A bear raid occurs when investors heavily short sell a stock, driving its price down rapidly due to panic selling and negative market sentiment. This tactic can significantly impact a company's valuation and trigger widespread fear among shareholders. Discover how bear raids operate and how you can protect your investments by reading the full article.

Table of Comparison

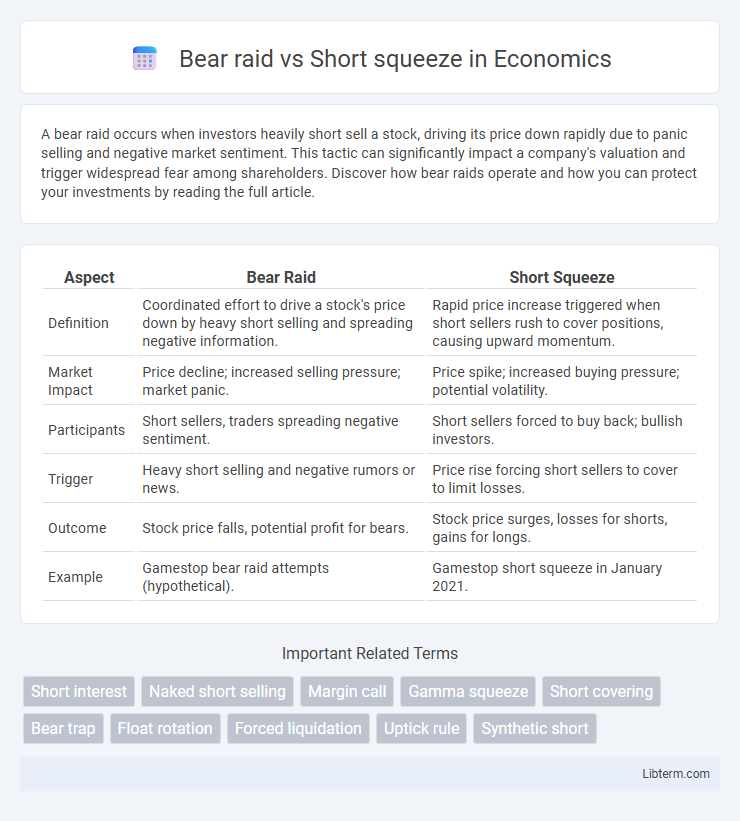

| Aspect | Bear Raid | Short Squeeze |

|---|---|---|

| Definition | Coordinated effort to drive a stock's price down by heavy short selling and spreading negative information. | Rapid price increase triggered when short sellers rush to cover positions, causing upward momentum. |

| Market Impact | Price decline; increased selling pressure; market panic. | Price spike; increased buying pressure; potential volatility. |

| Participants | Short sellers, traders spreading negative sentiment. | Short sellers forced to buy back; bullish investors. |

| Trigger | Heavy short selling and negative rumors or news. | Price rise forcing short sellers to cover to limit losses. |

| Outcome | Stock price falls, potential profit for bears. | Stock price surges, losses for shorts, gains for longs. |

| Example | Gamestop bear raid attempts (hypothetical). | Gamestop short squeeze in January 2021. |

Understanding Bear Raids: Definition and Mechanics

A bear raid involves coordinated selling of a stock to drive its price down, often by spreading negative rumors or selling large volumes to create panic. This tactic exploits market psychology, targeting overvalued or vulnerable securities to profit from price declines. Understanding the mechanics requires recognizing how short sellers amplify downward pressure, triggering stop-loss orders and causing a rapid price drop.

What is a Short Squeeze? Key Features and Triggers

A short squeeze occurs when heavily shorted stocks experience a rapid price increase, forcing short sellers to buy back shares to cover losses, which further drives the price upward. Key features include high short interest, increased buying pressure, and limited stock supply, causing sharp volatility. Triggers often involve positive news, unexpected earnings, or coordinated buying efforts that disrupt bearish positions.

