Producer surplus represents the difference between the amount producers are willing to accept for a good or service and the actual amount they receive from sales, highlighting their economic benefit. This concept helps in understanding market efficiency and producer incentives within competitive markets. Explore the rest of the article to discover how producer surplus impacts pricing strategies and market dynamics.

Table of Comparison

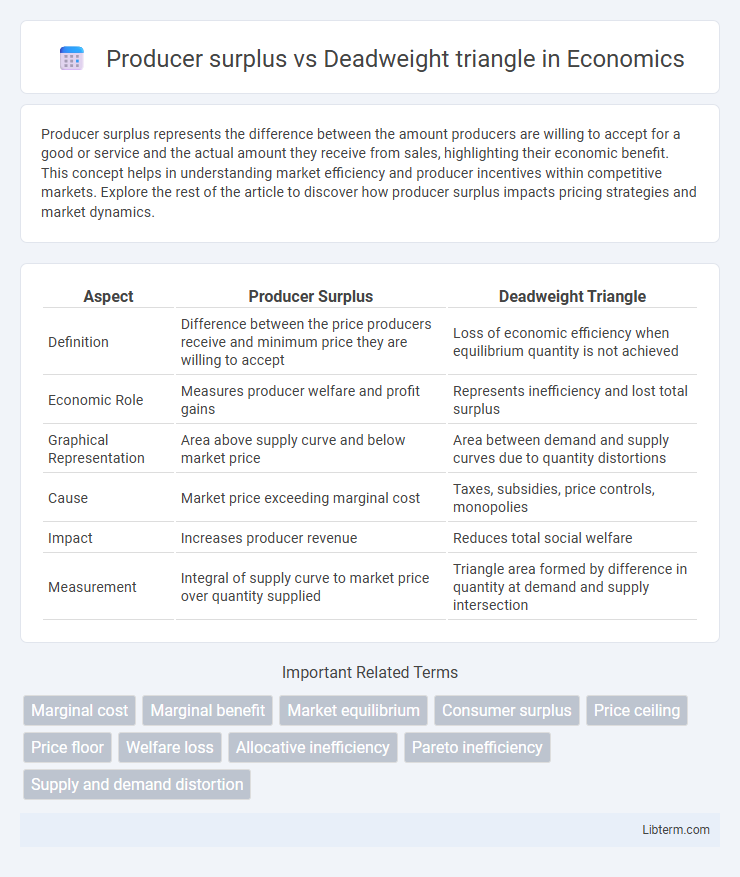

| Aspect | Producer Surplus | Deadweight Triangle |

|---|---|---|

| Definition | Difference between the price producers receive and minimum price they are willing to accept | Loss of economic efficiency when equilibrium quantity is not achieved |

| Economic Role | Measures producer welfare and profit gains | Represents inefficiency and lost total surplus |

| Graphical Representation | Area above supply curve and below market price | Area between demand and supply curves due to quantity distortions |

| Cause | Market price exceeding marginal cost | Taxes, subsidies, price controls, monopolies |

| Impact | Increases producer revenue | Reduces total social welfare |

| Measurement | Integral of supply curve to market price over quantity supplied | Triangle area formed by difference in quantity at demand and supply intersection |

Introduction to Producer Surplus and Deadweight Triangle

Producer surplus represents the difference between the amount producers are willing to accept for a good and the actual price they receive, reflecting their economic benefit in a market transaction. The deadweight triangle, or deadweight loss, quantifies the loss of total surplus that occurs due to market inefficiencies, such as price controls or taxes, resulting in reduced trade. Understanding the relationship between producer surplus and deadweight loss is essential for analyzing market efficiency and the impact of policy interventions.

Defining Producer Surplus

Producer surplus represents the difference between the price producers receive for a good and the minimum price at which they are willing to supply it, reflecting their economic benefit. The deadweight triangle, also known as deadweight loss, measures the loss of total surplus due to market inefficiencies or distortions like taxes or price controls. Understanding producer surplus is crucial for analyzing how changes in market conditions impact producer welfare and overall economic efficiency.

