Monopolistic competition is a market structure characterized by many firms offering differentiated products, allowing for some degree of pricing power. Firms compete on product quality, branding, and customer service rather than just price, leading to diverse consumer choices. Discover how this dynamic market impacts your buying decisions and business strategies in the rest of the article.

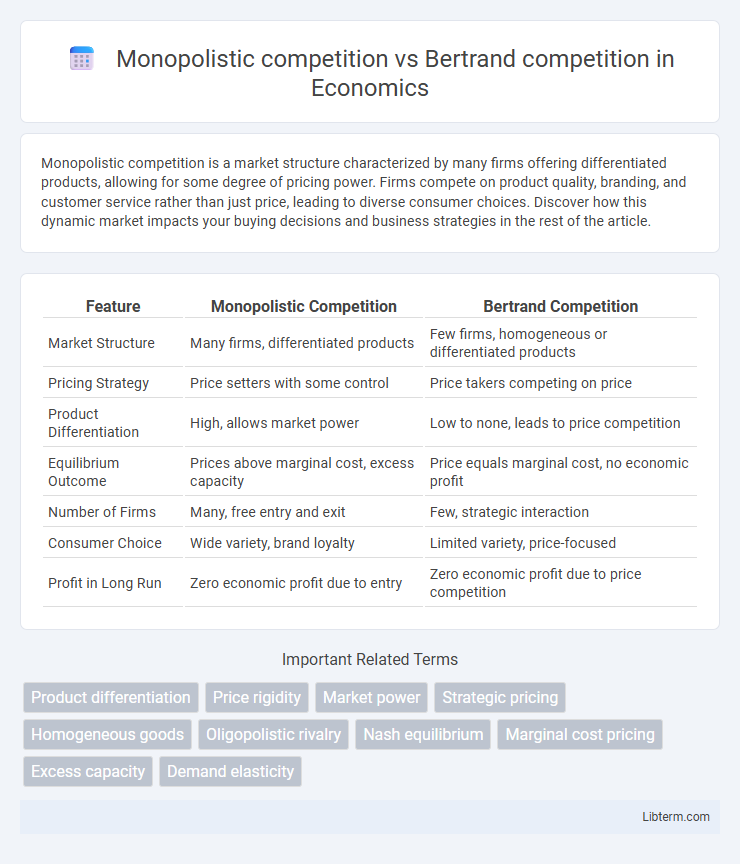

Table of Comparison

| Feature | Monopolistic Competition | Bertrand Competition |

|---|---|---|

| Market Structure | Many firms, differentiated products | Few firms, homogeneous or differentiated products |

| Pricing Strategy | Price setters with some control | Price takers competing on price |

| Product Differentiation | High, allows market power | Low to none, leads to price competition |

| Equilibrium Outcome | Prices above marginal cost, excess capacity | Price equals marginal cost, no economic profit |

| Number of Firms | Many, free entry and exit | Few, strategic interaction |

| Consumer Choice | Wide variety, brand loyalty | Limited variety, price-focused |

| Profit in Long Run | Zero economic profit due to entry | Zero economic profit due to price competition |

Introduction to Market Structures

Monopolistic competition features many firms offering differentiated products, allowing for some pricing power and non-price competition. Bertrand competition involves firms competing on price with homogeneous products, often driving prices down to marginal cost in equilibrium. These market structures differ significantly in terms of product differentiation, pricing strategies, and the resulting market outcomes.

Defining Monopolistic Competition

Monopolistic competition is characterized by many firms selling differentiated products, allowing each firm some control over its prices due to product uniqueness. Unlike Bertrand competition, where firms compete on price for homogeneous goods, monopolistic competitors use branding and product features to create market power. This market structure leads to a downward-sloping demand curve for each firm, reflecting consumer preferences for variety.

Key Features of Bertrand Competition

Bertrand competition is characterized by firms competing primarily on price, assuming products are homogenous and consumers always choose the lowest-priced option, leading to prices driven down to marginal cost. Unlike monopolistic competition, where product differentiation allows firms some price-setting power, Bertrand competition results in zero economic profits in equilibrium due to aggressive price undercutting. The key features include firms simultaneously choosing prices, product homogeneity, and the assumption of perfect information among consumers and competitors.

Product Differentiation in Monopolistic Competition

Monopolistic competition is characterized by significant product differentiation, where firms compete by offering unique variations of products that cater to specific consumer preferences, creating brand loyalty and reducing direct price competition. In contrast, Bertrand competition assumes homogeneous products, leading firms to compete primarily on price, often resulting in lower prices and minimal profit margins. Product differentiation in monopolistic competition allows firms to maintain some price-setting power and achieve positive economic profits in the short run.

Price Setting in Bertrand Competition

Bertrand competition emphasizes price setting where firms simultaneously choose prices, assuming rivals' prices are fixed, leading to a market outcome with prices driven down to marginal cost. In contrast to monopolistic competition, where firms have some price-setting power due to product differentiation, Bertrand competition assumes homogeneous products, resulting in aggressive price undercutting. This price-setting behavior in Bertrand models causes firms to earn zero economic profit in equilibrium, reflecting highly competitive market dynamics.

Market Outcomes: Prices and Profits

Monopolistic competition results in prices above marginal cost due to product differentiation, allowing firms to earn positive but limited profits in the long run as new entrants erode excess profits. In contrast, Bertrand competition drives prices down to marginal cost because firms compete on price with homogeneous products, leading to zero economic profits. The presence of differentiated goods in monopolistic competition preserves some market power, while homogeneity in Bertrand models forces fierce price rivalry and minimal profits.

Consumer Welfare Analysis

Monopolistic competition features many firms offering differentiated products, leading to some price-setting power and higher prices than perfect competition, which can reduce consumer welfare due to inefficiencies and markup pricing. In contrast, Bertrand competition involves firms competing on prices with homogeneous products, driving prices down to marginal cost and maximizing consumer welfare through lower prices and increased consumer surplus. Consumer welfare tends to be higher under Bertrand competition because intense price rivalry eliminates deadweight loss commonly observed in monopolistically competitive markets.

Barriers to Entry and Business Strategies

Monopolistic competition features low barriers to entry, enabling many firms to enter the market with differentiated products, leading to a focus on product innovation, branding, and marketing strategies to gain market share. In contrast, Bertrand competition involves firms competing primarily on price in markets with low entry barriers, prompting aggressive pricing strategies and cost efficiencies to outperform rivals. Both market structures require businesses to continuously adapt strategies, but monopolistic competition emphasizes differentiation, while Bertrand competition centers on price competition.

Real-World Examples and Applications

Monopolistic competition is exemplified by retail clothing brands like Zara and H&M, where numerous firms offer differentiated products and compete on style, quality, and branding to attract consumers. Bertrand competition is observed in industries such as airline pricing, where companies like Southwest and JetBlue aggressively undercut each other's ticket prices for identical routes, pushing prices toward marginal cost. Understanding these models aids businesses in strategy formulation; firms in monopolistic competition invest in product differentiation, while those in Bertrand competition focus on pricing strategies to gain market share.

Conclusion: Comparing Monopolistic and Bertrand Competition

Monopolistic competition features many firms offering differentiated products with some price-setting power, leading to positive economic profits in the short run and zero in the long run due to free entry and exit. Bertrand competition assumes firms produce homogeneous goods and compete by setting prices simultaneously, typically resulting in prices equal to marginal cost and zero economic profit. While monopolistic competition yields product variety and some market power, Bertrand competition drives prices down to competitive levels, benefiting consumers through optimal pricing.

Monopolistic competition Infographic

libterm.com

libterm.com