Historical Origins: Bear Raids vs Short Squeezes

Bear raids originated in the early 20th century as coordinated efforts by traders to drive stock prices down through heavy short selling and spreading negative rumors, aiming to profit from declining markets. Short squeezes, on the other hand, have historical roots in market dynamics where rapid price increases force short sellers to cover their positions, leading to accelerated upward price momentum and intense buying pressure. Notable examples of bear raids include the 1929 stock market crash manipulations, while famous short squeezes involve the 2008 Volkswagen event and the 2021 GameStop surge.

Major Differences Between Bear Raids and Short Squeezes

Bear raids involve aggressive selling intended to drive down a stock's price by spreading negative information or panic selling, aiming to profit from a declining market. In contrast, short squeezes occur when a heavily shorted stock experiences a rapid price increase, forcing short sellers to buy back shares to cover positions, which further drives the price up. Major differences include the intent behind the actions, with bear raids focusing on price decline manipulation and short squeezes resulting from market dynamics causing forced cover buying.

The Role of Short Sellers in Market Dynamics

Short sellers play a crucial role in market dynamics by borrowing and selling shares to profit from anticipated price declines, which can trigger a bear raid as they aggressively target a stock to drive its price downward. Conversely, during a short squeeze, these same short sellers are forced to buy back shares at rising prices to cover their positions, causing a rapid price spike. Their actions influence liquidity and volatility, making them key players in both downward pressure and abrupt market reversals.

Investor Psychology: Fear, Greed, and Market Volatility

Bear raids exploit investor fear by driving stock prices down through coordinated short-selling, amplifying market volatility and triggering panic selling. Short squeezes leverage investor greed and fear of missing out, forcing short sellers to buy back shares rapidly, which accelerates price surges and heightens volatility. Both phenomena reveal how intense emotions like fear and greed can disrupt market equilibrium and drive extreme price movements.

Legal Implications: Regulation of Bear Raids and Short Squeezes

Bear raids, involving coordinated short selling to depress stock prices, often attract scrutiny under securities laws for potential market manipulation and violation of anti-fraud provisions enforced by the SEC. Short squeezes, triggered by rapid price increases forcing short sellers to cover positions, generally fall within market dynamics but can raise concerns if orchestrated through misleading information or collusion, leading to regulatory investigations. Both activities require careful legal analysis to determine intent and impact, with regulators emphasizing transparency and fairness to protect market integrity.

Famous Case Studies: Market Events and Lessons Learned

The 2021 GameStop saga exemplifies a powerful short squeeze where retail investors rapidly drove up the stock price, forcing short sellers to cover their positions at significant losses. In contrast, the 1929 stock market crash illustrated a bear raid where coordinated selling pressure intensified the market's decline, contributing to the Great Depression. These cases highlight the market's vulnerability to both aggressive short-selling tactics and sudden buying frenzies, emphasizing the importance of regulatory oversight and risk management.

Identifying Warning Signs: Protecting Your Investment

Identifying warning signs of a bear raid involves monitoring abrupt heavy selling pressure and unusual volume spikes aiming to drive stock prices down. In contrast, signs of a short squeeze include rapid price increases and high short interest ratios, indicating potential forced buybacks by short sellers. Protecting investments requires vigilance in tracking market sentiment and short interest data to anticipate these opposing market dynamics.

Future Trends: The Evolving Landscape of Market Manipulation

Bear raids are likely to adapt through more sophisticated algorithmic strategies aiming to exploit market vulnerabilities, while short squeezes may become increasingly influenced by social media-driven investor coordination, amplifying volatility. Regulatory bodies are expected to enhance surveillance technologies and enforce stricter disclosure requirements to detect manipulative practices more effectively. The evolving landscape of market manipulation will demand advanced real-time data analytics and increased collaboration between exchanges to safeguard market integrity.

Bear raid Infographic

libterm.com

libterm.com