overlooks fiscal policy's role. Controversies include Monetarism's failure to address stagflation adequately during the 1970s and its assumption of predictable velocity of money, which often proves unstable in practice. Modern Monetary Theory challenges monetarist views by advocating for flexible fiscal spending backed by sovereign currency issuance, sparking debate over inflation risks and government debt sustainability.

Debates and Criticisms of Modern Monetary Theory

Modern Monetary Theory (MMT) faces criticism for its assertion that governments with sovereign currencies can finance large deficits without inflation risks, challenging traditional Monetarism's emphasis on controlling money supply to manage inflation. Monetarists argue that MMT underestimates the inflationary consequences of excessive government spending and dismisses the role of central bank independence. Debates focus on whether MMT's approach to fiscal policy undermines monetary discipline and the credibility of inflation targets.

Policy Implications: Future of Monetary Economics

Monetarism emphasizes controlling money supply growth to manage inflation and stabilize the economy, advocating for fixed rules and limited government intervention. Modern Monetary Theory (MMT) supports expansive fiscal policies financed by sovereign currency issuance, prioritizing full employment and social welfare over inflation targeting. The future of monetary economics may involve integrating Monetarist discipline with MMT's flexible fiscal tools to balance inflation control and economic growth sustainably.

Monetarism Infographic

libterm.com

libterm.com