Understanding the Deadweight Triangle

The deadweight triangle represents the loss of total surplus caused by market inefficiencies such as taxes, price controls, or subsidies, highlighting the reduction in both consumer and producer surplus. Producer surplus is the difference between the market price and the minimum price producers are willing to accept, while the deadweight triangle illustrates the net loss in welfare when transactions fail to occur due to distortions. Understanding the deadweight triangle is crucial for analyzing the social cost of market interventions and optimizing resource allocation.

Economic Significance of Producer Surplus

Producer surplus represents the difference between the amount producers receive for a good and the minimum amount they are willing to accept, serving as a key indicator of producer welfare and economic efficiency. The deadweight triangle quantifies the loss in total surplus due to market distortions such as taxes or price controls, reflecting inefficiencies that reduce producer surplus along with consumer surplus. Analyzing producer surplus alongside deadweight loss helps economists evaluate the impact of policy changes on market incentives and resource allocation.

Causes of Deadweight Loss in Markets

Deadweight loss in markets arises primarily from inefficiencies such as taxes, price ceilings, and monopolistic pricing that distort the equilibrium between supply and demand, reducing total surplus. Producer surplus decreases when sellers receive less than the competitive market price due to these interventions, creating a deadweight triangle representing lost economic welfare. This loss occurs because trades that would benefit both consumers and producers fail to happen, shrinking the total gains from trade in the market.

Graphical Representation: Comparing Surplus and Deadweight

The producer surplus is depicted on a supply and demand graph as the area above the supply curve and below the market price, illustrating the difference between the price producers receive and their minimum acceptable price. The deadweight triangle, or deadweight loss, appears as a triangle between the supply and demand curves where transactions do not occur due to market inefficiencies such as taxes or price controls. Comparing these areas visually highlights how producer surplus measures benefits to producers, while the deadweight triangle quantifies economic inefficiency and lost total surplus.

Effects of Market Interventions on Surplus and Deadweight

Market interventions such as price ceilings or floors disrupt equilibrium, causing producer surplus to either shrink or expand depending on the regulation's nature, while deadweight loss emerges as a triangular area representing inefficiency in market transactions. Producer surplus decreases when price controls force prices below equilibrium, limiting producers' revenue and quantity supplied, whereas deadweight loss quantifies the lost gains from trade that neither producers nor consumers capture. Economically, interventions create a trade-off where protecting consumer or producer interests results in a welfare cost depicted as the deadweight triangle, highlighting reduced total surplus in the market.

Real-World Examples: Producer Surplus vs Deadweight Loss

Producer surplus represents the difference between the price producers are willing to accept and the actual market price, illustrating gains from trade in markets like agriculture or manufacturing. Deadweight loss, often visualized as a triangle on supply-demand graphs, occurs when market inefficiencies from taxes, price ceilings, or monopolies reduce total welfare, as seen in cases like rent control or tariffs. Real-world examples such as the imposition of tariffs on steel increase prices benefiting some domestic producers via higher producer surplus while simultaneously creating deadweight loss by reducing consumer surplus and overall economic efficiency.

Policy Implications and Economic Efficiency

Producer surplus represents the benefit producers receive when market prices exceed their minimum acceptable price, reflecting economic gains from trade. Deadweight loss, often illustrated by the deadweight triangle, indicates inefficiencies caused by market distortions like taxes, subsidies, or price controls, resulting in lost total surplus. Policy implications emphasize minimizing deadweight loss to enhance economic efficiency, as preserving a larger producer surplus alongside consumer surplus leads to more optimal resource allocation and maximized social welfare.

Conclusion: Key Takeaways on Producer Surplus and Deadweight Triangle

Producer surplus measures the difference between what producers are willing to accept and the actual market price, reflecting producer gains from trade. The deadweight triangle represents the loss of total surplus due to market inefficiencies like price floors, taxes, or monopolies. Understanding the interaction between producer surplus and the deadweight triangle highlights how policies can either enhance producer benefits or create welfare losses in the market.

Producer surplus Infographic

libterm.com

libterm.com