Pigovian taxation imposes a tax on activities that generate negative externalities, such as pollution, to correct market inefficiencies and reflect the true social cost of those activities. By incentivizing producers and consumers to reduce harmful behavior, this tax promotes more sustainable economic decisions. Explore the rest of the article to understand how Pigovian taxes can effectively balance economic growth with environmental responsibility.

Table of Comparison

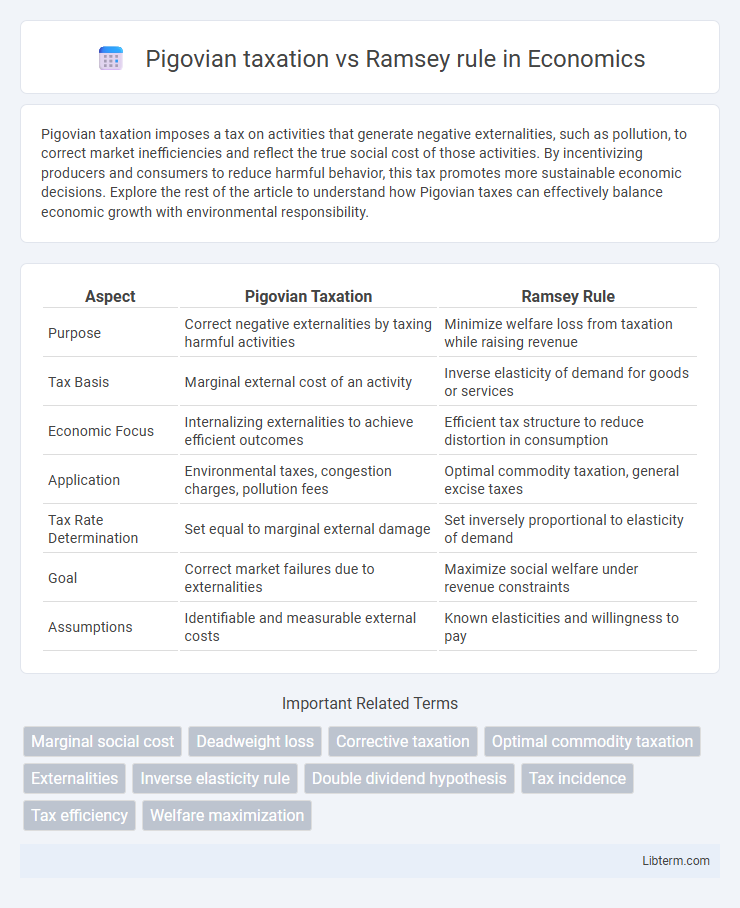

| Aspect | Pigovian Taxation | Ramsey Rule |

|---|---|---|

| Purpose | Correct negative externalities by taxing harmful activities | Minimize welfare loss from taxation while raising revenue |

| Tax Basis | Marginal external cost of an activity | Inverse elasticity of demand for goods or services |

| Economic Focus | Internalizing externalities to achieve efficient outcomes | Efficient tax structure to reduce distortion in consumption |

| Application | Environmental taxes, congestion charges, pollution fees | Optimal commodity taxation, general excise taxes |

| Tax Rate Determination | Set equal to marginal external damage | Set inversely proportional to elasticity of demand |

| Goal | Correct market failures due to externalities | Maximize social welfare under revenue constraints |

| Assumptions | Identifiable and measurable external costs | Known elasticities and willingness to pay |

Introduction to Pigovian Taxation and Ramsey Rule

Pigovian taxation targets negative externalities by imposing taxes equal to the social cost of harmful activities, thereby correcting market inefficiencies and encouraging socially optimal behavior. The Ramsey rule, in contrast, focuses on minimizing welfare losses when raising revenue through distortionary taxes by setting tax rates inversely proportional to the elasticity of demand or supply for taxed goods. Both principles guide optimal taxation but emphasize distinct objectives: Pigovian taxes aim to internalize external costs, while the Ramsey rule strives to balance efficiency with revenue needs.

Theoretical Foundations of Pigovian Taxes

Pigovian taxation is grounded in the theory of externalities, aiming to correct market failures by imposing taxes equal to the marginal social cost of negative externalities, thereby internalizing external costs and improving allocative efficiency. The fundamental principle, established by economist Arthur Pigou, suggests that taxes levied on activities generating harmful spillover effects align private incentives with social welfare. In contrast to the Ramsey rule, which focuses on minimizing distortionary taxation to optimize revenue, Pigovian taxes directly target externality correction for environmental and public health policy applications.

