Cryptocurrency is a digital asset designed for secure and decentralized transactions using blockchain technology. It offers increased privacy, reduced transaction fees, and the potential for high returns on investment. Explore the rest of the article to discover how cryptocurrency can impact your financial future.

Table of Comparison

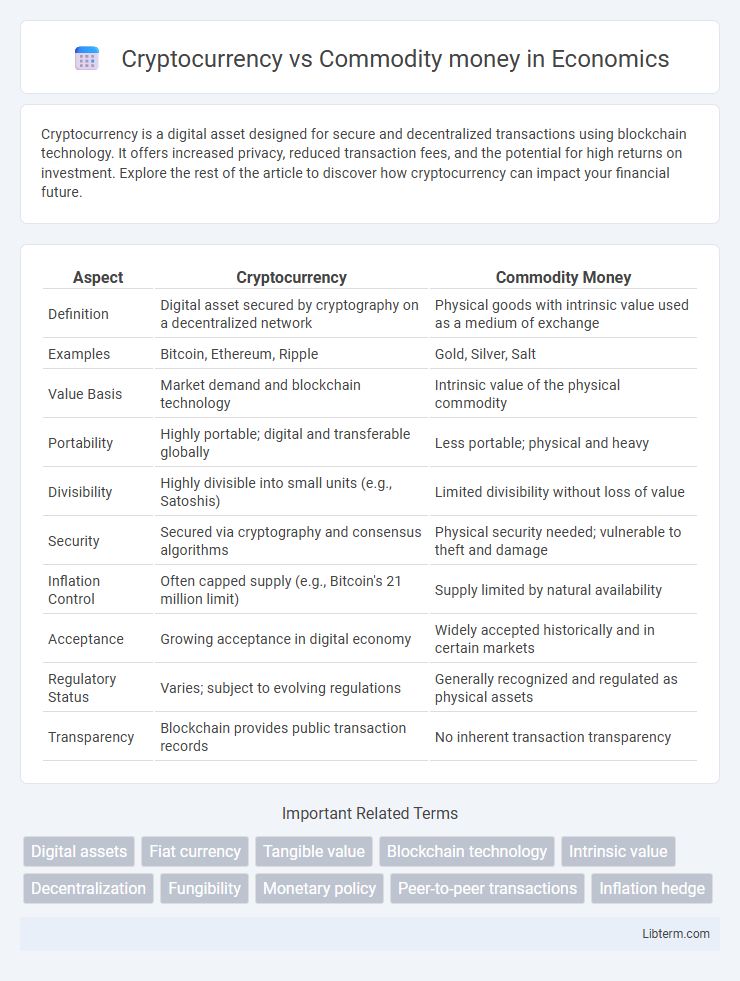

| Aspect | Cryptocurrency | Commodity Money |

|---|---|---|

| Definition | Digital asset secured by cryptography on a decentralized network | Physical goods with intrinsic value used as a medium of exchange |

| Examples | Bitcoin, Ethereum, Ripple | Gold, Silver, Salt |

| Value Basis | Market demand and blockchain technology | Intrinsic value of the physical commodity |

| Portability | Highly portable; digital and transferable globally | Less portable; physical and heavy |

| Divisibility | Highly divisible into small units (e.g., Satoshis) | Limited divisibility without loss of value |

| Security | Secured via cryptography and consensus algorithms | Physical security needed; vulnerable to theft and damage |

| Inflation Control | Often capped supply (e.g., Bitcoin's 21 million limit) | Supply limited by natural availability |

| Acceptance | Growing acceptance in digital economy | Widely accepted historically and in certain markets |

| Regulatory Status | Varies; subject to evolving regulations | Generally recognized and regulated as physical assets |

| Transparency | Blockchain provides public transaction records | No inherent transaction transparency |

Introduction to Cryptocurrency and Commodity Money

Cryptocurrency represents a form of digital or virtual currency secured by cryptography, enabling decentralized transactions on blockchain networks without the need for intermediaries. Commodity money, historically exemplified by items like gold, silver, and other precious metals, holds intrinsic value based on its physical properties and widespread acceptance as a medium of exchange. While cryptocurrency relies on technological innovation and cryptographic protocols to ensure security and trust, commodity money derives value from tangible assets that have been used for trade and store of value across cultures and centuries.

