The discount rate is a critical financial metric used to determine the present value of future cash flows, influencing investment decisions and loan evaluations. It reflects the opportunity cost of capital and the risk associated with an investment, guiding businesses and individuals in assessing profitability. Explore the rest of the article to understand how the discount rate impacts your financial strategies.

Table of Comparison

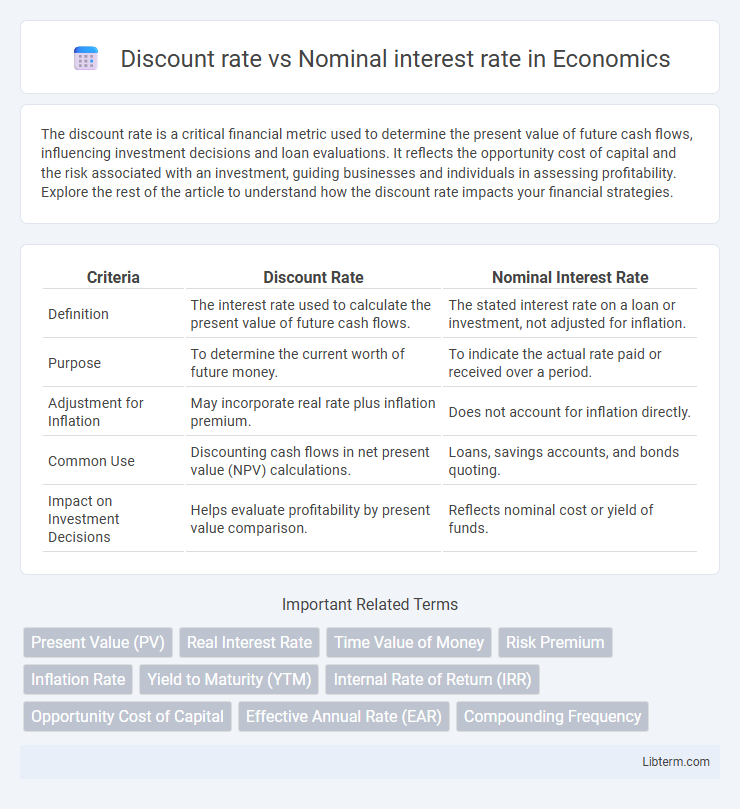

| Criteria | Discount Rate | Nominal Interest Rate |

|---|---|---|

| Definition | The interest rate used to calculate the present value of future cash flows. | The stated interest rate on a loan or investment, not adjusted for inflation. |

| Purpose | To determine the current worth of future money. | To indicate the actual rate paid or received over a period. |

| Adjustment for Inflation | May incorporate real rate plus inflation premium. | Does not account for inflation directly. |

| Common Use | Discounting cash flows in net present value (NPV) calculations. | Loans, savings accounts, and bonds quoting. |

| Impact on Investment Decisions | Helps evaluate profitability by present value comparison. | Reflects nominal cost or yield of funds. |

Introduction to Discount Rate and Nominal Interest Rate

The discount rate represents the interest rate used to determine the present value of future cash flows, playing a crucial role in discounted cash flow (DCF) analysis and investment appraisals. The nominal interest rate, on the other hand, indicates the stated or face interest rate on a loan or investment without adjusting for inflation or compounding effects. Understanding the distinction between the discount rate and nominal interest rate is essential for accurate financial valuation and effective decision-making in finance.

Defining the Discount Rate

The discount rate is the interest rate used to determine the present value of future cash flows by adjusting for the time value of money. It reflects the opportunity cost of capital and risk associated with the investment's cash flows, often set by central banks or derived from market conditions. Unlike the nominal interest rate, which includes inflation expectations, the discount rate focuses on the real value adjustment to evaluate investment profitability or loan pricing.

What is a Nominal Interest Rate?

The nominal interest rate represents the stated annual rate of interest without adjusting for inflation, reflecting the cost of borrowing or the return on investment before considering the eroding effects of rising prices. It is typically used in loan agreements, bonds, and savings accounts to indicate the percentage charged or earned over a period. Distinguishing nominal interest rates from discount rates is crucial, as discount rates account for time value of money and risk, while nominal rates provide a straightforward measure of interest payments or earnings.

Key Differences Between Discount Rate and Nominal Interest Rate

The discount rate is the interest rate used to determine the present value of future cash flows, reflecting the opportunity cost of capital, while the nominal interest rate represents the stated or face rate on a loan or investment without adjusting for inflation. The discount rate incorporates risk and time value of money, influencing investment decisions in discounted cash flow analysis, whereas the nominal interest rate indicates the cost of borrowing or expected return in dollar terms. Understanding these differences is crucial for accurate financial modeling, investment appraisal, and comparing real versus stated returns.

Role of Discount Rate in Financial Decisions

The discount rate plays a critical role in financial decisions by determining the present value of future cash flows, influencing investment appraisals and project viability assessments. It reflects the opportunity cost of capital and risk adjustment, guiding firms in evaluating the profitability of long-term investments compared to the nominal interest rate, which indicates the cost of borrowing or the yield on investments without adjusting for inflation. Understanding the discount rate allows businesses to make informed capital budgeting choices and optimize resource allocation for wealth maximization.

Nominal Interest Rate in Loan and Investment Contexts

The nominal interest rate represents the stated percentage charged on a loan or earned on an investment without adjusting for inflation. In loan contexts, it determines the periodic payment obligations borrowers must fulfill, influencing overall borrowing costs and cash flow management. For investments, the nominal rate indicates expected returns before inflation, guiding investors in assessing potential gains and comparing financial products.

How Discount Rate Influences Present Value Calculations

The discount rate directly affects present value calculations by determining the degree to which future cash flows are reduced to reflect their current worth. Higher discount rates decrease the present value, indicating greater risk or opportunity cost associated with future payments. This relationship is critical in investment appraisals and financial modeling for accurately assessing project viability and comparing cash flow streams.

Impact of Inflation on Nominal Interest Rate

The nominal interest rate reflects the total return on an investment without adjusting for inflation, causing it to rise when inflation expectations increase. Inflation erodes the purchasing power of money, prompting lenders to demand higher nominal rates to maintain real returns. The Fisher equation quantifies this relationship by linking nominal interest rates, real interest rates, and expected inflation rates, highlighting inflation's critical impact on nominal rates.

Real-World Applications and Examples

The discount rate, used by central banks to lend to commercial banks, directly influences short-term borrowing costs and monetary policy implementation, while the nominal interest rate reflects the stated return on loans or investments without adjusting for inflation. For example, when the Federal Reserve adjusts the discount rate, it signals changes in monetary policy that affect lending rates and overall economic activity, whereas mortgage and savings account rates reflect nominal interest rates that consumers encounter daily. Understanding the difference helps investors and policymakers assess real returns and make informed decisions in areas such as bond pricing, loan structuring, and inflation impact analysis.

Choosing Between Discount Rate and Nominal Interest Rate

Choosing between the discount rate and nominal interest rate depends on the financial context and investment goals. The discount rate reflects the present value of future cash flows, making it crucial for capital budgeting and project evaluation, while the nominal interest rate represents the stated annual interest without adjusting for inflation, often used in loan agreements and savings. Understanding the impact of inflation and the time value of money ensures selecting the appropriate rate for accurate investment analysis and decision-making.

Discount rate Infographic

libterm.com

libterm.com