Understanding the Ramsey Rule in Taxation

The Ramsey Rule in taxation aims to minimize the overall efficiency loss by setting tax rates inversely proportional to the elasticity of demand for each good, thereby reducing the distortion in consumer behavior. Unlike Pigovian taxation, which targets externalities through corrective taxes equal to the social cost of the externality, the Ramsey Rule addresses optimal revenue generation while limiting economic inefficiencies. This approach supports efficient tax design by balancing equity and efficiency in the allocation of resources within an economy.

Objectives and Policy Goals Compared

Pigovian taxation aims to correct negative externalities by imposing taxes equal to the social cost of the external harm, targeting optimal resource allocation and reducing welfare losses. The Ramsey rule focuses on minimizing excess burden in taxation by setting tax rates inversely proportional to the price elasticity of demand, optimizing overall revenue with minimal economic distortion. While Pigovian taxes prioritize internalizing externalities for environmental or social welfare, the Ramsey rule emphasizes efficiency in tax structure to balance equity and economic growth.

Economic Efficiency: Pigovian vs Ramsey Approaches

Pigovian taxation targets externalities by imposing a tax equal to the marginal social cost, thus directly correcting market inefficiencies and achieving economic efficiency in resource allocation. The Ramsey rule, designed for optimal taxation of commodities, minimizes welfare loss by balancing distortion across goods with different elasticities, ensuring overall efficiency but not specifically addressing externalities. While Pigovian taxes prioritize internalizing external costs for precise efficiency, Ramsey taxes emphasize minimizing excess burden, leading to different applications in economic policy design.

Revenue Generation and Fiscal Impact

Pigovian taxation targets externalities by imposing taxes equal to the social cost of negative spillovers, effectively internalizing external costs and generating specific revenue streams earmarked for mitigation efforts. The Ramsey rule aims to minimize excess burden by taxing goods with inelastic demand, optimizing overall revenue without significantly distorting consumption patterns. While Pigovian taxes prioritize correcting market failures with potential variable fiscal impact, Ramsey taxation ensures stable revenue generation by focusing on efficiency across broad consumption bases.

Distributional Effects and Equity Considerations

Pigovian taxation targets externalities by imposing taxes equal to the social cost of negative external effects, promoting efficiency but often raising equity concerns due to disproportionate burdens on low-income households. The Ramsey rule aims to minimize welfare loss by adjusting tax rates inversely to demand elasticities, which may favor efficiency but exacerbate inequality by placing heavier relative taxes on necessities. Distributional effects of Pigovian taxes can be mitigated through revenue recycling or targeted transfers, while Ramsey taxation's equity implications require complementary policies to address regressive impacts.

Implementation Challenges in Practice

Pigovian taxation faces significant implementation challenges due to difficulties in accurately measuring externality costs and setting precise tax rates that reflect social marginal damages. The Ramsey rule aims to minimize economic distortions by adjusting tax rates according to goods' elasticity of demand, yet it requires detailed knowledge of consumer behavior and market parameters often unavailable or costly to obtain. Both approaches struggle with practical application, as incomplete information and administrative complexities hinder effective policy design and enforcement.

Case Studies and Real-World Applications

Pigovian taxation is widely applied in environmental policy to correct negative externalities, with case studies like Sweden's carbon tax demonstrating significant reductions in greenhouse gas emissions while maintaining economic growth. The Ramsey rule, employed primarily in public finance, guides optimal commodity taxation to minimize welfare loss, exemplified by India's reform of excise duties to balance revenue needs and economic efficiency. Real-world applications reveal Pigovian taxes target specific external costs, such as pollution, whereas the Ramsey approach optimizes tax structures for broader economic contexts, highlighting their complementary roles in policy design.

Policy Implications and Future Directions

Pigovian taxation directly targets negative externalities by imposing taxes equal to the marginal social cost, promoting efficient resource allocation and environmental sustainability. The Ramsey rule, designed for minimizing welfare loss when raising government revenue, suggests distorting taxes inversely proportional to demand elasticity, which may not address externalities effectively. Future policy directions emphasize integrating Pigovian principles within Ramsey frameworks to balance efficiency and revenue needs, leveraging advances in behavioral economics and dynamic modeling to refine tax design for complex, evolving markets.

Pigovian taxation Infographic

libterm.com

libterm.com