Historical Evolution of Money Systems

Commodity money, such as gold and silver, dominated early monetary systems due to intrinsic value and widespread acceptance in ancient civilizations. The transition to cryptocurrency represents a shift towards digital, decentralized currencies built on blockchain technology, beginning with the creation of Bitcoin in 2009. This evolution highlights the movement from tangible assets to cryptographic proof and peer-to-peer transactions, redefining the concept of money in the modern economy.

Defining Cryptocurrency: Digital Assets Explained

Cryptocurrency represents digital assets secured by cryptography, enabling decentralized transactions recorded on blockchain technology. Unlike commodity money, which derives intrinsic value from physical goods like gold or silver, cryptocurrencies possess value primarily through network trust and scarcity mechanisms such as limited supply protocols. Key examples include Bitcoin and Ethereum, which function as both digital currencies and programmable assets within decentralized finance ecosystems.

Understanding Commodity Money: Value Through Physical Goods

Commodity money derives its value from the intrinsic worth of physical goods such as gold, silver, or other precious metals, which have historically been used as a medium of exchange and store of value. Unlike cryptocurrency, which holds value through decentralized digital consensus and cryptographic principles, commodity money's value is tangible and directly linked to the physical item itself. This tangible nature provides inherent stability but limits flexibility compared to the digital, borderless nature of cryptocurrencies.

Key Differences: Tangibility, Supply, and Backing

Cryptocurrency is digital and intangible, relying on blockchain technology, whereas commodity money has physical tangibility such as gold or silver. Cryptocurrency supply is typically capped by algorithmic protocols, ensuring scarcity, while commodity money supply depends on the availability of the physical resource. Unlike commodity money backed by intrinsic value or government decree, cryptocurrencies derive value from decentralized consensus and network security.

Security and Trust Factors in Transactions

Cryptocurrency utilizes blockchain technology to ensure transaction security through decentralized verification and cryptographic encryption, reducing the risk of fraud and double-spending. Commodity money, such as gold or silver, relies on physical possession and government backing to establish trust, making it vulnerable to counterfeit and theft but historically recognized for intrinsic value. Trust in cryptocurrency depends on network consensus and technological robustness, whereas commodity money's trust derives from tangible assets and regulatory authority.

Volatility and Stability: Comparing Value Fluctuations

Cryptocurrency exhibits high volatility driven by speculative trading and regulatory uncertainties, resulting in rapid value fluctuations that challenge its use as a stable medium of exchange. Commodity money, such as gold or silver, maintains relative stability due to intrinsic value and historical acceptance, providing a more consistent store of value over time. Investors seeking long-term security often prefer commodity money to avoid the unpredictable price swings characteristic of cryptocurrencies.

Adoption and Usability: Practical Applications

Cryptocurrency adoption has surged due to its digital nature, enabling instant cross-border transactions and decentralized finance applications, while commodity money relies on physical exchange and intrinsic value, limiting scalability and global usability. Cryptocurrencies facilitate smart contracts and programmable money, broadening use cases in industries like supply chain and gaming, unlike commodity money, which primarily serves as a store of value and medium of exchange. Practical adoption challenges remain for cryptocurrencies, including regulatory uncertainty and volatility, whereas commodity money's established historical trust supports everyday transactions and wealth preservation.

Regulatory and Legal Perspectives

Cryptocurrency faces evolving regulatory challenges due to its decentralized nature, with agencies such as the SEC and CFTC in the United States seeking to classify and oversee digital assets under securities and commodity laws. Commodity money, like gold and silver, benefits from established legal frameworks and historical precedents that simplify regulatory compliance and valuation standards. Legal perspectives on cryptocurrencies emphasize anti-money laundering (AML) and know-your-customer (KYC) requirements, while commodity money is primarily governed by tangible asset regulations and traditional market stability measures.

Future Outlook: Cryptocurrency vs Commodity Money

The future outlook of cryptocurrency compared to commodity money highlights significant technological advancements and increased adoption of digital assets, positioning cryptocurrencies as viable alternatives for global transactions and investment. Commodity money, traditionally valued for its intrinsic physical properties such as gold or silver, faces challenges from digital currencies that offer enhanced liquidity, security through blockchain technology, and programmability features. Market forecasts predict growing integration of cryptocurrencies into financial systems, while commodity money retains its role as a stable store of value during economic uncertainties.

Cryptocurrency Infographic

libterm.com

libterm.com